2025 in Review: Uncertainty amidst a new brand of chaos

Persistent volatility, policy whiplash, and uneven demand left logistics managers feeling trapped in a loop - where every solution seemed temporary, and every forecast came with an asterisk. From tariffs and trucking to rail and ocean freight, the year's defining force was disruption itself

During an October episode of 60 Minutes, journalist Andrew Ross Sorkin remarked: “We’re in our own Roaring 20s, with stocks climbing for months, just like then.”

Sorkin, a seasoned markets reporter and creator of the hit series Billions, believes today’s economy is being artificially lifted by massive investment in the AI boom—a dynamic that may carry significant risk as traditional guardrails come down. Are we in a bubble? If so, how long will it last, and what happens when it bursts?

If his view proves accurate, the underlying economy may not be as strong as it appears—raising real concerns for businesses and the supply chains that support them. In fact, one word surfaced repeatedly during this year’s research and expert interviews: uncertainty.

For many logistics and transportation professionals, 2025 felt like Groundhog Day—a replay of 2024’s volatility. Economic, operational, and financial uncertainty continued to cloud decisions about new facilities, capital investments, and workforce expansion. Against that backdrop, we once again turned to a panel of freight transportation experts to offer their perspective on how each mode is navigating this uneasy landscape.

Shippers

As 2025 draws to a close, shippers continue to navigate shifting trade policies, unpredictable tariffs, and volatile political dynamics among global partners.

Bill Hutchinson, long-time supply chain executive and former senior vice president of logistics at WestRock, says, “AI is everywhere, representing one of the biggest productivity unlocks we’ve seen.” Yet, he cautions that companies must first ensure their data foundation is solid to fully capture those benefits.

“The challenge of data quality has been with us for a long time—it’s not a new problem,” Hutchinson adds. “It requires real investment and focus. The wave of new tech firms promising to fix it reminds me of the dot-com bubble of the late ’90s. Don’t sit it out, but choose your partners wisely.”

Hutchinson also notes that trade compliance may have been the toughest job in logistics this year, given the pace and scale of tariff changes. “If you’ve got good people in compliance, take care of them—they deserved combat pay in 2025.”

Nearshoring continues to gain traction across industries, but Hutchinson questions whether the U.S. workforce can meet the opportunity. “Everyone wants a strong industrial economy, but it remains to be seen if this generation wants that kind of career,” he says. “With relations strained with both Canada and Mexico, we’re missing out on the regional stability this could bring to the entire continent.”

A chief supply chain officer at a major U.S. retailer, who requested anonymity, reports smoother global freight conditions overall. “Ocean cargo was easy to secure at Asian origins, and there were few port delays on arrival,” the executive says. “We expect the Union Pacific–Norfolk Southern merger to streamline transcontinental intermodal, though it won’t affect much retail freight.”

The same executive describes trucking as “a bit of a mishmash”—some carriers chasing volume, others holding firm on rates. The end of the de minimis exemptions, however, has eased parcel congestion. “Carriers are hungry for volume,” the CSCO adds. “Peak season hiring has been steady, and we’re not seeing labor shortages despite low unemployment.”

Domingo Amunategui, vice president of logistics at Graphic Packaging, says domestic trucking remained “surprisingly flat.” Expectations for a rebound in core demand never materialized. “The new tariffs created panic among consumers and shippers, which led to hesitation and a lack of risk-taking,” he explains. “We saw a brief inventory surge as manufacturers rushed shipments before tariffs took effect, but that bump was quickly absorbed by excess capacity.”

Motor Freight

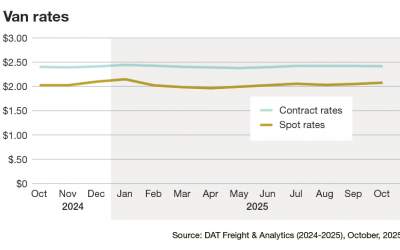

As I mentioned, the overarching theme I heard during interviews was that 2025 looked a lot like 2024. This is borne out by DAT data on truckload contract and spot rates.

John Larkin, operating partner, transportation and logistics at Clarendon Capital, has been around the game for a long time and provides a trenchant point of view on the motor carrier segment: “Demand is mediocre, thanks to weak industrial production, weak home sales and flat retail volumes. Capacity is not leaving the industry as it has in the past.”

According to Larkin, the dry van sector has been hurt the most, while reefer and flatbed are weak, but better than dry van. “Intermodal is remarkably strong, as shippers look to save dollars,” he adds. “And the tank sector is soft on the chemical side, but stable in the refined petroleum sector.”

In Larkin’s view, the “Big, Beautiful Bill” has provisions in it that will stimulate investment in America by allowing businesses to deduct 100% of their capex as an expense, among other things. He also says that “claims that tariffs would throw us into a recession and reignite inflation have proven to be overblown.”

Larkin also believes that the “EV fad” is fading. “There are not enough rare earth minerals to manufacture batteries, not enough power generation given data center demand, and the economics don’t work without subsidies.”

However, he observes that the rise of technology use in trucking is on the cusp of revolutionizing the business: “Autonomous trucks are coming, even with EVs in a holding pattern. AI is allowing for automation of labor-intensive back-office functions, while network optimization tools are finally becoming mainstream.”

Satish Jindel, principal of transportation consultancy and analyst firm SJ Consulting Group, always provides insightful feedback on both LTL and parcel transportation markets.

According to Jindel, the total LTL market size declined marginally by 1% from $53.2 billion in 2023 to $52.8 billion in 2024. This is estimated to further decline by 2% in 2025 to $51.9 billion. After Yellow’s closure in August 2023, the unionized carriers’ revenue share among the Top 10 LTL carriers dropped from 15% in 2023 to 13% in 2024. Also, the public carriers’ share in total LTL market size also dropped from 61% in 2023 to 57% in 2024.

Interestingly, the number of LTL terminals increased by 11% in 2024, reaching a total of 3,216 when majority of Yellow’s terminals became operational again after being bought by other carriers. This increase in terminal count continued in the first-half of 2025 as well, reaching 3,330 in August 2025. The overall LTL door counts also increased. Excess capacity with terminals has contributed to decline in operating margin for the LTL industry from 14.3 percent in 2023 to 12.2 percent in 2024.

ShipMatrix, a company of SJ Consulting Group, has a distinct view of the U.S. domestic parcel market. Revenues increased 4.1% from $181 billion in 2023 to $188 billion in 2024. The total parcel volume handled by all providers increased by 3.9% from 22.9 billion packages in 2023 to 23.8 billion in 2024.

This means 90.9 million parcels were delivered every day in 2024 as compared to 88.1 million last year. Total volumes decreased 1 percent for the top four parcel carriers (FedEx, UPS, USPS and Amazon) in the first-half of 2025, as compared to similar period in 2024, however the total parcel market is estimated to show annual growth of 2.9 percent in 2025, reaching 24.5 billion packages.

And, while Amazon is now delivering more parcels than any of the “Big 3” parcel carriers (FedEx, UPS and USPS), the industry is now more fragmented than ever before with other large retailers like Wal-Mart, Target, and Costco looking to build out their own private delivery networks and new startups entering the market using gig-workers and lower prices.

Intermodal & Rail

We always look to intermodal guru Larry Gross for his insights. As he said, last year the major theme was the impressive strength of the international intermodal market and the movement of ISO containers. For North America in 2024, these shipments were up 13.9% versus year-to-day 2025 of 5 5.%.

Much of this was laid to a combination of factors, including strong retail demand, shipments moving earlier than normal, both to beat potential tariff actions and to avoid getting hung up in the ILA strike, and higher West Coast import share than normal, due to both the Red Sea Houthi rebels making transits from Asia to the US East Coast more expensive and also fear of the ILA strike.

This has changed. During 2025, we saw a surge in business earlier in the year, as importers rushed to beat the effect of new tariffs. This has largely dissipated. Gross’s numbers show the peak occurring in July this year, with volumes tailing off and not expected to rebound by year end. “Beneficial cargo owners have tariff fatigue,” he says. “By the time they react, things have changed again.”

Intermodal industry veteran Ted Prince echoes the chant that 2025 was a re-run of 2024—with a whole lot of trade craziness thrown into the mix. “Inland ports are totally dependent on trade and are being hit with tariff-related volume shrinkage,” he says. “People don’t like uncertainty in trade or in economics, so it’s put a damper on the economy. Consumers are putting off decisions to spend on things like housing, cars and other consumables, which ultimately impacts freight volumes.”

To date, rail service is generally good, but not being tested with volume surges. In a recent survey, intermodal was seen to be both more expensive and slower than truck, so not a sign that growth in this sector is on the short-term horizon.

Of course, the big news was the announcement of Union Pacific’s intent to acquire Norfolk Southern. While this has been well-covered in the media, we won’t really know what to expect until the actual filing later this year.

No rail freight year-in-review would be complete without tapping the expertise of Tony Hatch, principal of New York-based ABH Consulting. However, he too subscribes to the Groundhog Day theory. “In 2025 nothing much new is happening, beyond the news of the UP move to acquire NS. We’re know more about all of this when actual application is filed.”

According to Hatch, we’re still in a freight recession, with muted volumes, “leading to a blah and uninspiring year that’s been hurt by economic uncertainty and harmful policies from DC. Growth from near-shoring has not really materialized and green initiatives, which are generally positive for railroads, are largely in abeyance.”

Jason Kuehn, VP of the transportation and advanced industrials practice at Oliver Wyman says that “economic uncertainty still looms large, and I read nothing but negativity in the trucking sector with talk of freight recession and flat or negative rate outlooks. In comparison the rail sector—so far—looks pretty good.

According to Kuehn, through the end of third quarter, U.S. rail traffic year-to-date is up 2.1% for carload and up 3.5% for intermodal while North American traffic is up .6% for carload and 3.9% for intermodal. The carload growth in the U.S. is heavily driven by coal and grain which are not particularly truck competitive.

“While the future is still very uncertain, nonetheless the rail industry has been doing pretty well even if they are producing AI competitive stock valuations,” says Kuehn. “Activist investors are still looming large in the rail industry as we saw with the abrupt management change at CSX, keeping a tight focus on quarterly results,.”

Ocean

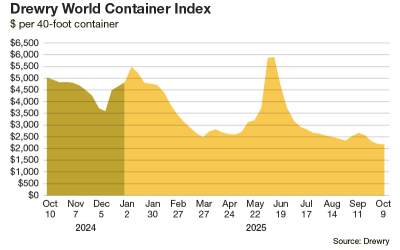

The ocean freight market in 2025 has been defined by tariffs, volatility, and disruption. According to Phil Damas of Drewry Shipping Consultants, new import duties, rising port fees, and erratic transport volumes created an uneven year marked by rate swings and operational uncertainty.

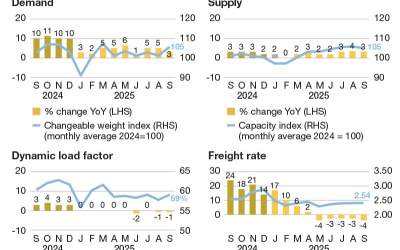

After a strong start, the trans-Pacific eastbound surge collapsed in the second quarter. Asia-to-North America container traffic rose 8% year-over-year in Q1 as importers front-loaded shipments ahead of new tariffs—then plunged 7% in Q2 as demand cooled. Drewry and the National Retail Federation expect further declines through year-end as the effects of shifting U.S. trade policy continue to ripple across global lanes.

Blank sailings have also spiked. Project44 data shows cancellations on U.S.–China routes reaching levels not seen since the early pandemic, with October blanks projected to exceed those 2020 highs. The firm attributes much of the pullback to the so-called “Liberation Day” tariffs, which distorted import costs and forced carriers to cancel sailings to protect rate stability.

“Carriers are blanking sailings at an intensity we haven’t seen since the early pandemic period,” says Project44 researcher Bart De Myunck. “This time, the strategy is less about crisis response and more about maintaining rate stability in a tariff-distorted market.”

Despite the turbulence, sourcing patterns remain largely intact. Shifts away from high-tariff origins like China are expected to take years to materialize, with the costs of tariffs currently split among manufacturers, importers, and consumers.

Veteran ocean carrier executive Peter Keller says 2025 will be remembered as a year of tumult and transition. “Trade barriers—both obvious and hidden under regulation—have always been part of the landscape,” Keller notes. “Now, significant change is underway. It’s fundamental, it’s disruptive, and it will take years to settle. Expect a bumpy ride ahead.”

Article Topics

Amazon News & Resources

2025 in Review: Uncertainty amidst a new brand of chaos 2025 parcel peak volumes are expected to climb as shippers brace for higher fees, says ShipMatrix Amazon Shipping rolls out higher Peak Season fees for 2025 holidays UPS Q2 revenue falls 2.7% amid economic uncertainty, Amazon volume glide down takes hold Amazon announces plans to triple delivery network, targeting rural U.S. with $4B push for same- and next-day deliveries Shipware weighs in on rekindled Amazon-FedEx business relationship FedEx and Amazon take steps to resume partnership, with a focus on residential large package delivery More AmazonLatest in Logistics

DHL’s 2025 Peak Season approach includes more planning and less panic Union Pacific–Norfolk Southern merger filing with the STB is delayed delayed until mid-December Old Dominion Freight Line issues November operating metrics update Services economy remains on growth track in November, reports ISM Looking at the LTL market with Scooter Sayers U.S. Department of Transportation targets ‘CDL Mills’ as thousands of training providers removed from federal registry Key Ocean, Air, and Trade Trends as We Approach the New Year More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources