Cold Chain Gains Traction in Emerging Markets

The recent Global Cold Chain Alliance report shows that temperature-controlled warehouse space has experienced steady growth since 2014. Emerging markets, including those with undeveloped transport infrastructure, played a key role in this trend in spite of lingering challenges.

Latest Logistics News

How Warehouse Leaders Turn Uncertainty into Advantage 2025 Salary and Compensation Study Warehouse/DC Operations & Automation: Time to transform operations 2024 Less-than-truckload Research Study 2024 Salary Survey Research Report More Special ReportsLogistics managers may assume that leading industrial nations would be driving the growth for controlled atmosphere warehousing, but recent research suggests that this is not the “cold case” it appears to be.

According to the “2016 Global Cold Chain Alliance (GCCA) Capacity Report,” total global capacity was 600 million cubic meters in 2016—an increase of 8.6% since 2014, the last time the survey was conducted. However, the data also reveal that much of the increase in refrigerated warehousing space came from new construction in emerging markets.

“It’s exciting to see such strong growth and new construction around the world,” says Corey Rosenbusch, president and CEO of the GCCA. “We’ve been watching the shift in capacity as a product of middle-class growth in emerging markets like China and India, even as consolidation occurs in other developed markets.”

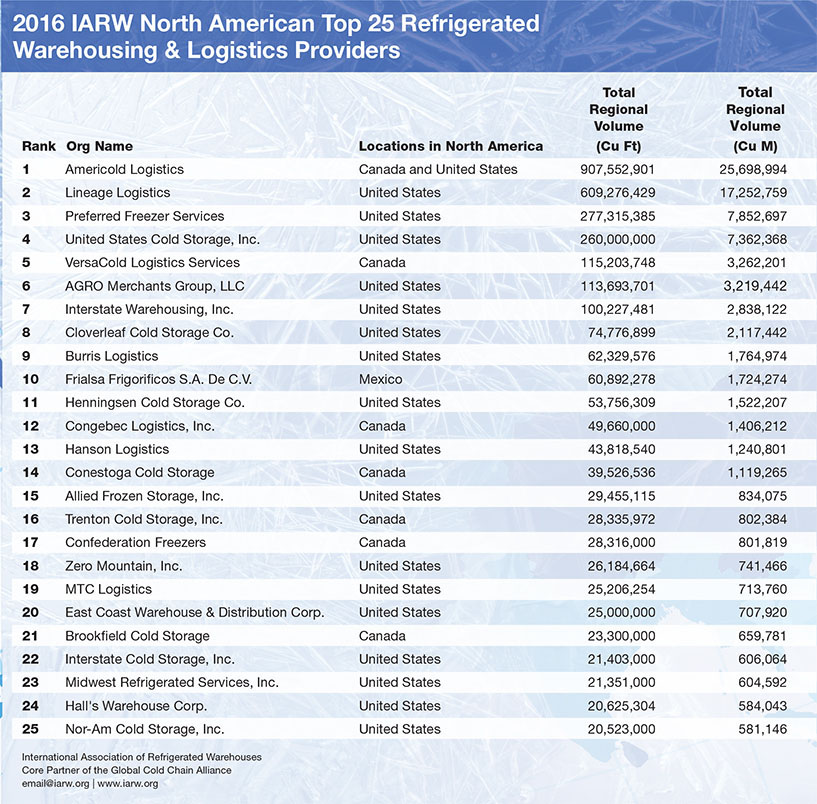

Construction also occurred in markets that previously had little cold storage capacity, namely Uzbekistan and Turkey. The United States, Mexico and Canada each indicated growth in refrigerated warehouse capacity since 2014.

Reports from Europe, however, indicated that refrigerated warehouse space declined in 2016 in several countries, with Turkey and Great Britain being the exceptions. The report found that expansion in Great Britain was largely due to retailers’ construction of distribution centers for private use.

According to Rosenbusch, most of the new building has been done at ocean cargo load centers or emerging nations, even if roads and highways are less than optimal.

“In Russia, for example, we had been seeing shippers just take the reefer boxes off the ships and stack them portside,” he adds. “They’d pay the demurrage fees while using this container hotels as distribution centers” he says. “That’s clearly not a sustainable model.”

New consumers

Written by Dr. Victoria Salin, a professor in the department of agricultural economics at Texas A&M University, the GCCA report includes analyses on growth trends in global capacity, market development indicators and characteristics of refrigerated warehouses around the world.

“Having tracked the trends in refrigerated warehousing for several years, we’re now able to establish that large-format supermarket retailing is a leading indicator of warehousing in nearly all countries, with India being the exception,” says Salin. “In countries where the rate of supermarket expansion exceeded 25% per year, the refrigerated warehouse market penetration per capita grew by 20% or better.”

Salin is also the scientific advisor for the World Food Logistics Organization (WFLO)—a core partner of the GCCA. She says that this recent analysis gives insight into the consumer and points out the countries where refrigerated warehouse capacity has not kept pace with the growing population.

The report also features cold storage market data on 52 countries. During the last two years, approximately 11 million cubic meters of additional refrigerated warehouse capacity has been added to the GCCA database from countries that were included for the first time in 2016. The newly added countries were South Korea, Peru, Mauritius, Ecuador and Kenya.

High-tech investments

If there is a common theme running through today’s cold chain narrative, it’s that industry leaders continue to invest in technology. Americold, for example, recently announced the introduction of its next generation temperature-controlled supply chain visibility and reporting tool, i-3PL.

According to Thomas Musgrave, executive vice president and chief information officer for Americold, the company’s i-3PL application offers food shippers a portal to track inventory throughout more than 145 Americold facilities across the U.S.

“Logistics specialists can view and manage their inventory, check the status of shipments, enter and update orders, place orders on hold, run reports and manage alerts based on data from across the U.S. Americold network,” says Musgrave. “All data is available through EDI integration, making the information resident within a shipper’s ERP system, but it’s also available instantaneously through our online portal.”

At the same time, Americold has been conducting focus sessions with shippers to ensure that the user interface, new navigation, and features of the redesign are adapted without significant disruptions.

One might think that the 200-year-old Hong Kong-based Swire Group would be more resistant to risking as much in revamping its IT, but even this conservative global player continues to expand its research and development departments. Clement Lam, general manager of Swire Pacific Cold Storage, says that their new warehouse management software allows shippers to monitor the storage condition of goods at any time while keeping track of incoming orders.

“The operational transparency is key for us in Mainland China,” says Lam. “Consumer demand for new products and food is driving this innovation, and our division must anticipate and keep up with corporate acquisitions of aviation terminals and container facilities.”

Lineage Logistics, based in Irvine, Calif., is another example of how cold chain champions remain on top. It was founded through the combination of leading temperature-controlled warehousing companies—some that have roots dating back to the early 1900s. Today, all its divisions are strategically linked to lead national supply chains serving the food, retail, agriculture and distribution industries.

“The logistics industry provides very little room for error,” observes Sudarsan Thattai, the Lineage chief information officer. “We currently support a wide variety of warehouse management systems as a result of various acquisitions activities made over the last several years, but we can’t afford to stand still.”

In an effort to stay a step ahead, Thattai says that Lineage recently implemented Infor’s supply chain execution (SCE) version 10.3 in a Cloud-hosted environment. To help improve enterprise-wide processes, he says that the organization is undertaking a consolidation initiative with the goal of making each warehouse activity more efficient.

“In choosing and implementing SCE in the cloud, we gain a scalable way to combine warehouse management functionality, labor management, 3PL billing and transportation execution in a single, unified Cloud-enabled solution,” adds Thattai.

Transport issues abound

Advances in information technology clearly enable cold chain logistics providers with advantages in penetrating emerging markets, but the verities of macro transportation networks still apply, note GCCA analysts.

“While income and the closely associated food retail industries are measurable drivers of the ultimate demand for refrigerated warehousing, there are also supply-side constraints that should be considered,” says Salin.

Indeed, in her report she notes that the operational feasibility of a warehouse is closely tied to transportation networks. Roads, bridges and ports are important for service providers operating on a for-hire basis. The local transportation situation is naturally very complex and requires site-specific information in emerging markets.

Comparisons of transportation and infrastructure quality across countries are made in Salin’s report, using national-level assessments provided by the World Bank and the World Economic Forum. The World Bank Logistic

Performance Index (LPI) is based on six quantitative and qualitative elements:

- efficiency of customs and border

- management clearance;

- quality of trade and transport

- infrastructure;

- ease of arranging competitively priced shipments;

- competence and quality of logistics services—trucking, forwarding, and customs brokerage;

- ability to track and trace consignments; and

- frequency with which shipments reach consignees within scheduled or expected delivery times

The highest-ranked countries, according to the LPI, are still developed economies. None of the emerging economies where refrigerated warehousing industries were expanding most rapidly appear on the top 20 of the World Bank LPI.

“At the same time, within the developing world, several countries received noteworthy upgrades on the LPI,” says Salin. “For example, in 2010, Rwanda was ranked 151 and in 2015 Rwanda moved to 73, an improvement of 78 levels on the ranking. The list of countries with the greatest improvements in transportation systems includes Namibia and Nigeria—two countries that reported on capacity of refrigerated warehouses to GCCA.”

However, the ultimate driver of demand for refrigerated warehousing in most countries is consumer ability and willingness to purchase refrigerated or frozen foods, the GCCA report concludes. In a few countries that export foods, the refrigerated warehouse industry supports production and exports, and in those countries, the income of buyers overseas is also a factor in the expansion of capacity.

“For future studies, we plan to look for better indicators that reflect quality of highways, which is a logical leading indicator for distribution center development,” says Salin. “Unfortunately, it remains a challenge to find indicators of transportation quality which drill down to the precise location of a port or distribution hub in a developing country.”

Article Topics

Special Reports News & Resources

How Warehouse Leaders Turn Uncertainty into Advantage 2025 Salary and Compensation Study Warehouse/DC Operations & Automation: Time to transform operations 2024 Less-than-truckload Research Study 2024 Salary Survey Research Report Warehouse/DC Automation & Technology: It’s “go time” for investment 31st Annual Study of Logistics and Transportation Trends More Special ReportsLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources