Latest posts about Cass Freight Index

Page 3 of 11 pages.

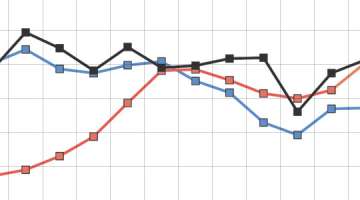

December freight shipments and expenditures see annual declines, notes Cass Freight Index

January 13, 2023

December’s shipment reading—at 1.161—was down 3.9% annually, and December expenditures—at 4.231—fell 4.3%.

Cass Freight Index sees mixed November shipment and expenditure readings

December 14, 2022

November’s shipment reading—at 1.201—was down 0.4% annually, falling short of the 2.9% and 4.8% annual gains seen in October and September, respectively. November expenditures—at 4.476—increased 4.7%, below October’s 11.1% annual increase and was up 50.7% on a two-year stacked change basis.

Cass Freight Index points to annual October gains

November 21, 2022

October’s shipment reading—at 1.224—saw a 2.9% annual gain, falling short of the September’s 4.8% annual increase and was also below August’s 1.278 reading, which marked the highest level for shipments since May 2018. On the expenditures side, the report said that October’s 4.399 reading marked an 11.1% annual increase, and rose 52.4% on a two-year stacked change basis

September Cass Freight Index Report points to gains

October 17, 2022

September’s shipment reading—at 1.241—rose 4.8% annually, and freight expenditures—at 4.627—climbed 21.2% annually.

August freight shipments and expenditures head up, reports Cass Freight Index

September 16, 2022

August’s shipment reading—at 1.278—increased 3.6% annually, and freight expenditures—at 4.614—increased 20.4%

July’s Cass Freight Index Report points to switch from goods to services spending

August 15, 2022

July’s shipment reading—at 1.182—declined slightly annually, falling 0.4%, less than June’s 2.3% decrease, and July expenditures—at 4.499 increased 28.2% annually, while falling 3.6% compared to June.

June Cass Freight Index Report shows more mixed signals

July 14, 2022

June’s shipment reading—at 1.203—fell 2.3% annually, and June expenditures—at 4.665—rose 25.0% annually, slightly below May’s 27.5% annual gain.

May Cass Freight Index shows further continuation of freight shipment and expenditure trends

June 15, 2022

May’s shipment reading—at 1.235—fell 2.7% annually, which was steeper than April’s 0.5% annual decline. And May expenditures—at 4.287—were up 27.5% annually, in line with April’s 30.6% annual gain and continuing to be paced by major inflation gains.

April Cass Freight Index sees shipment and expenditure declines

May 13, 2022

April’s shipment reading—at 1.172—saw a slim 0.5% increase, and April expenditures—at 4.510—saw a 30.6 annual gain, spurred on by a near 40-year high, for inflation.

March Cass Freight Index shows signs of freight slowness

April 15, 2022

March’s shipment reading—at 1.203—eked out a 0.6% annual increase, down 3.0% from February’s 3.6% annual increase and ahead of January’s 2.9% annual decline.

January freight shipment and expenditure readings feel impact of Omicron variant, says Cass

February 15, 2022

January’s shipment reading—at 1.078—fell 2.9% annually, coming off of a 7.7% annual gain in December. And January expenditures—at 4.027—saw a 31.2% annual increase, in tandem with U.S. wholesale inflation up 9.7% annually for the month, as per U.S. Department of Labor data.

Freight shipments and expenditures see gains to end 2021, reports Cass Freight Index

January 13, 2022

December’s shipment reading—at 1.208—saw a 7.7% annual increase, and freight expenditures—at 4.419—increased 43.6%.

Cass Freight Index highlights ongoing freight shipments and expenditures gains

December 21, 2021

November’s shipment reading—at 1.206—saw a 4.5% annual increase, and freight expenditures—at 4.275—were up 43.9% annually.

Freight shipments and expenditures again see gains, at a reduced rate, notes Cass Freight Index

October 19, 2021

The report’s shipment reading—at 1.184—eked out a 0.6% annual gain, well short of August’s 12.3% annual gain, and September freight expenditures—at 3.818—increased 32.2% annually, which is off from August’s 42.2% annual gain.

Cass Freight Index shows more annual gains but at a reduced rate

September 14, 2021

The report’s shipment reading—at 1.234—was up 12.3% annually, and freight expenditures—at 3.832—saw a 42.2% annual gain.