2017 Salary Survey: Fresh Voices Express Optimism

Our “33rd Annual Salary Survey” reflects more diversity entering the logistics management market, and in marked contrast to 2016, paints a rosier outlook for career placement and advancement.

According to the findings of “Logistics Management’s 33rd Annual Salary Survey,” new demands facing logistics managers this year are again driven by the continued double-digit growth of e-commerce. As a consequence, salaries are set to match the complex skill sets needed to make companies competitive in this highly dynamic marketplace.

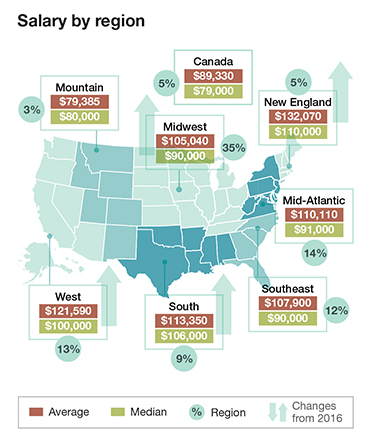

In other high-level findings, our Peerless Research Group (PRG) also notes that professionals are being lured by logistics jobs that are providing a better standard of living in regions where new concentrations of e-commerce are being created.

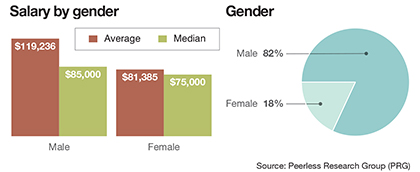

And while news has surfaced recently about the limited opportunities for women in the high-tech industry, just the opposite seems to be happening in logistics management. Our research also indicates that there has never been a better time for women to choose this career path.

Overall, a slight bump

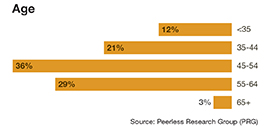

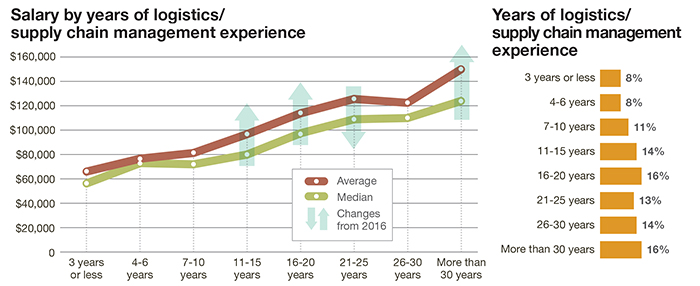

And while much of the findings pulled from this year’s data indicate a movement toward the need for a younger, more diverse mix, we did find that aggregate salaries inched up glacially last year, with middle-aged managers still earning more than their younger peers.

However, after age 55 those earnings plateau, and we’re seeing more “boomers” consider retirement. Enter the young guns, who demand and expect better compensation for delivering solutions driven by digitized supply chains.

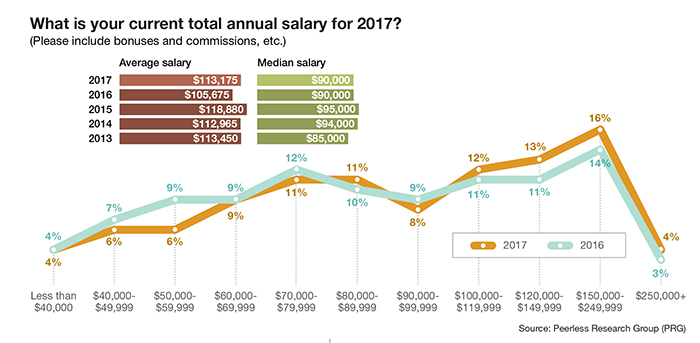

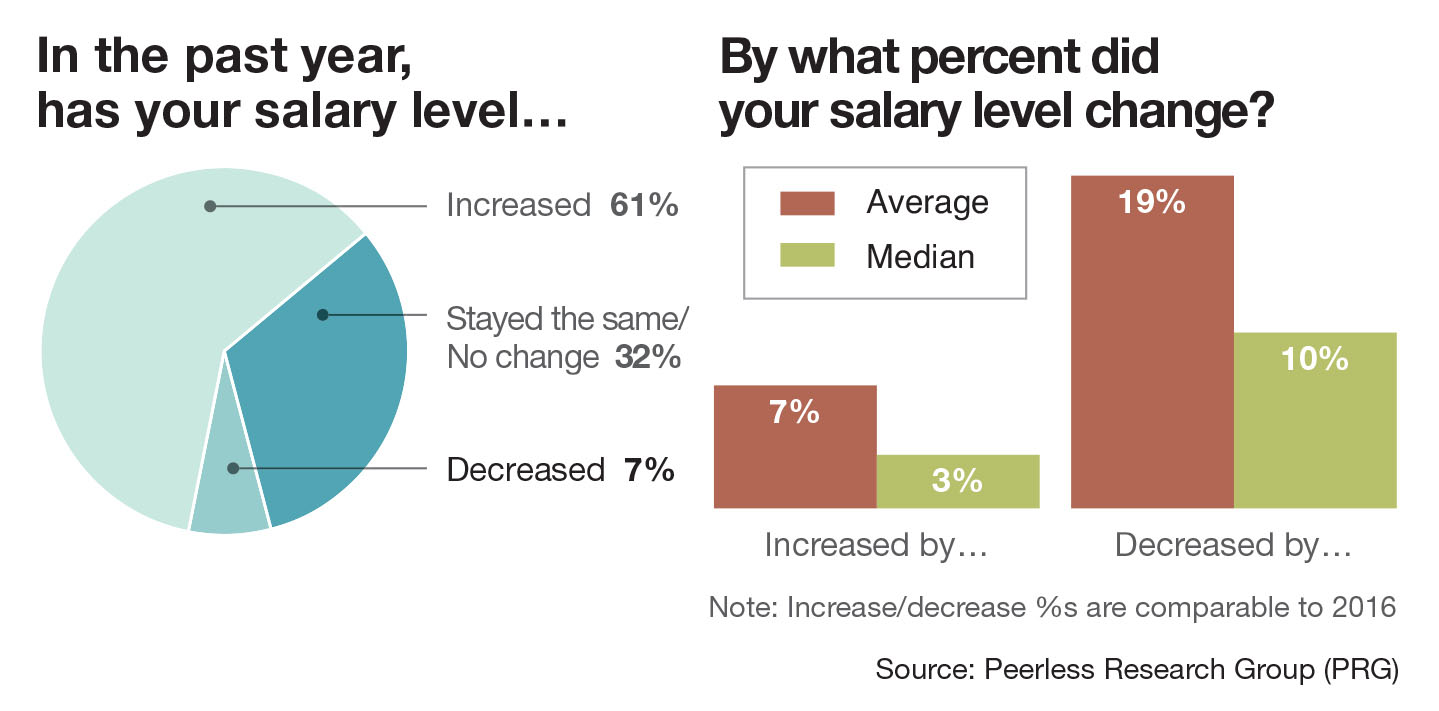

In the meantime, peak 2017 median salaries remained at $90,000, matching last year’s number, with managers at all levels reporting cost-of-living raises. However, those survey respondents who have only been in their present position for 3 years to 5 years—the highest percentage of those questioned—captured the greatest gains in income, rising to $97,000 from $87,000 over just the past 12 months.

“It’s interesting to note that logistics managers with the most expertise in e-commerce strategies are still the highest paid,” says PRG research director Judd Aschenbrand.

In fact, those survey respondents who say that they’re “highly knowledgeable” about e-commerce are bringing in a median salary of $105,000 compared to the $73,500 earned by those who say they are on the low end of the learning curve. “This is a trend we first tracked last year, indicating that younger workers might be better positioned for advancement, as they tend to be more comfortable with digitized commerce,” adds Aschenbrand.

-Inline2.jpg) But while attracting young talent to logistics seems to be gaining traction, retaining them may be another matter. Unlike older generations, workers in their 20s and 30s tend to keep looking for better offers more frequently—and it’s not just about money, say their veteran managers. Young people are searching for a finer balance between their careers and personal lives, and want their jobs to have “meaning.”

But while attracting young talent to logistics seems to be gaining traction, retaining them may be another matter. Unlike older generations, workers in their 20s and 30s tend to keep looking for better offers more frequently—and it’s not just about money, say their veteran managers. Young people are searching for a finer balance between their careers and personal lives, and want their jobs to have “meaning.”

Those survey respondents in the $95,000 per-year median range represent the 43% who “are always looking for better opportunities.”

Another important observation made by PRG researchers was the growing influence of social networking for younger workers negotiating compensation. This particular skill was judged as “very important” by 40% of our respondents—up from 29% just a year ago.

Just before the soaring bull market took off after the Presidential election last November, salaries were still rising from $80,000 to $85,000 for managers working for privately-held companies. Should economic indicators like job growth and consumer confidence continue to gain wind, logistics managers in the private sector are likely to be even more optimistic in the future.

Millenials looking for “balance”

Greg Stewart is on what he calls “the backside” of his career. Having worked for a trucking company before spending more than a decade with Wal-mart, he’s now the logistics manager for Red Dakota Corp., a privately held company in Cedar Rapids, Iowa, specializing in ready-mixed concrete manufacturing and distribution.

“I have been with just three companies throughout my career—which is not unusual for my generation,” says Stewart. “But young people tend to move around a lot more.” However, he doesn’t believe that seeking higher compensation is the catalyst for those frequent moves.

According to Stewart, Millennials want greater balance in their lives, while many are unwilling to chase six-figure salaries if they must sacrifice time with their friends and families. “This is a great profession for young people who want a stimulating career, job satisfaction and a good, middle-class life,” he says.

Candy Snyder, an operations and logistics manager for a small consumer manufacturing company in New Hampshire, is also in the late stage of her career, having worked of just a handful of companies earlier.

“Years ago, there was more company loyalty,” says Snyder. “But today, young people tend to change jobs more frequently. You can’t blame them, though. The world has changed, and the security blanket is no longer there for them stay in one place.”

Greener pastures in the Midwest

Looking for greener pastures may mean making a move to the U.S. Midwest, our research shows. Logistics managers in this region saw a spike in median salaries go from $81,000 last year to $90,000 in 2017. Also worth noting is that the highest percentage of survey respondents (35%) come from these states.

Our findings certainly mirror recent research done by the industrial real estate firm Jones Lang LaSalle (JLL) that found a hotbed of e-commerce fulfillment being created in Indianapolis, Columbus, Cincinnati and St. Louis over the past 24 months. In a nutshell, the JLL research links the shortage of DC labor in the United States to growth in DC leasing/construction activity in what are considered by JLL to be “secondary” Midwestern markets.

“These findings on logistics-related job growth in that region were not much of a surprise,” says Walter Kemmsies, Ph.D., JLL’s managing director, economist and chief strategist. “Given the fact that more goods must be held in more locations in these markets, we expect to see a shift in logistics to the Midwest.”

Matt Powers, JLL’s vice president of retail e-commerce, agrees, and shared this observation on our Midwest wage data: “There’s been a ‘ripple effect’ in compensation for logistics managers in the region. And as lower-wage workers are becoming better paid, those in management are expecting to earn more, too.”

Women in logistics

For the first time, PRG used our “Salary Survey” platform to begin taking a more detailed look at how women are competing in the logistics management profession.

A close reading of our findings reveals the following:

- More women are likely to be involved with import/export operations.

- Women say the number of functions in their job has increased over the past 2 years to 3 years.

- More women than men are planning to take continuing education programs or classes during the next 12 months because they believe a class or program will lead them to earn a better salary.

- A greater ratio of women believe that there are advancement opportunities.

- Women are more likely to find job fairs, trade media and social media helpful in learning more about opportunities for better paying jobs in the logistics management marketplace.

At the same time, say PRG researchers, there’s considerable data suggesting that women appear more dissatisfied with lack of recognition and promotion to leadership positions—a conclusion echoed in a recent interview with a prominent executive recruiter (see sidebar above).

Finally, and as we’ve found in years past, our research discovered that money isn’t everything. “Feeling of accomplishment” (55%) and “relationship with colleagues” (52%) were again judged to be more important than salary (47%). This explains in large part why 83% are recommending this career path to a son, daughter or friend, and why another whopping 84% expect to see younger logistics managers entering the workforce.

Download the 2017 Salary Survey!

Article Topics

Premiums News & Resources

2025 Less than Truckload Research Study Results Warehouse/DC Operations & Automation: Time to transform operations E-commerce Logistics: Tackling the evolving challenges head-on Warehouse Operations Trends 2024 2024 Motor Freight Trends Warehouse/DC Automation & Technology: Time to gain a competitive advantage E-commerce Logistics: Balancing new patterns of demand More PremiumsLatest in Logistics

Union Pacific–Norfolk Southern merger filing with the STB is delayed delayed until mid-December Old Dominion Freight Line issues November operating metrics update Services economy remains on growth track in November, reports ISM Looking at the LTL market with Scooter Sayers U.S. Department of Transportation targets ‘CDL Mills’ as thousands of training providers removed from federal registry Key Ocean, Air, and Trade Trends as We Approach the New Year National diesel average falls 7.3 cents, down for second consecutive week, reports EIA More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources