36th Annual State of Logistics: 3PLs face challenges, but consolidation and tech investment offer path to resilience

July 1, 2025

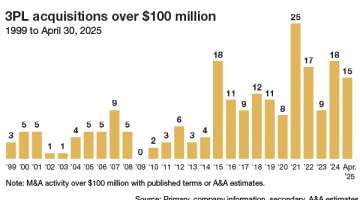

Third-party logistics (3PL) providers are grappling with geopolitical instability, fluctuating tariffs, rising costs, and labor shortages, while also facing pressure to accelerate e-commerce order fulfillment. Smaller 3PLs struggle to keep pace with larger peers due to high costs of automation, AI, and robotics. Despite these challenges, the U.S. 3PL market saw growth in 2024, with net revenues increasing by 1.6%.

36th Annual State of Logistics: Questions loom over current air cargo volumes status

July 1, 2025

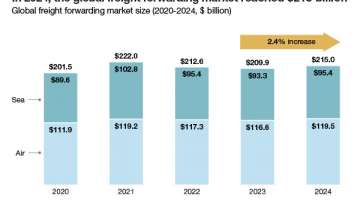

The global airfreight market, valued at $319.4 billion in 2024, is projected to reach $492.7 billion by 2033, with a compound annual growth rate (CAGR) of 4.9%. While air cargo volumes have shown upward trends, market stability remains uncertain due to fluctuating tariff policies and geopolitical events.

36th Annual State of Logistics: Back on track? Rail and intermodal volumes hint at a rebound

July 1, 2025

The freight rail and intermodal sectors are facing continued market fluctuations in 2025, with U.S. rail carloads showing a slight decline and intermodal volumes reaching a three-year high. While rail carloads grew by 2.5% year-over-year through May, intermodal growth slowed with only a modest 0.6% gain in May.

36th Annual State of Logistics: Tariffs and market uncertainty challenge LTL carriers’ profitability

July 1, 2025

The $66 billion less-than-truckload (LTL) market is facing a turbulent year, with tariffs and economic uncertainty significantly impacting profitability. Analysts predict a challenging environment for LTL carriers, who are dealing with supply constraints, changes to the National Motor Freight Classification (NMFC), and increasing pressure on pricing strategies.

36th Annual State of Logistics Report: Truckload carriers face freight declines and tariff challenges amid China pullback

July 1, 2025

The 36th Annual State of Logistics Report highlights the challenges facing the truckload sector, the largest segment of the $387 billion trucking market. With tariffs on foreign goods affecting freight volumes, major carriers like J.B. Hunt, Knight-Swift, and Werner Enterprises are experiencing declines, particularly in intermodal and TL pricing.

36th Annual State of Logistics Report: Navigating uncertainty amid rising costs and global disruptions

July 1, 2025

The 36th Annual State of Logistics (SoL) Report highlights a logistics market tested by economic and geopolitical uncertainties. Despite ongoing disruptions, including rising tariffs and environmental challenges, the report showcases strategies that logistics professionals are using to adapt and maintain resilience. With e-commerce growth driving demand for faster deliveries and more efficient operations, the report offers a snapshot of the industry's current state and forecasts for 2025.

36th Annual State of Logistics Report: Trump tariff policies wreak havoc for ocean sector

July 1, 2025

Ocean shipping on trans-Pacific trade lanes is grappling with extreme volatility as fluctuating U.S. tariffs disrupt import volumes, leading to shipping freezes, capacity reductions, and soaring freight rates. With tariffs shifting unexpectedly, shippers are rushing to move goods before deadlines, causing port congestion to spike and freight rates to climb as carriers impose surcharges.