2024 Lift Truck Usage Survey: Buyers look beyond the price tag, service matters

New study reveals lift truck utilization insights and explores fleet purchasing, maintenance, and management trends.

This year, global e-commerce sales are on track to surpass $6.3 trillion. That’s an almost 9% jump over last year’s numbers, and online sales are expected to climb even higher in the coming years. Consumers like the convenience of mobile shopping, platforms like Instagram continue to promote the “social shopping” experience, and the world as a whole is moving in a digital direction.

Of course, someone must still move that growing volume of orders around—from the inbound freight to moving goods around on the DC floor to getting them back out the door. At most fulfillment operations, lift trucks serve as the backbone of these operations.

Whether these vehicles run on gas, propane or electric, or if they’re operated by humans, automated or semi-automated, they serve a key purpose: to keep the modern distribution environment humming.

Every year, Peerless Research Group take the pulse of lift truck usage to get a gauge on the purchasing, maintenance and management trends taking place in the industry.

This year’s survey revealed that buyers are looking beyond purchase price when making buying decisions, and that service after the sale is also a key deciding factor. The number of companies using autonomous or semi-autonomous trucks hasn’t changed much over the last two years, but more companies are using electric-powered lift and pallet trucks than they were last year.

The findings of the “2024 Lift Truck Acquisition & Usage Study” provide valuable insights for warehouse managers, logistics professionals, equipment manufacturers, and anyone interested in the constantly evolving modern distribution environment. Peerless Research Group conducted the study, which is based on input from roughly 200 subscribers.

Respondents qualified for the survey by having personal involvement in the evaluation and purchase of lift trucks for their facility. They work in the manufacturing (74%), wholesale trade (6%), and transportation and warehousing services (6%) sectors. On average, these companies have about 300 employees and annual revenues of $520 million.

Optimizing the workhorse of the warehouse

Companies use a variety of lift truck models in their fulfillment operations, where more than half (58%) of respondents are using electric-powered rider trucks. This vehicle category includes counterbalanced, sit-down and stand-up types (Class I).

Nearly half (46%) of companies use electric-powered pallet trucks, including walkies, riders, low and high lift, and reach types (Class 3), which is up from 35% last year. The electric-power pallet truck category has overtaken IC-powered counterbalanced lift trucks with cushion tires (Class 4), which only 36% of respondents are now using in their facilities (down from 43% last year).

Thirty-five percent of respondents rely on electric-powered narrow-aisle trucks, including orderpickers, side-loaders, turret trucks, stackers, and reach trucks (Class 2). Twenty-six percent of them have IC-powered counterbalanced lift trucks with pneumatic tires (Class 5), while 13% use rough terrain lift trucks (Class 7), and 6% use electric-powered and IC-powered rider-type tow tractors (Class 6).

Lift truck fleet size differs across organizations, with smaller fleets being a common thread across most of the companies that participated in this year’s survey. Nearly one-third (32%) have three to nine lift trucks in their fleets and 28% have less than three. Meanwhile, 13% have 10 to 14 trucks (up from 8% last year); 11% have 15 to 24 (down from 11% last year), and 7% have 25 to 49 lift trucks.

At the high end of the scale, 8% of companies use more than 100 lift trucks and 6% have 50 to 99 vehicles in their fleets. Currently, the average fleet size is 20 trucks, the average truck age is nine and the average “oldest truck in use” is 15 years old.

Lift truck must-haves

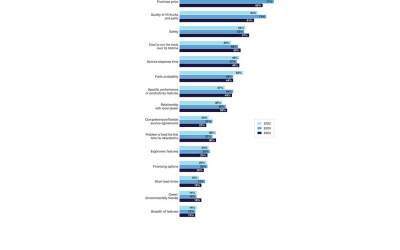

As the workhorses of the modern warehouses, lift trucks must be able to manage a tough, demanding job every day—and sometimes around the clock. When shopping for new vehicles, companies look first at purchase or lease price, but the number of respondents that put price first dropped to 68% (versus 77% in 2023). Other key shopping criteria include quality of the vehicle/parts and safety.

Half of respondents (50%) consider the cost to run the truck over its lifetime when evaluating new lift truck options; 49% view service response time as important; and 44% factor in parts availability. Specific performance or productivity features; the relationship with local dealers; and comprehensive or flexible service agreements also play important roles in the selection process.

Replacement and renewal trends

When asked how often they typically replace lift trucks, 27% of respondents say they do it every 10 years or more (compared to 39% last year), while 25% say five to less than eight years, 18% say eight to less than 10 years, and 16% say less than five years. On average, companies are replacing or retiring lift trucks a little faster than they were last year (7.2 years versus 8.2 years, respectively).

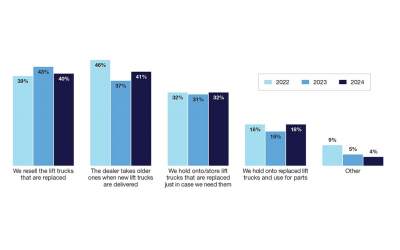

To rotate and dispose of their lift trucks, 41% ask their dealers to take older trucks when new lift trucks are delivered (up from 37% last year)’; and 40% of respondents resell the lift trucks that are being replaced (compared to 43% last year). Other companies (32%) hold onto or store the lift trucks that are replaced just in case they need them, and 18% keep them for parts.

Key buying and leasing trends

This year, 41% of respondents say they operate a core fleet that they use regularly. This percentage has been slowly dropping and is down from 43% in 2023 and 47% in 2022. When asked how lift trucks are acquired, 64% buy the trucks, 16% lease them, and 21% use both methods (up from 18% last year). In 2024, 51% of lift trucks are purchased, while 29% are leased.

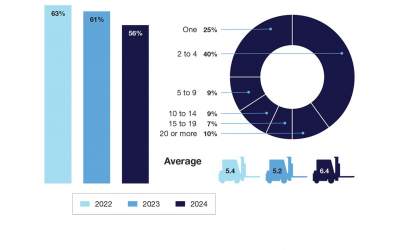

The survey also explored companies’ lift truck spending habits and expectations for 2024 and beyond. Fifty-six percent of respondents plan to buy or lease new vehicles within the next 24 months (compared to 61% last year). More specifically, most companies plan to acquire two to four trucks (40%), a single truck (25%) or 20+ trucks (10%), with the average being 6.4 trucks (up from 5.2 last year).

Half of respondents will spend less than $50,000 on lift trucks in the coming year; 19% plan to spend between $50,000 and $99,999; 14% will allocate $100,000 to $249,999; and 8% will shell out $500,000 to $1 million for new vehicles.

The average expected spend for 2024 is $174,379—an increase over 2023’s expected outlay of $139,815. Most of those lift trucks (84%) will be purchased directly from dealers, although 21% of respondents buy directly from manufacturers and 8% purchase them from another source.

Factoring in the economic conditions

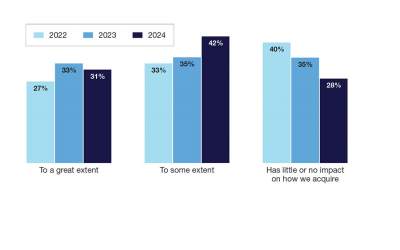

High interest rates, inflationary woes and overall economic uncertainty are all impacting companies’ purchasing plans this year. About 42% of companies say these factors impact their lift truck buying decisions to some extent (up from 35% last year) and 31% say the issues impact them to a great extent. One-third (28%) of companies say the economy and market factors have little to no impact on their lift truck acquisition plans.

Of those respondents who said the economy is significantly impacting their lift truck purchase decisions, the biggest issues include business demand, cash flow, price and “generally being unsure about what the economy is doing” and adjusting lift truck purchases based on that.

Other respondents say available stock, available funds, cost and pricing are guiding their purchase habits this year. “If business is down, we wait to replace,” said one survey respondent. Others echo the same sentiment.

Parts, training, and service

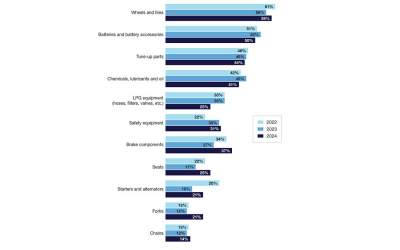

Asked about their lift truck parts purchase or replacement parts plans for the next 12 months, 59% of companies will purchase or replace wheels and tires; 50% need batteries or battery accessories; 44% will buy tune-up parts; and 41% will purchase or replace chemicals, lubricants and oil. Some of the other commonly used parts include hoses, filters, valves, safety equipment, brake components, and seats.

To train their lift truck operators, the majority (80%) of companies use an internal training program within their organizations, 19% use dealer training resources, and 13% rely on an independent service provider to train their operators. For lift truck servicing and maintenance, 47% use their dealer’s maintenance offering, 28% rely on in-house staff, and 21% outsource the job to an outside contractor.

Implementing fleet technology

The number of companies using autonomous or semi-autonomous lift truck technology in their operations hasn’t changed much over the last few years. According to this year’s survey, 19% of companies plan to use this type of technology and 81% have no plans to move in this direction. These results are fairly consistent with 2023’s and 2022’s survey results.

About 40% of companies are using fleet management software (down from 48% last year), with tracking maintenance history (77%), tracking maintenance costs (57%) and tracking safety measures (55%) being the biggest uses for these solutions. The software is also being used to track truck age, vehicle utilization levels, operating costs and productivity levels.

Article Topics

Caterpillar News & Resources

2024 Lift Truck Usage Survey: Buyers look beyond the price tag, service matters C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024Latest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources