Latest posts about Armstrong & Associates

Page 1 of 6 pages.

3PLs in the Fast Lane: Meeting the e-commerce surge with tech, scale, and smarts

October 1, 2025

As e-commerce sales surge toward $8 trillion, third-party logistics providers (3PLs) are evolving to handle higher order volumes, tighter delivery windows, and complex returns using automation, AI, and integrated warehouse management systems (WMS). By offering scalable fulfillment, reverse logistics, and real-time visibility, 3PLs help shippers of all sizes optimize operations, cut costs, and enhance customer satisfaction in a rapidly changing digital marketplace.

36th Annual State of Logistics: 3PLs face challenges, but consolidation and tech investment offer path to resilience

July 1, 2025

Third-party logistics (3PL) providers are grappling with geopolitical instability, fluctuating tariffs, rising costs, and labor shortages, while also facing pressure to accelerate e-commerce order fulfillment. Smaller 3PLs struggle to keep pace with larger peers due to high costs of automation, AI, and robotics. Despite these challenges, the U.S. 3PL market saw growth in 2024, with net revenues increasing by 1.6%.

U.S. 3PL market rebounded in 2024, says new Armstrong & Associates report

June 13, 2025

The report, entitled “Working through the Uncertainty—Latest Third-Party Logistics Market Results and Outlook,” said that U.S. 3PL Market net revenues, which Armstrong defines as gross revenues less purchased transportation, increased 1.8%, to $131.5 billion in 2024, coming off of a 12.8% annual decline, to $129 billion, in 2023.

3PLs navigate uncertainty in $10.15B Big and Bulky Last-Mile Market, notes Armstrong report

June 6, 2025

A new report issued by Brookfield, Wis.-based supply chain consultancy and global third-party logistics (3PL) research provider Armstrong & Associates, in collaboration with the National Home Delivery Association, examines the current state of a key aspect of the last-mile delivery market, big and bulky last-mile delivery.

3PLs Under Pressure: Growth collides with global logistics disruption

June 1, 2025

Ongoing U.S. trade policy shifts—including new de minimis rules for Chinese shipments—are reshaping global logistics. With rising tariffs and reduced exemptions impacting cross-border e-commerce, Armstrong & Associates projects 2025 third-party logistics (3PL) revenue to hit $316.2 billion, up 4.5%, fueled by early-year growth despite increased uncertainty.

2024 Digital Freight Matching Roundtable: Evolving for a digitized future

November 1, 2024

As market conditions remain flat and capacity continues to loosen, digital freight matching (DFM) leaders are preparing for a technology-driven rebound, focusing on AI and automation to optimize future growth.

E-commerce Fulfillment: A new standard for SPEED

October 1, 2024

The e-commerce boom has driven third-party logistics providers to heavily invest in automated fulfillment. Shippers have embraced the change, making e-commerce a leading growth driver across all segments of 3PL services.

U.S. 3PL revenues see significant annual declines, according to Armstrong report

July 31, 2024

The report, entitled “Divergence—Latest Third-Party Logistics Market Results and Outlook,” said that U.S. 3PL Market net revenues, which Armstrong defines as gross revenues less purchased transportation, fell 12.8%, from 2022 to 2023, to $129 billion, with overall gross revenues down 26.1% annually, and total U.S. 3PL Market revenue coming in at $299.5 billion, for 2023.

Top 50 Third Party Logistics (3PLs) Providers 2024: Not out of the woods

June 1, 2024

Most global and domestic 3PLs faced huge challenges last year as shippers adjusted to ongoing issues related to inventory optimization and geopolitical risk. To keep pace, the top 3PLs are now amping up their collaboration with carrier partners and implementing as much cutting-edge automation as they can to improve customer service—but will it be enough?

2024 State of Freight Forwarders: What’s next is happening now

May 1, 2024

Technological solutions and platforms are being rapidly developed and are catapulting the freight forwarding industry into a new era. Today, the forwarding industry is undergoing a digital revolution, and analysts surmise that companies that fail to keep pace with these advancements risk falling behind—and fast.

LM Podcast Series: 3PL market update with Evan Armstrong

March 25, 2024

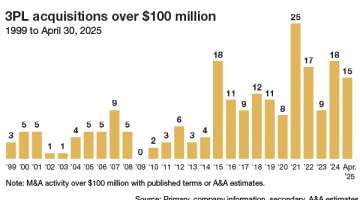

Themes focused on over the course of this podcast included: the state of the market; ways in which the pandemic affected 3PL operations; M&A; how 3PLs are adjusting to and leveraging nearshoring; and the economy, among other topics.

3PL market update with Evan Armstrong

March 11, 2024

In this podcast, Jeff Berman, Group News Editor for Logistics Management and the Peerless Media Supply Chain Group interviews Evan Armstrong, President of Brookfield, Wisc.-based supply chain consultancy Armstrong & Associates.

Wincanton’s board endorses GXO’s acquisition offer

March 1, 2024

Following a previous announcement that Greenwich, Conn.-based global contract logistics services provider GXO Logistics made a $965 million cash offer to acquire Chippenham, UK-based Wincanton, a supply chain solutions services provider across myriad vertical markets, it appears that Wincanton is receptive to the offer.

Global 3PL market revenues fall in 2023, with future growth on the horizon, Armstrong report notes

February 28, 2024

Total estimated 2023 global 3PL market revenue was off 18.5% annually, coming in at $1.2 trillion. But even with that decline, the firm observed that this tally still represented a 25.3% increase, when compared to pre-pandemic 2019.

2023 In Review: Let’s turn the page

December 6, 2023

We canvassed a seasoned group of industry observers to record what happened this past year and what it means to our logistics and supply chain operations as we head into 2024. Here’s what they had to say.