Tightening up on your inventories

The “just-in-case” era is over, with operations looking to right-size inventory levels while avoiding stock outs. That may call for layers of technology, starting but not ending with WMS and effective data capture.

This spring will mark four years from when the COVID-19 pandemic put global trade and inventory levels into disarray. At first, it was hard to get inventory, as so many organizations bought what they could to prevent stock outs, even if quantities exceeded just-in-time (JIT) principles.

This “just-in-case” approach helped fill empty retail shelves and meet surging e-commerce demand, but led to excess goods. In the electronics industry alone, management consulting firm Kearney last year estimated excess inventory is a $250 billion problem.

Inventory gluts aren’t just a procurement issue either. It’s felt at the DC level, too. Our Peerless Media annual DC Operations study for 2023 found a 9% increase over 2022 in respondents saying they want to increase inventory turns. In a recent survey of supply chain practitioners from third-party logistics (3PL) company Kenco, managing inventory levels ranked as the leading issue of focus in prepping for the 2023 peak holiday season, ahead of customer dissatisfaction and finding suitable seasonal staff.

“The demand and supply chain shocks experienced during the pandemic were quite unprecedented, and we also had a lot of freight disruption,” says Douglas Kent, executive vice president of corporate and strategic alliances for the Association for Supply Chain Management (ASCM). “Many of these issues have stabilized now that freight trends have largely normalized from a cost and capacity standpoint, and as a result, people are tending to avoid the overbuying that happens to mitigate the potential of freight disruption, which is good news for inventory-leveling.”

The challenge, Kent adds, is plenty of uncertainty remains, from war and global unrest to high interest rates, which continue to make inventory management a critical issue. What’s more, he explains, the remedy isn’t just tracking goods, but optimizing how much to hold and where to balance costs with service levels for consumers and B2B customers who demand rapid, accurate fulfillment.

“That is where technology is playing a bigger role, not just to support accuracy, but to optimize the placement of inventory quantities against the fulfillment requirements coming from customers,” says Kent.

Think layers

The result is a need for multiple layers of technology. Most observers agree that at the DC level, the foundation for accuracy is a warehouse management system (WMS) with bar code data capture processes and verification routines. A modern, easy-to-use WMS is with little doubt the foundation for DC-level inventory accuracy.

“The need to ensure inventory accuracy in warehouses has been a core WMS value driver for decades,” says Adam Kline, senior director of product management for Manhattan Associates. “Today when we talk about inventory accuracy, we’re not talking about how to achieve it in distribution centers, because for the most part, that’s been solved.”

Kline does offer some caveats. First, the WMS should not be antiquated and the data collection devices should be newer, ergonomic equipment.

Second, the WMS itself should support different configurations based on experience of the associates, so veteran team members take fewer verification steps, while new associates or temps use more verifications to ensure high accuracy, while not slowing down the proficient users.

“Our customers are achieving very high, almost gaudy inventory accuracy, so the conversation today is less about how to achieve high accuracy in the warehouse and more about how to balance high accuracy with speed and productivity,” says Kline. “We can do that through what we call strategies, which are configurations based on the experience level of the associate.”

For example, rather than force a proficient user to scan each item to verify quantity of the same SKU from the same pick location, administrators can let these users key in the quantity. WMS also can help with productivity by grouping picking tasks to achieve high pick density, so less travel is involved.

“Achieving high inventory accuracy with WMS is something we’ve enabled for a long time,” says Kline. “I think we’re in a phase of optimization at this point.”

In retail supply chains generally, adds Kline, accuracy at the store level lags compared to DCs because many stores lack WMS-like inventory control software. Manhattan offers retail store systems that address this need, adds Kline, but in general, there’s progress to be made. “If you’ve put all these measures and software into place in your DCs to ensure inventory accuracy, but then you ship it to stores, and there are no effective systems in place, that’s not a good situation to be in,” he says.

For some users, Kline says managing inventory spans types of software, with WMS for the DCs, retail store systems, Manhattan’s demand and inventory planning software at the enterprise level, and also distributed order management (DOM).

The layers complement each other, Kline adds, with DOM playing the role of allocating which inventory nodes to fill orders from, based on factors like cost and shipment speed, with WMS and store solutions providing the needed accuracy for what is available to pick and ship.

Kent agrees that WMS and bar coding, while vital, are already widely used for inventory accuracy, with many organizations now turning to solutions like supply chain network design and optimization tools, and multi-echelon inventory planning software.

DOM (also known as order management systems, or OMS) are important, too, Kent adds, but “you have to have accuracy over your inventory and transparency into its location to most effectively give your promise date.”

In one sense, WMS and bar code data capture are “table stakes” when it comes to inventory management, but the resulting knowledge of where inventory sits and at what point in the process, enables upstream visibility and order promising, says David Miller, vice president of strategy for Extensiv, which provides an omni-channel software platform that spans warehouse, inventory and order management. The cloud software is leveraged by third-party logistics (3PLs) providers to support warehouse process, and by brands and merchants who tap its order management and visibility functions.

The brands that leverage Extensiv’s solution want to know inventory positions to help with procurement and inventory balancing, as well as to provide status updates on order progress and shipments for customer service reasons, Miller adds.

“It all plays together,” says Miller. “When we think about warehouse management and data collection—that’s foundational to making better decisions upstream. Knowing very specifically where inventory is at the warehouse, and by location and status in each warehouse, enables confidence in what we’re doing from an order management perspective.”

Inventory insights

DOM provides a current “pooled” view of available inventory across multiple nodes and systems, which makes it important to complex supply chains with a mix of stores, DCs or 3PL partners, says Bill Denbigh, vice president of product marketing with Tecsys.

WMS is more widely needed by DC operators, Denbigh adds, not only for accurate picking and other inventory moves, but also for inventory-focused analytics that provide insights on issues like SKU velocity, available cubic volume in the warehouse and carrying costs.

While WMS solutions have long featured canned reports, in the past, new reports or analytics needed to be created by specialists, which historically made WMS business intelligence inflexible, says Denbigh. In response, Tecsys has made its analytics configurable by non-programmers.

“We’re seeing the need for a democratization of analytics for inventory management,” says Denbigh. “Now the warehouse operations managers, the non-technical people, can configure new insights. It’s putting that functionality into the hands of the management users as opposed to needing to wait to have someone build it for them.”

Tecsys has also devised mobile analytic views, and last year added a digital twin view of where inventory sits in the DC. Denbigh says this allows managers to compare the digital view of the warehouse with the storage reality, to better spot changes that might be needed, like moving a SKU to a better pick position.

“It gives you so much more ability to visualize changes that need to be made when you can view that digital twin of your warehouse on a mobile device, as you’re out looking at where the inventory is at,” he says.

Another inventory concern with WMS, says Denbigh, is that systems should offer an integration layer to goods-to-person (GTP) automation systems, which typically control inventory within the GTP zone. This integration should support dynamic synchronization, so WMS can function as a single source of truth on inventory, manage replenishment to the GTP zone, and also handle order consolidation with items that need to be picked from other parts of the warehouse.

“Use of automation is growing and filling a much more important role in warehouses, but you still need functionality for overall flow control, for integration, and inventory and order visibility, as well as for making data-driven decisions, and these are all broader roles that WMS continues to perform,” says Denbigh.

When it comes to autonomous mobile robot (AMR) solutions that work on a GTP principle, it’s the robotics software that manages inventory within its zone, using algorithms that fine tune the inventory placement, explains Joseph Kraft, director of systems consulting for Geek+.

“The Geek+ system can dynamically slot and re-slot inventory based off a heat score assigned to each active SKU,” Kraft says. “The heat score assigned to a SKU can be determined by historical velocity data, actual or predicted demand, or any combination of the above.”

The GTP system will slot products into optimal position on rack shelves based on this heat score, Kraft adds, and also assign a heat score to the rack itself. “We use that heat score to relocate the racks to more optimal locations in the field so there’s less distance for the robots to travel when they need to retrieve the higher-score racks,” he says. “Each time the system performs dynamic re-slotting and rack optimization, it can report the results back to an upper-level WMS as required.”

Ease of use matters

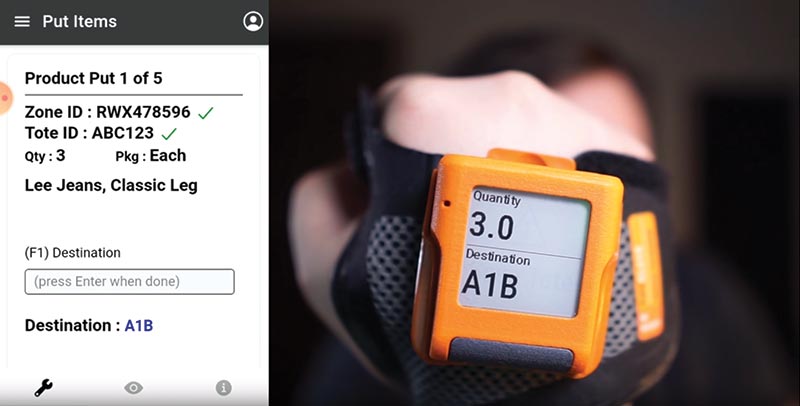

The adaptability of a WMS helps with inventory management by allowing end user organizations or implementation teams to tweak or add functions while streamlining device screens to make picking or put tasks easier to follow, which helps drive inventory accuracy and productivity, say Mark Fralick, chief technology officer for Softeon.

Overall, adds Fralick, the push in the WMS space has been to streamline screens and make it very simple for associates to see where to go next. Whereas a legacy system will often indicate next pick location with a set of cryptic numbers, Softeon’s approach with its LUCA platform is to present a simple bit of advice a streamlined UI, like “aisle change” for the next pick, or “move 3 bays” over.

“We’ll use simple instructions to decode the next location so the user doesn’t have to,” says Fralick. “This helps with onboarding, and even if someone has been around for a while and knows the warehouse, if location is hard to decode, it might take a couple of seconds to figure that out.”

The LUCA platform is “composable,” Fralick explains, because it supports UI and workflow creation, as well as integration, without traditional, hard-coded programming. For example, tasks and UIs for wearables like glove-based devices can be quickly configured rather than programmed. “What we’re doing is minimizing the clutter on the screen, to make it easier for associates to see what is going on,” says Fralick.

WMS providers need to do many things well these days, Fralick concludes, from offering warehouse execution capabilities and orchestrating manual processes with robotics and automation, but ease-of-use for associates performing manual tasks still matters, because it drives both accuracy and efficiency.

“You’re not going to address every challenge by replacing humans [with robotics],” says Fralick. “I always say, ‘look, humans will remain a big part of the equation, so you have to provide them with the tools to make their work better.’”

Article Topics

Manhattan Associates News & Resources

Companies are excited to use AI in freight, but report finds most aren’t ready Retailers gear up for holiday shopping as consumers shift to early planning amid inflation concerns Cutter & Buck finds the perfect fit for order picking efficiency Tightening up on your inventories Labor Management as a dynamic tool Manhattan Associates introduces new transportation management offering Manhattan Associates releases updated version of flagship TMS More Manhattan AssociatesLatest in Logistics

Looking at the impact of tariffs on U.S. manufacturing UP CEO Vena cites benefits of proposed $85 billion Norfolk Southern merger Proposed Union Pacific-Norfolk Southern merger draws praise, skepticism ahead of STB Filing National diesel average is up for the fourth consecutive week, reports Energy Information Administration Domestic intermodal holds key to future growth as trade uncertainty and long-term declines persist, says intermodal expert Larry Gross Railroads urged to refocus on growth, reliability, and responsiveness to win back market share Q&A: Ali Faghri, Chief Strategy Officer, XPO More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources