Redefining Resilience: How autonomy is reinventing global supply chains

In a world where cost-efficiency alone no longer guarantees success, global supply chains must evolve. AI-driven autonomy offers the solution, enabling faster, more agile, and sustainable operations. Recent Accenture research reveals how autonomy is not just an operational improvement—it's the key to long-term value and the next phase of industrial evolution.

Over the past five years, companies have endured a cascade of disruptions, from pandemics and war to supply chain breakdowns and economic dislocation. Understanding the challenge, supply chain leaders have responded decisively.

From cybersecurity to data infrastructure, boardrooms have doubled down on risk-readiness. But despite diversified footprints and cost-efficient structures, many companies still lack true operational optionality: the capacity to reroute, shift, or reconfigure supply chains in real time.

This structural rigidity has led to extended response times, slower recovery and escalating costs, making operational resilience a critical blind spot.

The resilience gap

Data from recent Accenture research titled “Resilience Redefined” shows a 4% drop in operational resilience between 2018 and 2024—a number that might seem small, but revealing.

An overwhelming 91% of companies that were in the bottom quartile pre-pandemic remain there today. They’re still stuck with cost-optimized, but rigid operating models, which weren’t designed for volatility.

The result? Fewer than 15% consistently achieve long-term profitable growth. These organizations are held back by global operating models optimized for cost, not adaptability. With limited ability to pivot in response to tariffs or geopolitical shocks, they lack the agility needed for sustained performance.

On the workforce front, only 38% of companies that led in people resilience before the pandemic have retained that edge. Others have been overtaken by firms that invested in turnover reduction, talent upskilling, and agile role structures.

Many laggards still rely on outdated workforce models: static job roles; sporadic training; and limited human-AI teaming, all of which fail in a high-disruption environment. Adding to the complexity is the loss of institutional knowledge due to an aging workforce, decreasing job tenure and shortage of skills.

Further underscoring this gap, 69% of C-suite executives acknowledge their operating models cannot adapt to the pace of change, and 88% expect disruption to intensify going forward.

Without action, these companies face a growing risk: longer recovery periods; deeper financial impacts; and erosion of market relevance.

Today, it’s simply not enough to be just cost-efficient. Global supply chains must also be fast, agile and sustainable—they must reach a new value frontier.

Advancements in AI have positioned autonomy as the means to reach that destination. Recent Accenture research shows it’s also the new strategy to create lasting value. Why? It’s the next phase of industrial evolution.

Limited autonomy is holding back operational resilience

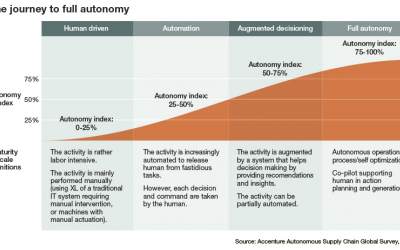

But let’s get back to the present. Indeed, most companies still aren’t ready for disruption. Autonomy, or the lack of it, plays a big part. Today, supply chains are still only 21% autonomous on average on an index that ranges from 0% (fully manual) to 100% (fully autonomous).

That means most operations still rely heavily on human oversight, manual decision-making, and siloed systems. True autonomy is about intelligent systems that not only automate tasks, but also make decisions fast, accurately and, at scale. The more autonomous a supply chain is, the more resilient it becomes. It can detect, react, and reconfigure when disruptions happen whether it’s a supplier shutdown, a tariff hike, or a cyberattack.

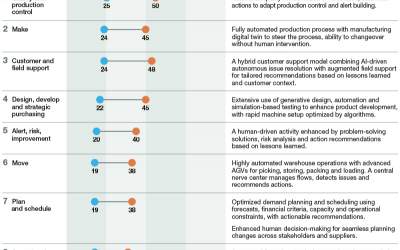

Progress toward higher supply chain autonomy can be understood by grouping typical processes into nine clusters (Figure 2). The “Make” cluster, for example, includes production, assembly, and packaging.

Each activity within these clusters is advancing through defined stages of autonomy, and AI is expected to augment all of them to some extent. Most activities remain at low levels of automation and delegation, though clusters like Make, Quality Control, and Customer Support are seeing faster adoption. In manufacturing, for instance, automakers are increasingly using AI-driven robotic assembly lines to improve speed and reduce errors.

Estimated benefits from higher supply chain autonomy

Leaders know the potential here and they’re acting. Sixty-six percent of executives plan to increase their supply chain autonomy, and they’re not just chasing efficiency.

Among them, approximately 40% aspire to achieve a higher degree of autonomy where the system handles most operational decisions. They expect to cut reaction time to disruptions by 62% and reduce recovery time by 60%.

To put that in perspective: the average reaction time today is 11 days. With greater autonomy, that could potentially shrink to just 4 days, a critical advantage in moments of crisis.

But it’s not just about speed. Our survey found supply chain leaders are estimating higher autonomy to boost the bottom line too, with a 5% gain in On-Time In-Full (OTIF), a key customer service metric and a 4% drop in Cost of Goods Sold (COGS). Combined, this could bring potential improvements to EBITDA and ROCE, depending on the business model.

Supply chain leaders also expect autonomy to drive meaningful sustainability and workforce improvements, anticipating 27% shorter order lead times, a 25% increase in labor productivity, and up to a 16% reduction in carbon emissions, according to nearly 40% of respondents.

The Big Unlock: Agentic AI

Enter Agentic AI, the next frontier. This isn’t about rules-based automation or pre-programmed workflows.

Agentic AI can independently orchestrate complex, dynamic decisions in real-time, without waiting for human input. It brings intelligence and agility together, allowing companies to compress decision-making cycles, handle exceptions at scale and continuously adapt.

And the payoff? Companies with the highest operational resilience deliver EBIT margins nearly 3% points higher than their peers. It’s not just technology adoption; it’s a strategic advantage.

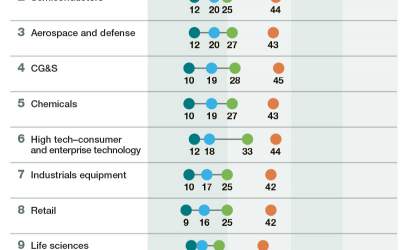

Autonomy varies by industry

Of course, not all industries are progressing equally. Discrete manufacturing sectors like automotive, semiconductors and aerospace are more advanced.

They’ve invested in automation for years. While process industries like oil & gas and chemicals are slower, often due to complex compliance needs and legacy systems.

Talent reinvention in the works

Autonomy doesn’t mean replacing humans—it means augmenting them. Despite fears that automation will reduce headcount, only 1% of executives expect a significant decrease in staffing.

Instead, AI is transforming how work gets done. Employees gain more control and ownership over their roles; they see clearer connections between their actions and business outcomes; and are empowered to focus on higher-value tasks, supported by intelligent systems.

This is a revival of craftsmanship with digital tools. People feel more engaged, not less. And in a world where talent retention is critical, that kind of empowerment is priceless.

Barriers to autonomy and how leaders are responding

Several challenges still slow autonomy adoption, including poor data quality across the supply chain, cybersecurity concerns, process maturity gaps, and employees’ limited trust in AI-driven decisions.

Leaders are taking actions by building strong data foundations with an adaptable AI stack, piloting AI solutions like gen AI and agentic AI with defined guardrails. But the most impactful action leaders are taking is all about redefining roles to enable AI-human collaboration.

Investing in autonomy pays off

The time for companies to innovate and adapt to the evolving landscape is now, but it requires commitment: an estimated investment of 0.9% of revenue per year. But the returns, across agility, efficiency, profitability, and sustainability, are transformative.

Autonomous systems not only promise value creation, but also prepare organizations for future technological advancements, including artificial general intelligence (AGI) and quantum computing.

By focusing on critical outcomes and fostering human/machine collaboration, businesses can unlock new levels of efficiency and resiliency throughout their end-to-end supply chains. In an age of constant disruption, autonomy is emerging as the new foundation for resilient, disruption-proof, future-ready supply chains.

Four pillars of resilience

Resilience is a system of interdependent strengths. Organizations that reinforce all four pillars of technology, commercial, people and operational resilience are best positioned to adapt to frequent disruptions.

- Technology Resilience: Foundation for reinvention Technology resilience has become a top priority for supply chain leaders since the pandemic. It’s being driven by advances in AI, data capabilities, cybersecurity, and most recently, agentic architecture. This pillar provides the adaptive foundation companies need to reinvent themselves amid constant change.

- Commercial Resilience: Navigating cost and pricing pressures Commercial resilience is under immediate pressure due to rising tariffs, increasing input costs and fluctuating demand. Companies are being forced to make fast decisions about which costs to absorb and which to pass on. Strong commercial resilience enables faster, more confident responses to these pressures while preserving margin and customer trust.

- People Resilience: The overlooked multiplier In the race to adopt gen AI and agentic technologies, organizations are prioritizing technology investments without focusing on workforce readiness. This creates a critical gap. Accenture research shows that companies that invest in both talent and technology are 4x more likely to achieve long-term profitable growth.

- Operational Resilience: A growing blind spot Operational resilience has been in sustained decline since before the pandemic, according to the Resilience Index. The new benchmark is no longer static risk management—it’s real-time flexibility. This means having the ability to shift, reroute, or reconfigure operations quickly in response to sudden changes. Many organizations are struggling to meet this new standard.

By Kris Timmermans, Global Supply Chain and Operations Lead at Accenture; Max Blanchet, Global Supply Chain & Operations Strategy Lead at Accenture; Stephen Meyer, Principal Director, Supply Chain & Operations, Accenture Research

Article Topics

Accenture News & Resources

U.S.-based retailers are preparing for stock shortages this holiday season Redefining Resilience: How autonomy is reinventing global supply chains 36th Annual State of Logistics: 3PLs face challenges, but consolidation and tech investment offer path to resilience 3PLs Under Pressure: Growth collides with global logistics disruption Tech Transforms, People Deliver: Why talent must lead the logistics revolution Talent Reinvention: Making the urgent case for people-centric supply chains Rethinking Cybersecurity: Ready for a makeover in supply chain risk management More AccentureLatest in Logistics

Looking at the impact of tariffs on U.S. manufacturing UP CEO Vena cites benefits of proposed $85 billion Norfolk Southern merger Proposed Union Pacific-Norfolk Southern merger draws praise, skepticism ahead of STB Filing National diesel average is up for the fourth consecutive week, reports Energy Information Administration Domestic intermodal holds key to future growth as trade uncertainty and long-term declines persist, says intermodal expert Larry Gross Railroads urged to refocus on growth, reliability, and responsiveness to win back market share Q&A: Ali Faghri, Chief Strategy Officer, XPO More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources