Price Trends

Pricing across the transportation modes

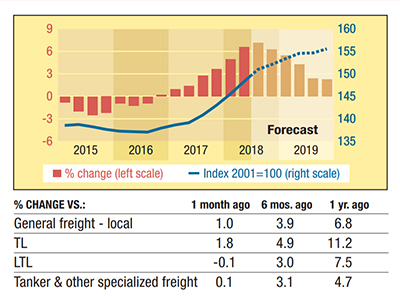

Trucking

Long-distance truckload prices increased at a 7.8% pace in the first seven months of 2018 compared to a year ago. LTL followed the same route, up at a 7.4% rate. For the entire U.S. trucking industry, prices were up 6.2%.

Meanwhile, in the 12-month period ending June 2018, operating costs that had fallen also increased 5.2% thanks to a 23.6% surge in fuel costs. Our cost model estimates the industry’s labor costs grew 2.7% and warehousing costs jumped 5.3%.

Parsing price and cost data, we estimate that for every $100 worth of sales, the industry’s pre-tax mark-up now stands at $30.21. Looking ahead, trucking industry prices are forecast to rise 6.3% in 2018 and 3.6% in 2019.

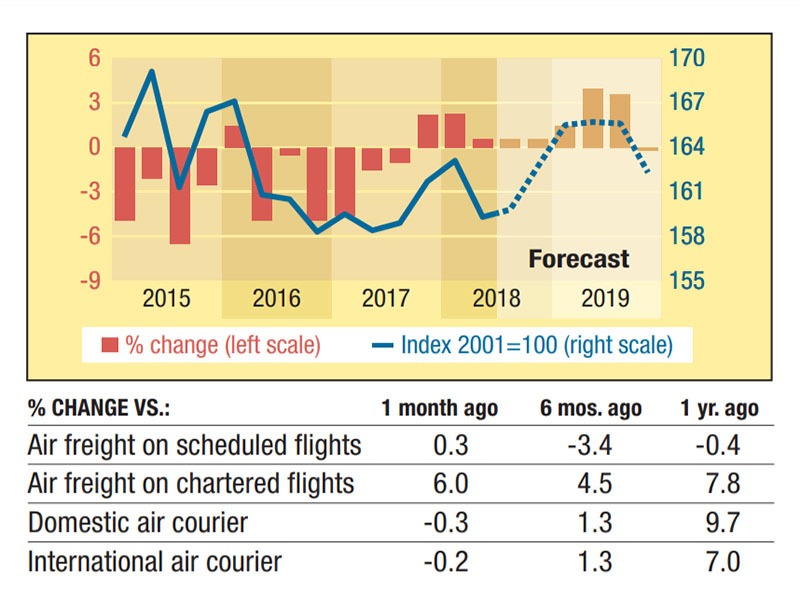

Air

Among U.S.-owned airliners hauling cargo in the belly of planes on scheduled flights, average prices increased at a 1.3% annual pace in the 12 months ending in July. This was the seventh consecutive price hike, cementing a reversal from the 2015-2017 history of falling prices.

For chartered cargo flights, transaction prices also grew at a 5.4% annual pace. Cost inflation, however, has become a serious concern.

In the entire U.S. airline industry, costs are rising at a 6% annual pace as equipment and materials costs increased 8.6% and processing costs (labor and fuels) jumped 20.9%. Our forecast for air cargo on scheduled flights calls for prices to increase 1% this year and 2.2% next year.

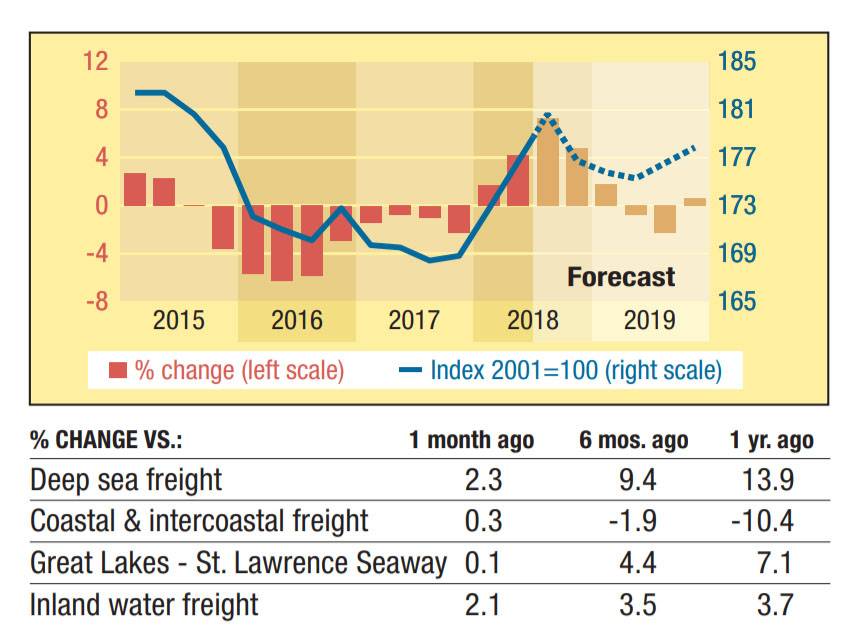

Water

When examining prices year-to-date, it appears that a trend shift is emerging in at least one beleaguered waterborne cargo carrier market.

Most notably, reversing a 2.8% price decline in 2017, prices for service on barges and ships plying inland waterways increased 0.2% in the first seven months of 2018 compared to the same period a year ago.

At the same time, deep-sea price tags maintained a consistent 9.3% pace and Great Lakes cargo service prices grew 4.4%. The only divergent trend came from coastal and intercoastal freight where average prices fell 12.6%.

Looking ahead, we forecast average prices industry-wide will be up 4.8% in 2018 and 0.6% in 2019.

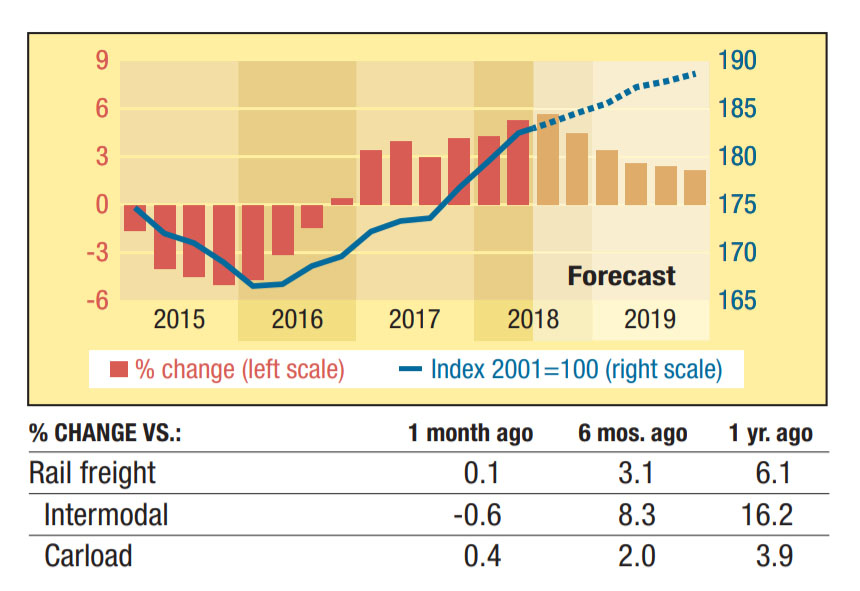

Rail

Price trends for rail services continue to impose ever-greater challenges for shippers.

According to the Bureau of Labor Statistics, the rail transportation industry’s average transaction prices increased 5% in the first seven months of 2018 compared to year-ago prices.

Most of the inflation push came from intermodal rail prices that grew 12.2% this year. That came on top of a 4.3% seven-month price hike in 2017. Carload tags, meanwhile, increased 3.4% in the first seven months of 2018, on par with a 3.4% price hike reported in the first seven months of 2017.

Looking at the industry’s expenses, our cost model shows worker wage inflation currently running at a 2.7% pace and fuel at a 23% pace.

Article Topics

Latest in Logistics

Looking at the impact of tariffs on U.S. manufacturing UP CEO Vena cites benefits of proposed $85 billion Norfolk Southern merger Proposed Union Pacific-Norfolk Southern merger draws praise, skepticism ahead of STB Filing National diesel average is up for the fourth consecutive week, reports Energy Information Administration Domestic intermodal holds key to future growth as trade uncertainty and long-term declines persist, says intermodal expert Larry Gross Railroads urged to refocus on growth, reliability, and responsiveness to win back market share Q&A: Ali Faghri, Chief Strategy Officer, XPO More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources