Top 30 Ocean Carriers: Pending moves set to shake things up

Today, the volume rankings of the leading ocean cargo carriers only tell half the story. With the planned merger of two of China’s largest players, and the pending sale of Singapore’s NOL, the whole scenario may be set for major upheaval.

Latest Logistics News

How Warehouse Leaders Turn Uncertainty into Advantage 2025 Salary and Compensation Study Warehouse/DC Operations & Automation: Time to transform operations 2024 Less-than-truckload Research Study 2024 Salary Survey Research Report More Special ReportsDespite their best efforts last year to address the over-capacity conundrum, vessel operators have yet to manage their space excess adequately and are still struggling to capture revenue and restore shareholder value.

When we examined this issue last year, it appeared that carrier consortiums had put into place innovative pricing strategies to bring some order to the situation, with shippers making concessions in exchange for sustainable service cycles and schedule integrity. Today, all bets are off. Given the disruption that’s taking place in the ranks of today’s major players, a new layer of complexity has been added, say industry analysts.

“Some U.S. retailers are paying less to transport their merchandise this year, thanks to the use of more large-capacity ships by ocean carriers,” says Ben Hackett founding president of the shipping consultancy Hackett Associates. “The increased capacity has driven down rates, but the relief could be short-lived because some lines have already canceled voyages to counteract the trend.”

Hackett adds that shippers are seeing “complete chaos” on the high seas in terms of the amount of capacity available and the level of spot freight rates. “One has to wonder why carriers cannot match supply to demand,” he says. “The end result will likely be a highly volatile situation of freight rates moving up and down.”

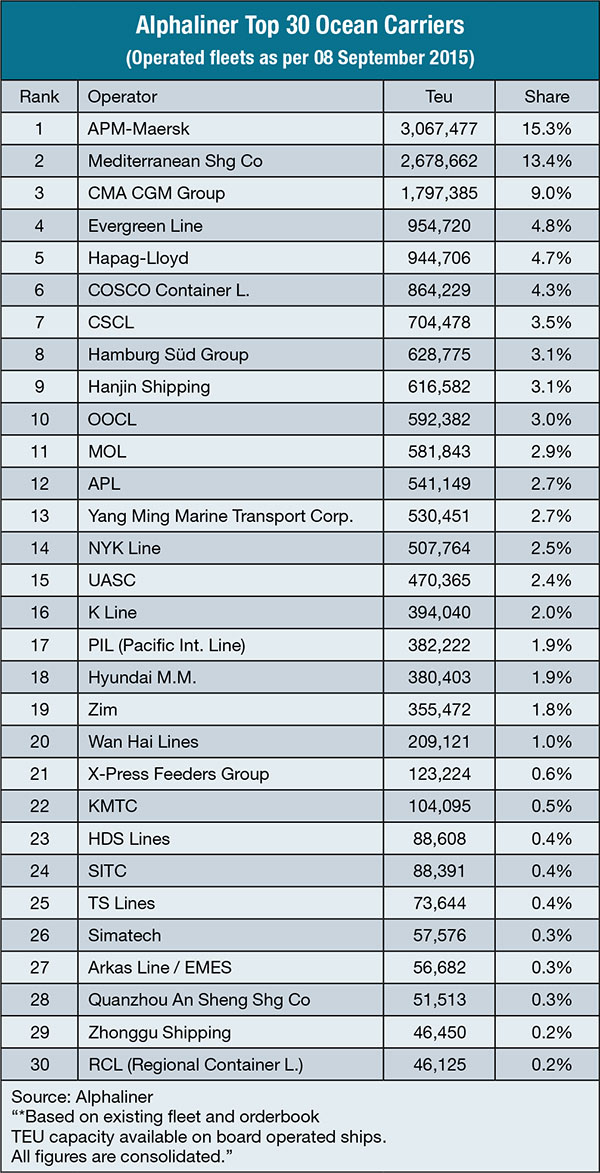

To fill the new generation of mega-vessels, ocean carriers honor agreements to share vessels and pool cargo to save money. Sixteen shipping companies operating in four major corporate alliances now control about 80 percent of the world’s container shipping fleet, according to maritime experts at Alphaliner in Paris.

Another trend worth noting, say analysts, is that most of those 30 carriers today are global operators, with scores of them comprising at least one of the four major alliances that dominate the east-west container trade. For the time being, this has been a good thing for U.S. logistics managers, who see rates softening on the robust, yet over-tonnaged Asia-to-Europe trade.

Alliance shakeup

In the wake of one government-backed carrier being put up for sale, Singapore’s NOL, China is preparing to merge two of its state-owned shipping entities, China Ocean Shipping Group Company (Cosco) and China Shipping Container Lines (CSCL). Cosco and CSCL currently sit at No. 6 and No. 7 respectively in the rankings of carriers delivering twenty-foot equivalent units (TEUs).

Based on today’s fleet, the combined entity would comfortably move into fourth place with a total fleet in excess of 1.5 million TEUs, giving a world share of around 8 percent.

Economists contend that the rationale for a merger is entirely sound from a financial viewpoint and calls into question why China has persisted with the two-carrier strategy for so long. Between them, the two carriers have approximately $900 million in operating losses from container operations in the previous five years.

Analysts agree. London-based Drewry Maritime Research, for example, says that it makes little sense to have two national—state-controlled—carriers competing fiercely against one another and against non-Chinese carriers in the same markets.

“It was Chinese competition regulators that blocked the proposed P3 alliance between the world’s three largest carriers Maersk Line, MSC and CMA CGM last year,” observes Drewry researcher Simon Heaney. “After blocking P3 on competition grounds, it seems now that China is happy for the number of major carriers to shrink by one.

There is certainly a hint of ‘double standards’ about this story.”

Shippers should also be wary that if the merger goes ahead, it has the potential to cause a domino effect on existing carrier alliances and inspire further carrier mergers in Asia that will be damaging to industry competition.

The first question shippers need to ask is: What will happen to the carrier alliances that the two lines participate in on the East-West trades? COSCO is a long-standing member of the CKYHE Alliance alongside K Line, Yang Ming, Hanjin and Evergreen, while CSCL is a part of the Ocean Three consortium alongside CMA CGM and UASC that was set-up at the start of this year.

A merger of the Ocean Three and CKHYE alliances would mean a combined market share above 40 percent—something unlikely to be approved by regulators. Instead, both alliances will be faced with a major void to fill were they to lose either Cosco or CSCL to the other carrier group, as each carrier provides around one-quarter of their respective alliance’s fleet.

Depending on which alliance wins or loses its Chinese member, Ocean Three and CKYHE will decline to a market share of just 13 percent or rise to a market share of 28 percent, based on today’s vessel deployment. Drewry maintains that any sale of NOL—part of the G6 Alliance—would also adjust the market shares, depending on who buys it.

Heaney says the next question that shippers need to ask is: If and when the merger occurs, will other countries be forced to consider similar consolidation of their shipping lines?

“While none can match the operating losses of the two Chinese carriers, vessel operators from other Asia countries have struggled more than their European counterparts in recent years. A merger between COSCO and CSCL makes sense for China, but the ramifications for the container shipping industry could be far-reaching,” concludes Heaney.

Transpacific turmoil

Transpacific shippers should also be concerned, as carriers now see a bottom in the market and expect pent-up fourth quarter demand ahead. Shipping lines in the U.S. export trade lane to Asia are attempting in enforce an across-the-board increase in freight rates during the current peak season.

“U.S.-Asia freight rates have fallen to historically low levels since the beginning of 2015 due to a strong dollar and unusually weak emerging market demand,” says Brian Conrad, executive director of the Transpacific Stabilization Agreement (TSA), a cartel-like organization that discusses rates and services. “Current westbound rate levels in many cases do not fully cover costs.”

At best, adds Conrad, the rate hikes make only a nominal contribution to a round-trip sailing. “What’s worse is that this comes at a time when westbound equipment is already in short supply, and depressed rates encourage migration of containers to other trades,” he says.

Analysts note that this action reflects the trade’s recovery from congestion challenges earlier in the year, a strengthening market heading into what is typically the trade’s peak season, and an urgent need to halt damaging rate erosion.

Meanwhile, the member carriers in the TSA’s westbound section will be seeking to establish new target rates in all dry commodity segments that translate into modest increases in most cases, with higher proportionate increases for the most depressed rates. TSA-westbound lines say they expect to follow with similar, gradual increases in November and December.

Sea change

Just as ocean carriers have been using their collective leverage to reshape the pricing and service arena, international shipper’s associations have been working together in closer harmony.

According to the 2015 Global Shippers’ Forum (GSF) Annual Report, the new generation of larger vessels, coupled with changes in carrier consortia, requires vigilance and cooperation. Based in London, the GSF is an umbrella organization of shippers’ associations such as the National Industrial Transportation League (NITL).

“We have recently launched the GSF SERVICECON contract which, for the first time, provides small and medium-sized shippers with the ability to enter into volume service contracts on fair and equitable terms,” says Chris Welsh, GSF secretary general.

In the past year, the GSF has helped facilitate an important revision of the former guidelines for the securing and stowage of cargo transport units through its chairmanship of a joint government and industry working group. This has led to agreement among stakeholders to introduce a new code of practice, which is designed to improve transport safety throughout the multimodal transport supply chain.

This was in addition to a variety of best practice and policy briefing documents published in 2014 and 2015, including GSF’s Working with Containers Guide. “We now look forward to the challenges ahead, in influencing the emerging debate about the impact of mega shipping vessels and maritime alliances,” says Welsh. “The policy think tank, International Transport Forum, is off to a good start.”

Article Topics

Special Reports News & Resources

How Warehouse Leaders Turn Uncertainty into Advantage 2025 Salary and Compensation Study Warehouse/DC Operations & Automation: Time to transform operations 2024 Less-than-truckload Research Study 2024 Salary Survey Research Report Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends More Special ReportsLatest in Logistics

USPS-Amazon contract uncertainty grows as reverse auction plan raises stakes for 2026 renewal Preliminary November Class 8 truck orders see another month of declines U.S. rail carload and intermodal volumes are mixed, for week ending November 29, reports AAR Logistics growth sees mild decline in November, states LMI CBP launches five-year pilot allowing non-asset-based 3PLs Into CTPAT for the first time DHL’s 2025 Peak Season approach includes more planning and less panic Union Pacific–Norfolk Southern merger filing with the STB is delayed delayed until mid-December More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources