2025 YMS Update: How yard management systems are transforming the modern supply chain

As supply chains evolve, so too must the yards that support them. Companies are modernizing their yard operations with modular systems that improve visibility, speed up trailer flow and increase efficiency.

In a perfect world, the warehouse or DC yard works like a well-oiled machine. Strategically positioned between busy fulfillment centers and complex transportation networks, these critical junctures can either be facilitators or chokepoints for the entire supply chain.

When yards are organized and supported by the right tools, they keep freight moving and operations on track. If they’re overly reliant on manual processes, guesswork and human intervention, however, yards can become a key source of friction in the already-hectic logistics environment.

For whatever reason, yards also tend to be last in line for digital and technological investments. Much investment has been poured into warehouse and DC software, automation and robotics over the last decade. Transportation networks have also received their fair share of attention through investments in software, digital tools like electronic logging devices (ELDs), and routing and scheduling software.

And yet for many companies, the yard remains the “black hole” of the supply chain—a place where visibility drops off, trailers sit idle (racking up demurrage and detention charges along the way) and dock schedules go off track. Without real-time visibility into trailer status, gate activity and yard asset location, for example, even an efficient warehouse or transportation plan can break down quickly.

Smarter yards, stronger supply chains

The good news is that more companies are beginning to take a closer look at yard operations and explore ways to make these logistics hubs more efficient.

Simon Tunstall, senior research director in Gartner, Inc.’s logistics and customer fulfillment team, says interest in yard management systems (YMS) is picking up across industries, including retail, consumer goods and manufacturing. Companies are realizing that manual yard management processes may be holding them back, he adds, and are adopting solutions like automated check-in/check-out, dock scheduling and related tools.

“I’d say companies’ appetite for YMS has grown over the last year or so after easing off a bit a couple of years ago,” Tunstall says. “We’re definitely getting more inquiries about it this year.”

Greg Braun, chief revenue officer at C3 Solutions, Inc., also sees more companies awakening to the important role that their yards play in their overall supply chains. A YMS helps manage trailer movements, track assets in real time, and coordinate check-in and check-out processes (among other things), and brings structure, visibility and control to busy yard operations.

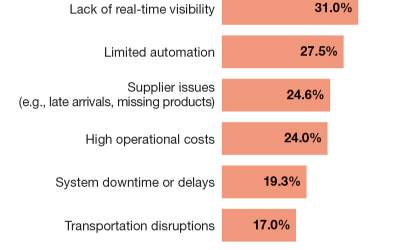

The company’s recent research report, “The State of Dock and Yard Management 2025,” outlined companies’ top yard and dock challenges as inefficient manual processes (for 39% of them), yard congestion (36%), labor shortages (35%) and a lack of real-time visibility (31%).

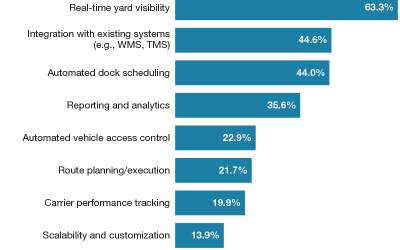

When shopping for solutions that can address these and other yard-related challenges, 63% of organizations want systems that provide real-time yard visibility; 45% want platforms that integrate with their existing systems (WMS, TMS, etc.); and 44% want access to capabilities like automated dock scheduling, according to the survey.

Some of C3’s customers include a battery manufacturer that was struggling with yard management inefficiencies. Managing the logistics between manufacturing plants and DCs was difficult due to complex material movements, long distances and outdated manual processes.

The company has multiple manufacturing buildings that need raw materials that are stored in silos. The manufacturer replaced its manual methods with C3 Yard and now has an automated system that tracks and optimizes movements across the campus—from managing raw materials to dispatching finished goods.

In another example, a U.K. health and beauty retailer worked with C3 to modernize its expanding yard operations at 23 sites across England, Scotland and Northern Ireland. The company wanted to improve the management of its inbound and outbound trucks for all of its DCs and direct-to-store deliveries.

With its new YMS in place, C3 says the retailer has better inventory and replenishment visibility; streamlined operations across all of its sites; and a single interface for managing yard and dock activity.

It's time to rethink the yard

As more companies lean into the idea of using technology to run their yards, the YMS platforms they’re evaluating and adopting are also advancing, improving and integrating more advanced functionalities.

Many of these systems now go beyond basic trailer tracking and check-in/check-out management to include tools like artificial intelligence-enabled vision, dock appointment scheduling, real-time asset visibility, and integration with WMS and TMS platforms.

The goal is to create a more connected, responsive yard environment that keeps freight moving, reduces dwell time and supports broader supply chain efficiency. Even smaller operations are taking the leap, knowing that the cost of inaction may quickly outweigh the upfront YMS investment.

“We’re seeing more inquiries coming directly from clients who realize there’s a real opportunity to improve yard efficiency,” Tunstall says. “It’s not just for the most complex operations anymore. Companies with distributed or previously-manual yard networks are also starting to take a closer look at YMS.”

Tunstall says that new technologies are helping to drive that shift. AI-enabled vision tools are gaining traction in the yard, and particularly for check-in, check-out and vehicle condition tracking. Companies like EAIGLE are working with YMS providers, Tunstall explains, to apply camera-agnostic systems that build on existing security infrastructure. And Loadsmart, which acquired computer vision startup NavTrac in 2023, is now expanding its platform’s capabilities to include dock scheduling and yard automation.

These are just a few examples of how companies are pairing up to create complete, integrated solutions that help address some of the long-standing yard operation gaps. By combining expertise in AI, computer vision and logistics software, this “partnering” trend gives end users more options, whether they need a full-blown YMS or simply want to improve a specific function (e.g., gate visibility or appointment scheduling).

In another development, Tunstall says more YMS point solution providers are also entering the space, giving companies even more flexible, accessible ways to modernize their yard operations. Many of those dedicated systems allow users to start with a specific function like dock scheduling or gate visibility and then scale from there as needed.

“It’s turning into somewhat of a race between these specialists and those companies that offer supply chain execution suites,” says Tunstall. “However, I do believe the specialists have the edge when it comes to managing complex networks and yards.”

Elevating yard operations

Matt Yearling, founder and CEO of YMX Logistics, believes the industry has yet to fully tap the potential of yard management systems. “There’s not one operation that couldn’t benefit from a YMS,” he says, “yet still a large majority of sites don’t have one in place.”

Even among large shippers, Yearling says he’s seen cases where companies build their own systems rather than invest in off-the-shelf platforms—a decision he sees as a sign of unmet expectations across the broader YMS landscape.

Part of the challenge, Yearling notes, is that the value of a YMS depends heavily on how well it’s implemented and used. “The software alone isn’t going to fix your yard,” he says. “It has to be deployed in a way that supports transparency, accountability and strategic decision-making.” Without all of those elements in place, employees may revert to using manual workarounds and conflicting data, both of which can undermine efficiency.

Yearling also notes that while most YMS platforms offer similar core functions like trailer tracking, gate management and dock scheduling, they often approach the problem from different angles. Some are focused on appointment scheduling, others on computer vision at the gate and still others on electronic bill of lading workflows.

For best results, Yearling encourages companies shopping for YMS to be clear about what they need and to compare providers on transparency, pricing and long-term value—not just product features.

Solutions built to scale

Looking ahead, Yearling sees yard operations continuing to become a more strategic part of the broader supply chain. “This isn’t just about technology,” he points out. “It’s about aligning operations and tools to deliver consistent results across the network.”

Speaking to shippers looking to install a new YMS or upgrade an existing one this year, Tunstall recommends taking advantage of the flexibility many solutions now offer. Instead of committing to a full-scale deployment upfront, he explains, you can start with targeted capabilities like dock appointment scheduling, gate check-in, or trailer visibility and expand over time.

“You don’t have to buy the whole thing on day one,” Tunstall says. “Many systems now let you start with what you need and add modules as your operation grows.”

Today’s YMS platforms are also becoming more versatile, with some providers extending their tools into adjacent areas like visitor management and personnel coordination. That expanded functionality helps support a wider range of yard workflows while enhancing overall visibility and control.

“We’re seeing vendors take a broader view of the yard, which makes these systems more valuable across different functions,” says Tunstall, who adds that even a basic solution can help a manual yard start boosting visibility, reducing delays, and paving the way for a more expansive YMS integration. “Shippers should know that they don’t have to solve everything at once—they just have to get started.”

Article Topics

C3 Solutions News & Resources

Worried About Supplier Risk? This Template Helps You Stay Ahead 2025 YMS Update: How yard management systems are transforming the modern supply chain Automotive Supply Chain The State of Dock and Yard Management Uncover the Top Manufacturing Industry Insights Leading to Your Success Get Your Warehouse Receiving Audit Checklist Now! Vendor Evaluation Questionnaire for RFPs More C3 SolutionsLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources