2023 Logistics Salary Survey: Strong numbers, high demand

Our survey says that 67% of logistics and supply chain professionals are earning more this year than they did in 2022. Here’s how the numbers break down, who’s earning what and what companies are doing to attract and retain logistics and supply chain talent.

Demand for seasoned, experienced and entry-level logistics professionals remains high this year as companies continue to place more emphasis on their supply chains and all things related to these vital networks. This continues a trend that started several years ago, but that was accelerated during the global pandemic due to the highly-publicized supply chain shortages and constraints.

“Supply chain and logistics talent has been in high demand pre-, during and post-pandemic,” says Michelle Duong, vice president at Adecco SEARCH, which provides direct hire placements nationwide. Supply chain and logistics is one of many verticals that the firm focuses on. From this vantage point, Duong sees both the vast opportunities that exist in today’s business environment as well as the recruiting and retention challenges that companies face as they work to secure new talent.

Rising salaries is one of those challenges. “On the direct hire side, on average across the United States, salary increases have definitely reached double-digit percentages across the board [regardless of specific industry sector] of at least 10%,” says Duong. “That has been happening over the last three years.”

According to Peerless Research Group’s “2023 Salary Survey,” 67% of logistics professionals surveyed say that their salary level has increased compared to what they were earning in 2022. “The biggest challenge that the hiring companies are facing right now is demand for higher salaries based on the rising cost of living,” says Duong. “Companies are also having to balance between remote, hybrid and on-site work in this specific sector.”

To address these and other challenges, companies are courting more women and other diverse job candidates, ramping up their training programs, and ensuring that positions offer the work-life balance that many new recruits are seeking. They’re also looking at factors like employee engagement—which Gallup says slumped to a seven-year low in 2022, with only 32% of employees feeling “engaged” in their work—and coming up with new ways to keep their employees satisfied, in-place and productive.

Duong says companies are also doing more upskilling (facilitating continuous learning by providing training programs and development) and reskilling (teaching new skills that help employees to move into new roles within their current companies), both of which can help keep current workforces in place and attract new employees. Other companies are reducing the required years of experience on their job postings in order to broaden their pools of qualified candidates.

Finally, Duong says this is also a good time to reevaluate employee benefits packages and ensure that they’re both competitive and that they meet applicants’ expectations. Some are prioritizing mental health, for example, and ensuring that team members have the related coverage when they need it.

Other firms are doling out more flexible paid time off (PTO), and still others are helping their employees pay their out-of-pocket health expenses. “These are some of the ways employers are working to attract more talent right now,” says Duong.

To learn more about the supply chain and logistics salary trends that are taking place right now, Peerless Research Group conducted its “2023 Salary Survey” in February.

The survey was conducted via e-mail, and was based on an invitation distributed to Logistics Management’s subscribers. More than 370 qualified respondents took part in the survey. Here’s what they had to say about the current work, salary and benefits environment and how the landscape has changed over the last year or so.

Earning more money

On average, the survey found that supply chain and logistics professionals are earning $121,150 annually in 2023, which represents a decrease compared to 2022, when the average was $126,215. The median salary in 2023 is $100,000, which is less than the median of $108,000 reported in 2022 and $110,000 in 2021.

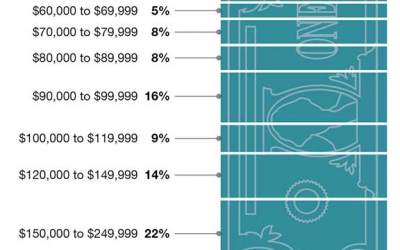

Although annual salaries vary based on multiple factors, 22% of supply chain professionals say they earn between $150,000 and $249,999 annually, while 16% earn between $90,000 and $99,999 annually, and 14% earn somewhere between $120,000 and $149,999. Additionally, 9% of respondents earn between $100,000 and $119,999, and 8% earn $80,000 to $89,999 annually.

At the upper end of the salary scale, about 5% of the professionals surveyed earn more than $250,000 a year (compared to 9% last year). And, 5% of respondents earn less than $40,000 annually, which is up from 3% last year.

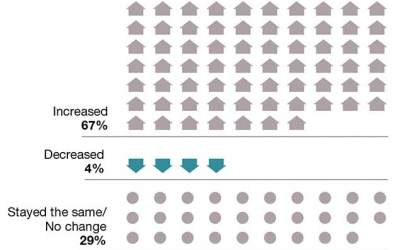

Although the survey tracked an average salary decrease for logistics professionals this year, 67% of professionals

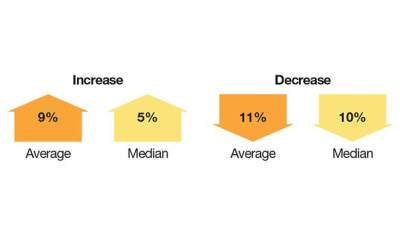

say that their salary levels have increased and 29% say their salary levels have stayed the same. Only 4% of respondents are earning less money than they did in 2022. Asked by what percent their salary has changed, the average increase was by 9% and the average decrease was by 11% (compared to 19% last year).

Who’s earning what?

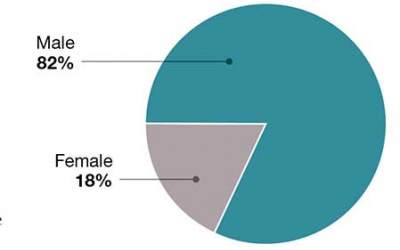

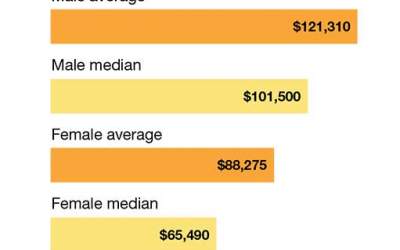

The respondent base for this year’s survey is 82% male and 18% female. On average, men earn more than women, with the former earning $121,310 annually and the latter reporting salaries of $88,275 on average this year.

Annual salaries clearly increase with age and experience, according to survey results. Respondents aged 55 to 64 reported the highest annual salary, $119,470 on average, while those aged 45 to 54 reported an average salary of $107,100. Logistics professionals between the ages of 35 and 44 earned an average of $85,000 per year, while those aged 65 or higher reported an average salary of $115,550. Finally, respondents under age 35 earn an average of $61,950.

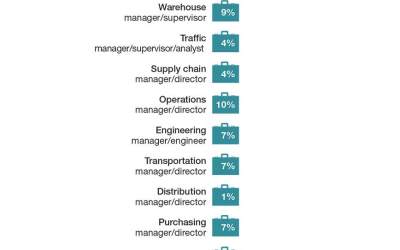

This year’s survey attracted professionals across a variety of different job roles and titles. Sixteen percent are logistics managers or directors; 10% are operations managers or directors; and 9% are warehouse managers or supervisors. Seven percent of respondents are engineering managers or engineers and an equal number are either transportation managers and directors, or purchasing managers or directors.

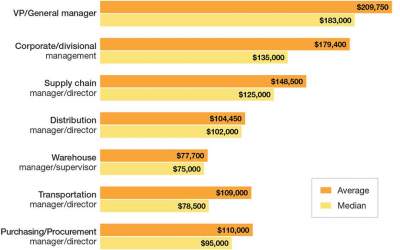

About 4% of the Logistics Management readers who participated in this year’s survey are either vice presidents or general managers. On average, those two job roles came out on top with an average annual salary of $209,750 in 2023, followed by corporate or divisional managers with an average of $179,400. Supply chain directors and managers earn $148,500 on average (compared to $151,675 in 2022), transportation directors and managers earn $109,000, and engineering managers earn $106,750.

Logistics directors and managers have seen their salaries increase over the last 12 months and now earn an average of $112,750, versus $108,410 in 2022. Purchasing and procurement directors or managers saw a similar lift in salary levels and are now earning an average of $110,000 annually, compared to $105,000 in 2022.

The experience-salary connection

When asked how many years they’ve been in their current position, 26% of respondents say they have held their positions for more than 10 years, and another 26% have been in their current positions for three years to five years. Other respondents have been in their role for one year to two years (21%), or six years to 10 years (18%). Nine percent have been in their current roles for one year or less.

Breaking those numbers down further, professionals who have been in their current positions for more than 10 years earn $117,880 on average, while those who have been there six years to 10 years earn $110,450 on average.

Individuals who have been in their roles for three years to five years earn $95,580 on average. Interestingly, logistics professionals who have been in their current positions for one year to two years are earning an average of $103,375, while those who have held their current positions for one year or less report an annual salary of $94,570.

Seeking new horizons

In terms of job pursuits, 46% of the professionals surveyed say that they’re “always open” to better opportunities. Thirty-one percent are happy where they are, 20% are passively looking for new career opportunities, and 3% are actively looking.

Respondents who are happy where they are report higher salaries ($126,395) than those who are actively looking for new jobs ($110,100). Respondents who say that they’re “passively looking” for new jobs earn $112,640 on average per year, while those who are “always looking” earn $115,925.

Asked to share their highest educational attainments, respondents say that they hold bachelor’s degrees (37%), have completed some college (22%), and hold MBA degrees (13%). Four percent of these professionals have earned another type of graduate degree, 12% earned associates degrees, 7% complete high school and 3% have a non-degree education.

When taking steps to advance their careers, 53% of professionals rely most on personal or social networking, 28% have earned industry certifications, and 22% took classes or earned a degree in business or a related field.

Eighteen percent of this year’s survey participants credit joining an industry or professional association with helping them advance their careers, while 15% say taking classes or getting a degree in transportation, logistics or supply chain have played important roles in their career advancement.

Article Topics

Photos News & Resources

32nd Annual Study of Logistics and Transportation Trends: Navigating a shallow pool of resources 2023 LTL Study: Partner for reliability 2023 Logistics Salary Survey: Strong numbers, high demand 2023 Warehouse Equipment Survey: Tighter budgets prompt targeted spend 2022 Less Than Truckload Study: Trials and tribulations of rising rates 38th Annual Salary Survey: Salaries begin to rebound 2021 Warehouse/DC Equipment Survey: Preparing for post-pandemic volumes More PhotosLatest in Logistics

Real Answers for Automation at the Loading Dock 2026 Freight Market Outlook: Key trends & insights Q3 intermodal volumes see annual gains, reports IANA Manufacturing declines for the ninth consecutive month, reports ISM Looking at the impact of tariffs on U.S. manufacturing UP CEO Vena cites benefits of proposed $85 billion Norfolk Southern merger Proposed Union Pacific-Norfolk Southern merger draws praise, skepticism ahead of STB Filing More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources