Emerging trends in logistics technology adoption

With the world effectively shrinking and deliveries now just a click away, businesses are turning to specialized point solutions that promise not only logistics cost reduction but also enhance service levels. This strategic investment in logistics technology is driving continuous value creation, making it an integral part of the supply chain narrative.

By Paras Mehta, Managing Director, Strategy & Consulting at Accenture & Vishal Tickoo, Senior Manager, Strategy & Consulting at Accenture

In today’s fast-paced global landscape, technological advancements in logistics are business imperatives and unlock competitive advantages worldwide. As consumer expectations continue to evolve and global trade dynamics shift, companies are under pressure to optimize their logistics operations.

Logistics costs, which typically account for 8% to 10% of total organizational expenditure (and even less for service sector organizations like banks, insurance firms and fintech), are under scrutiny. The industry’s current focus is clear: invest in tech that reduces logistics costs and meets global benchmarks in real-time, while maintaining service levels that meet the demands of an increasingly impatient consumer base.

The pace of technology adoption within logistics management varies widely across markets and industries, shaped by differences in cost structures, data maturity and business priorities. While all organizations recognize the value of digital transformation, they are at different stages of their journey toward intelligent, data-driven logistics.

Divergent market maturity

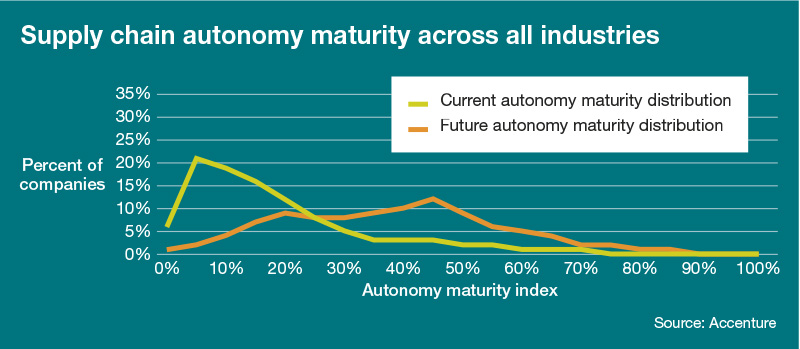

Developed markets have shifted their focus toward innovation and next-generation technologies such as generative AI (GenAI), agentic AI, and autonomous systems emphasizing automation, predictive insights and intelligence for real-time decision-making. The ambition for autonomous supply chain maturity varies significantly across different countries.

Our recent survey reveals that nearly 66% of respondents across various countries plan to advance their supply chain autonomy to the next level. Countries like Italy (74%), Canada (72%), Germany (70%), and the United States (70%) are leading in this aspect. In terms of achieving “higher autonomy” levels within the coming decade, countries like France (61%), India (56%), and Germany (46%) are among the most aspirational, indicating a strong push towards technological maturity.

In contrast, countries like Canada (31%) and Mexico (22%) show relatively lower but still significant ambitions for advancing to higher autonomy levels by 2035. Overall, around 40% of respondents aim for higher autonomy, showcasing a diverse landscape in supply chain maturity ambitions across the globe.

Similar is the case across industries. This survey also revealed diverse ambitions across industries for adoption of supply chain autonomy within the next decade. Key findings include:

- Industries aiming for next-level autonomy: Automotive (73%), Metals & Mining (72%), and Retail (70%) are at the forefront, indicating a strong push towards advanced autonomy.

- Industries with high aspirations for higher autonomy within the coming decade: Automotive (60%) stands out, followed by Consumer Goods & Services (51%) and High Tech (50%), suggesting a significant focus on achieving advanced autonomous systems.

- Industries with relatively lower aspirations for higher autonomy: Life Sciences (30%), Oil & Gas (30%), and Metals & Mining (22%) show less ambition for higher autonomy, potentially due to industry-specific challenges or priorities.

In contrast, growth markets continue to rely on manual operations, given the lower cost of labor and the ongoing evolution of digital accuracy. For instance, local route restrictions and incomplete mapping data still limit the efficiency of route optimization outputs from transportation management systems (TMS), reducing their impact on cost and service performance.

Acceleration of the journey to cloud

Although the “Journey to Cloud” narrative has existed for over a decade, migration of legacy systems, including enterprise resource planning systems (ERP), warehouse management systems (WMS), order management systems (OMS), and TMS, has significantly accelerated in recent years.

With more data now available on cloud platforms, companies are increasingly leveraging advanced analytics for informed, real-time decision-making. This transition has also heightened the need for strong data quality and governance frameworks to ensure accuracy and trust in analytics-led outcomes.

Changing global trade and marine logistics landscape

With dynamic global trade policies and tariffs, logistics management teams are under increasing pressure to be agile and data-driven in their response to supply-chain disruptions. Logistics Control Towers have become the new operational baseline, offering end-to-end visibility, real-time alerts, scenario simulations, and autonomous execution through system integration.

At the same time, as marine transportation accounts for nearly 80% of global trade, optimizing costs such as demurrage and detention has become a key opportunity. Organizations are investing in global trade management (GTM) systems and services to anticipate and mitigate delays related to customs clearance and compliance, ensuring that trade operations remain efficient and cost-effective.

Industry-led digital transformation

Global leaders are at the forefront of this evolution, exploring new tools and building integrated digital ecosystems to become future-ready for the AI revolution.

A leading global FMCG company recognized this growing demand for omni-channel fulfillment and is developing experience-led applications for distributors, retailers, and consumers, ensuring real-time order visibility. These integrated, data-democratized systems form the foundation for predictive and prescriptive logistics capabilities powered by GenAI.

Similarly, a global hi-tech enterprise that operates more than 20 interconnected logistics applications, is piloting AI-driven automation for freight settlement and audit functions, demonstrating how intelligent solutions are driving tangible efficiencies in logistics operations.

Impact on regulatory and cost-sensitive sectors

Managing the expectations of the conscious consumer is pushing industries, particularly in regulated sectors such as alco-beverages and tobacco, to reassess their portfolios and focus on cost-avoidance levers such as dynamic routing, warehouse automation, and just-in-time inventory optimization.

These transformations demand access to high-quality data and advanced analytics tools to unlock measurable value while maintaining compliance with regulatory standards.

Smart, sustainable and collaborative logistics models

The rising focus on Environment, Health, and Safety (EHS) has accelerated the adoption of green logistics and sustainable operations.

Modern logistics platforms now include features to track carbon footprint and emissions, monitor fleet and driver safety, and enable predictive maintenance for vehicles and assets. 39% of companies are anticipating more efficient, circular supply chains and a 16% fall in carbon emissions with the adoption of autonomous systems.

At the same time, with the advancement of the Fourth Industrial Revolution (4IR), logistics is evolving from traditional hubs into connected, intelligent, and interactive ecosystems that leverage IoT, AI, ML, drones and telematics to enhance visibility and control.

Furthermore, organizations with their own logistics departments are expanding their footprint by offering “Logistics as a Service” (LaaS). By leveraging technology, they aim to optimize profits, manage economies of scale, and build collaborative logistics networks through strategic partnerships, illustrating how digital maturity is redefining the economics of logistics operations worldwide.

Way ahead

As organizations continue to expand their digital footprint, the number of logistics-related tools and applications continues to rise. This growing complexity underscores the need for a strategic and selective approach to technology investment and deployment.

To navigate this evolving landscape successfully, companies must:

- Identify and implement fit-for-purpose AI-enabled autonomous technologies that align with their specific logistics objectives and desired business outcomes.

- Partner with trusted strategic advisors to define a robust logistics technology roadmap, perform maturity assessments, and manage vendor and technology selection effectively.

- Adopt a phased roadmap for AI enablement, starting with establishing strong data foundations, followed by automation of key processes, and progressing toward predictive and autonomous logistics capabilities.

About the authors: Paras Mehta leads global logistics and fulfilment capability at Accenture Strategy, driving large-scale transformations across industries. He advises Fortune 500 C-suites on supply chain challenges and opportunities, leveraging technologies like AI, cloud computing and automation. Vishal Tickoo is the transportation lead for Accenture’s Global Network with focus on strategic planning and system implementation. He has led global Transport Management System implementations for FMCG, Hi-Tech and Healthcare industries, enabling operations and data-driven decision making

Article Topics

Accenture News & Resources

Emerging trends in logistics technology adoption U.S.-based retailers are preparing for stock shortages this holiday season Redefining Resilience: How autonomy is reinventing global supply chains 36th Annual State of Logistics: 3PLs face challenges, but consolidation and tech investment offer path to resilience 3PLs Under Pressure: Growth collides with global logistics disruption Tech Transforms, People Deliver: Why talent must lead the logistics revolution Talent Reinvention: Making the urgent case for people-centric supply chains More AccentureLatest in Logistics

Union Pacific–Norfolk Southern merger filing with the STB is delayed delayed until mid-December Old Dominion Freight Line issues November operating metrics update Services economy remains on growth track in November, reports ISM Looking at the LTL market with Scooter Sayers U.S. Department of Transportation targets ‘CDL Mills’ as thousands of training providers removed from federal registry Key Ocean, Air, and Trade Trends as We Approach the New Year National diesel average falls 7.3 cents, down for second consecutive week, reports EIA More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources