36th Annual State of Logistics: 3PLs face challenges, but consolidation and tech investment offer path to resilience

Third-party logistics (3PL) providers are grappling with geopolitical instability, fluctuating tariffs, rising costs, and labor shortages, while also facing pressure to accelerate e-commerce order fulfillment. Smaller 3PLs struggle to keep pace with larger peers due to high costs of automation, AI, and robotics. Despite these challenges, the U.S. 3PL market saw growth in 2024, with net revenues increasing by 1.6%.

Third party logistics (3PLs) providers are being slammed by multiple challenges: geopolitical instability; ever-changing Trump Administration tariffs; rising costs; and the threat of recession and inflation. In addition, labor shortages are causing fierce competition for skilled workers in warehousing and transport.

Meanwhile, pressure is mounting to speed up order fulfillment—especially in e-commerce.

“Advancements in automation are easing some pressures, but smaller players struggle to invest in warehouse management systems, AI and robotics because of the high costs,” says Herman Guzman-Carranza, logistics and transportation subject matter advisor at Accenture. “This places them at a disadvantage as compared to their larger peers.”

It’s difficult to know what the real impact these factors will have on the 3PL industry in 2025. However, research by Armstrong & Armstrong (A&A) indicates that 3PLs fared well in 2024.

A&A data shows that net revenues of the U.S. 3PL market grew by 1.6%, compared to the 12.8% decline experienced in 2023. Meanwhile, the gross revenues across all four segments of the 3PL market—domestic transportation management (DTM), international transportation management (ITM), dedicated contract carriage (DCC), and value-added warehousing and distribution (VAWD)—increased by 1.1% year-over-year after its significant drop of 26.1% in 2023.

“This brings the total value of the U.S. 3PL market to $302.7 billion in 2024,” says Evan Armstrong, A&A president.

But industry sentiment has remained subdued, with freight headwinds weighing on revenues, profits, and merger and acquisition (M&A) activity since mid-2022. As a result, the industry is seeing significant consolidation.

“Large 3PLs are expanding their capabilities, technologies and reach through M&A, and this is making an impact on both the industry and its customers,” says Sarah Banks, global lead, freight and logistics at Accenture.

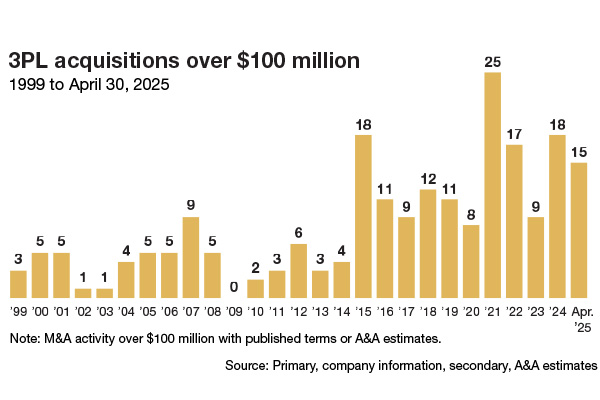

While M&A activity slowed in 2023, 2024 saw 18 transactions valued at over $100 million, including five acquisitions valued at over $1 billion. Capstone Partners reports that in 2024 3PL M&A activity saw a year-over-year increase of 23.4%, driven by strong strategic interest and operational realignment efforts.

“This year has started strong, with eight pending deals over $100 million as of January, including DSV's efforts to acquire DB Schenker,” Armstrong notes.

That acquisition concluded in May this year with DSV completing its acquisition of DB Schenker. The deal was valued at €14.3 billion, thereby making DSV one of the world’s largest freight forwarding and supply chain management firms. The acquisition is viewed as giving DVS a substantial foothold in worldwide logistics operations.

Over the last several years, DB Schenker has been leveraging digital platforms and AI-driven technologies in a strategy to differentiate itself in the competitive freight forwarding sector of the industry. Officials there emphasize that the focus on real-time visibility, predictive analytics, and sustainable logistics ensures that DB Schenker remains at the forefront of innovation in freight forwarding.

Meanwhile, DHL recently broke ground on its new 28,000 square foot Americas Innovation Center in Rosemont, Ill., to promote and accelerate the next generation of logistics to customers, partners, academia and thought leaders in an interactive showroom environment.

DHL operates similar centers in Germany and Singapore.

These bellwether examples are indicative of how, in the long run, fewer but stronger 3PLs are likely to dominate the industry.

“Large 3PLs’ tech-driven platforms will likely raise entry barriers, fueling international growth and last-mile improvements,” says Accenture’s Banks, adding that smaller firms will survive through specialization.

Article Topics

Accenture News & Resources

Emerging trends in logistics technology adoption U.S.-based retailers are preparing for stock shortages this holiday season Redefining Resilience: How autonomy is reinventing global supply chains 36th Annual State of Logistics: 3PLs face challenges, but consolidation and tech investment offer path to resilience 3PLs Under Pressure: Growth collides with global logistics disruption Tech Transforms, People Deliver: Why talent must lead the logistics revolution Talent Reinvention: Making the urgent case for people-centric supply chains More AccentureLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources