Transportation Best Practices/Trends: Private fleet growth soars

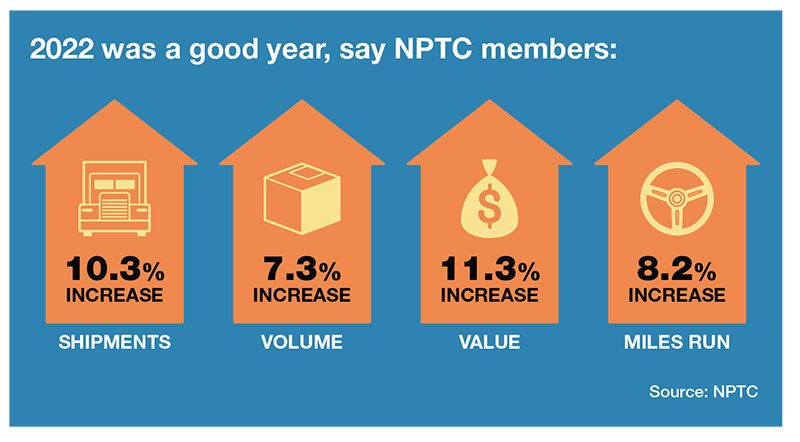

We take a deeper dive behind the numbers to examine why private fleets have had eight consecutive years of consistent growth in four key metrics—shipments, volume, value, and miles-run.

The $415 billion private fleet market has consistently grown in the past two decades to represent approximately 50% of the total number of fleets operating in the trucking industry. Some of the biggest names in industry—Amazon, Pepsico, Sysco, Walmart, Haliburton—operate the largest private fleets in America.

Despite facing numerous challenges, private fleet share has remained virtually unchanged due to the strength and versatility of its business model and focused commitment of the men and women who manage and run the fleets for their organizations.

According to figures compiled by a benchmarking survey of nearly 1,000 private fleets by the National Private Truck Council (NPTC), the sentiment among private fleet operators this year is “growth.”

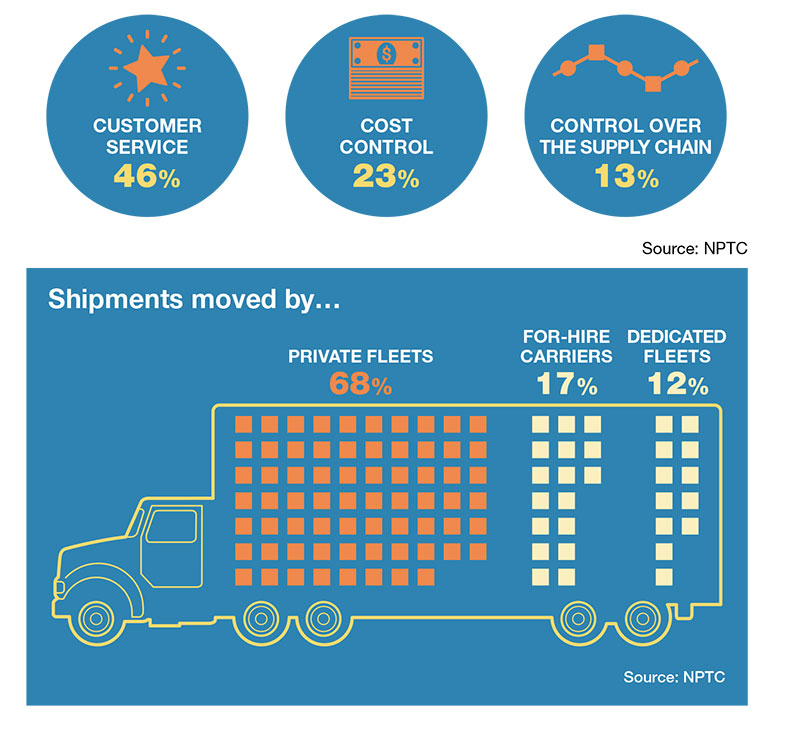

The top market drivers for having a private fleet are customer service (46%), cost control (22.9%), and control over the supply chain (13%). In 2022, 76% of private fleets—versus 68% in 2021—expected to grow their fleets in the next five years by adding equipment and handling more freight.

“The pandemic brought about a surge of business for many companies, and having a private fleet proved to be a winning advantage,” says Gary Petty, president and CEO of the NPTC. “The ability of private fleets to respond well to extraordinary levels of customer demand enhanced their reputation in upper management as reliable, essential, cost-efficient and an invaluable competitive edge.”

Today, the private fleet continues to be the “rising star” of transportation, says Petty. According to NPTC data, shipments by private fleets increased 10.3% in 2022, volume increased 7.3%, value of shipments was up 11.3%, and miles-run increased 8.2% last year.

Top reasons for having a private fleet, according to NPTC members:

Let’s take a look behind those numbers to examine why private fleets have grown in a market of restrained growth by their for-hire counterparts. We’ll look at how they’ve improved in recruiting and retaining drivers and why private fleets have had eight consecutive years of consistent growth in all four metrics—shipments, volume, value and miles—in an era of tight capacity and an ongoing driver shortage elsewhere

in trucking.

Private vs. for-hire?

There is always some “churn” occurring between private fleet operators and their for-hire brethren. Usually, it’s a constant juggling act as shippers, manufacturers and private fleets toggle between moving fleets internally or finding a for-hire carrier.

According to internal NPTC calculations, companies with private fleets moved an average of 68% of shipments with their private fleets, 17% with for-hire carriers and 12% with dedicated fleets. These share percentages have remained constant for six consecutive years, NPTC officials say.

“There is no trend to outsourcing private fleets to for-hire or dedicated carriers; in fact, the opposite is true,” says Petty. That’s because even before the pandemic years, corporations feared control of transportation was slipping away because of the constant risk that outside capacity was unacceptably expensive, inconsistent, or unavailable at any price when demand was at its peak.

This threat caused some major corporations, which previously have relied entirely on outside carriers, to start their own private fleets from scratch for the first time in their history. Higher outside carrier costs and at-risk capacity are helping grow the private fleet market. The average overall cost of outside carrier services ranges from 30% to 50% higher than the cost of operating a private fleet.

However, during the pandemic, outside carrier costs were sometimes two times to four times as high—if the service could be obtained. Some 67% of private fleets help justify their value by benchmarking their costs and quality of service against outside for-hire/dedicated service providers that are used to augment the private fleet, adds Petty.

How is driver market affecting private fleets?

Driver-related issues are the biggest challenges for private fleets. In 2022, driver turnover among private fleets was 22.5%, the highest level in many years. But that bump in turnover is still far superior to the 90% annual turnover of large, long-haul carriers and 72% of smaller carriers, according to the American Trucking Associations.

For the previous 15 consecutive years, the average rate of private fleet driver turnover has held steady at 14.25%. In the meantime, driver retention has dropped from an average of 10.5 years in 2021 to 9.5 years in 2022. Lucrative sign-on bonuses and retirement are contributing factors to greater turnover.

However, Petty says that “private fleets still attract the best drivers and have the best jobs in trucking.” Compensation averages $79,907 plus 22% of gross pay in benefits. Some 79% of companies offer driver incentive pay (versus 65% in 2021), and 68% of drivers are home every night. In many cases, drivers also enjoy newer equipment with premium upgrades and state-of-art safety technologies.

“Driver retention is high because of favorable working conditions, a culture that honors and rewards drivers, and an employer that respects the private fleet as an important component of the company’s business plan,” says Petty.

Successful fleet operation

A good example of a well-run private fleet is Standard Logistics, a fleet run under the Standard Industries aegis. It has doubled its size in the last 12 months, and is now using more than 300 drivers across its 17 locations.

Even with current global supply chain challenges, Standard Logistics is providing customers with stability and flexibility through reliable, versatile logistics solutions. It says the key is building an inclusive, community-

centric culture for its drivers.

“Our growth over the past year has proven that our logistics and transportation services are in high demand and that our focus on our drivers and company culture are what set us apart,” says Volker Bargenda, president of Standard Logistics. “Our people are our greatest asset.”

More than a tactical tool

The exceptional performance of private fleets comes after a period unlike any in the recent history of freight transportation. “It was a time marked by capacity constraints in many areas of for-hire transportation,” says Petty.

Once freight demand returned to more normal—if elevated—post-pandemic levels, capacity shortages emerged in the availability of outside carrier services. This meant that obtaining for-hire carrier services became more challenging and costly. Indeed, this lack of capacity impinged upon the strategy used by many private fleets to use outside carriers to flex up or down to meet market demand.

At the same time, there were supply chain shortages in component parts, hamstringing the ability of original equipment manufacturers to supply the amount of equipment that the trucking industry was demanding.

“We continued to suffer through a severe driver shortage that hampered the ability of all fleets to expand their operations,” says Petty. “And, as if those challenges weren’t enough, the industry was forced to absorb rising diesel fuel prices which began their steady ascent in June of 2021.”

Against this backdrop, the private fleet has proven itself as more than a tactical tool or resource, but also as a stable, strategic asset—a valuable link in a company’s supply chain operation. Private fleets are an answer to unsure capacity at for-hire fleets. Today’s private fleet allows companies to control logistics cost and service on both inbound and outbound sides of the supply chain, and to provide protection from the volatility present in the for-hire side of the business.

In addition, in an era in which supply chain shortages manifested themselves internally (in many cases preventing companies from shipping via full truckloads), experts say the private fleet provides flexibility to better control the supply chain and satisfy customer demand—at least partially on both the inbound and outbound sides of the ledger.

Private fleet advocates say that these unprecedented years since the pandemic underscore the essentiality of the private fleet service and the value provided by these companies.

Article Topics

American Trucking Associations News & Resources

Truck tonnage declines in August, reports ATA September truck tonnage falls, after two months of gains, reports ATA White House takes steps to tighten CDL requirements for truck drivers Truck tonnage levels head up for second straight month in August, reports ATA July truck tonnage sees marginal gains, reports ATA Various industry groups laud the passage of the ‘One Big Beautiful Bill’ Industry groups show support for Senate voting to pass the ‘One Big Beautiful Bill’ More American Trucking AssociationsLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources