The Great Disconnect: Bridging the knowing/doing gap in logistics

Our 34th Annual Study of Logistics and Transportation Trends survey team discovers a persistent gap between knowing what’s possible in logistics and actually putting it into practice. From AI adoption to talent development and technology integration, leaders understand the path forward, but action still lags behind insight.

One of our co-authors recently shared a story about his granddaughter. After visiting an elderly neighbor, she came home and marveled: “They have a phone that’s attached to the wall.”

In an era of mobile phones, AI-powered smart devices, and real-time connectivity, using a phone connected to the wall—though it still works—seems disconnected and out of sync with what’s available and possible today.

The same feeling—better tools and approaches are available, yet we continue to rely on those that worked well in the past—was evident in the 34th Annual Study of Logistics and Transportation Trends. Across the three pillars that keep supply chains moving—people, process, and technology—respondents revealed what we’re calling The Great Disconnect: the knowing/doing gap between recognizing what’s needed and possible and then consistently acting on it.

We’re going to put context behind the 2025 study’s findings and explore five distinct disconnects that highlight gaps in how the industry manages its people, processes, and technology—areas where what’s needed and possible is well understood, but action is still required to close the gap.

Voices from the field

Now in its 34th year, the annual study surveyed 281 logistics and transportation professionals across a diverse mix of company sizes, industries, and roles.

Three out of four respondents hold director-level or higher positions, and 85% have more than 15 years of experience in the industry. These are experienced leaders who understand the industry’s complexities, have weathered its cycles, and recognize both the progress we’ve made and the barriers that remain.

Respondents overwhelmingly recognize the technologies and workforce strategies that will shape the future, but actions are not keeping pace with the change. It’s as if we see the new mobile phone on the table, but we’re still tethered to our landline.

There’s a gap between knowing what to do and being able to do it. That’s the heart of The Great Disconnect. This year’s survey revealed five key disconnects that managers should resolve to improve performance and avoid.

Disconnect #1: Watching AI instead of using it (Technology)

Ask logistics leaders what’s reshaping the industry, and most will give the same answer: artificial intelligence (AI). It topped the list of trends respondents expect to impact their organizations over the next three to five years, outranking inflation, labor shortages, automation, and even geopolitical instability.

But when we examined actual engagement with AI inside companies, the tone shifts:

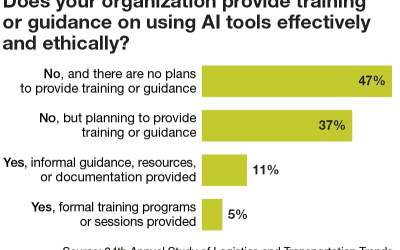

- Only 5% of respondents say that their organization provides structured training or guidance on AI use.

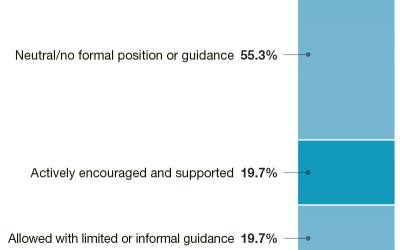

- Fewer than 20% report that their companies actively encourage or support AI experimentation.

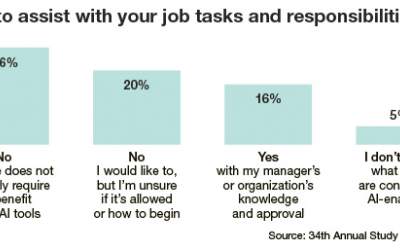

- Only 16% say they use AI for work with their manager or organization’s approval, and 29% report using AI without formal approval or guidance.

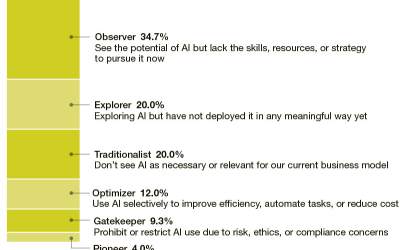

The contrast is stark: while most believe AI will be the top industry driver in the next three to five years, only 4% say that their organizations are true “pioneers” who are actively investing in and experimenting with AI to create long-term advantage. Most (34.7%) describe their organizations as “observers” who see the potential of AI, but lack the skills, resources, or strategy to pursue it.

We see this as part of the disconnect and gap between knowing and doing. AI-enabled tools are available, use cases are growing, and leaders recognize that logistics operations will be impacted. However, a gap between knowing and doing is created by the lack of systems, support, and leadership alignment necessary to leverage these tools effectively.

Disconnect #2: Talent is a priority, but few act like it (People)

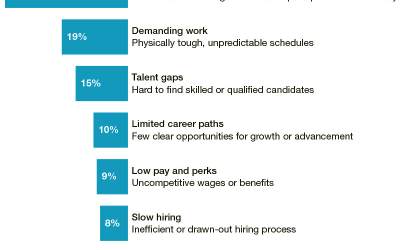

The next major disconnect shows up in the workforce, where talent is widely seen as critical, but it is often treated as optional. When asked which factors would have the most significant impact on logistics over the next three to five years, respondents ranked workforce shortages and demographic shifts as one of the top three challenges.

Yet, when we asked what companies are doing to secure, grow, and keep talent, the gaps were hard to miss:

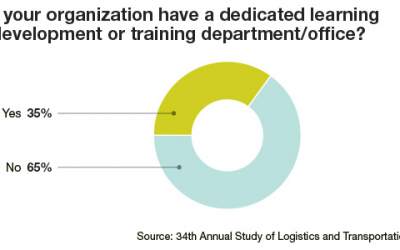

- Only 35% say that their company has a dedicated learning and development (L&D) function.

- Another 35% believe outdated perceptions and low awareness hurt the industry’s ability to attract talent.

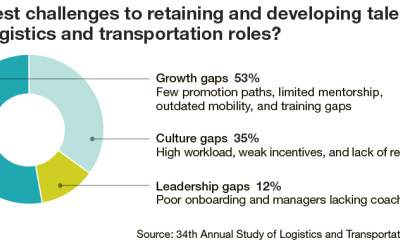

- Over half (53%) cite limited career paths, leadership development, and mobility as significant retention challenges.

This disconnect is both operational and cultural. Many companies acknowledge the urgency of workforce development, but haven’t aligned their systems, structures, or incentives to support it.

Disconnect #3: Credentials valued, not supported (People)

We also explore the use and support of external credentials and certifications, tools that have long been used to standardize knowledge, signal professional growth, and close skill gaps.

Transitioning from a landline to a cellular system requires some training; using today’s advanced tools will necessitate even more training. Once again, the story is mixed:

- 95% value university-issued credentials; 91% value those from industry associations like CSCMP, ASCM, SMC3, and TIA.

- 89% value government-issued credentials (e.g., CDL, FAC-P/PM, FAC-C) while 88% value tech-provider credentials (e.g., SAP, Oracle).

- However, only 35% said their company would help cover certification costs, and just 16% allow study time during work hours.

- Even fewer (6%) said certifications boost promotion chances, and only 3% said they lead to higher pay.

It’s a textbook example of the knowing/doing gap in action. The value is recognized, but the follow-through is missing. Companies claim that credentials matter, but often fail to support the time, cost, or structure required to earn them.

This gap is especially risky given a lack of internal L&D opportunities (e.g., Disconnect #2). Certifications would allow firms to outsource training, which is critical in today’s labor market. Younger professionals expect growth opportunities. Mid-career workers need reskilling. And the best talent is likely to gravitate toward organizations that put action behind their values.

Disconnect #4: Strategy Not Delivering (Process)

Faced with ongoing market volatility, policy changes, and global uncertainty, companies have adjusted their strategies to remain competitive.

In this year’s study, we asked respondents about the strategic moves their organizations made or were actively planning to implement in response to evolving conditions. The most common responses include:

- Adjust sourcing, production, or routing

- Freeze hiring or reduced their workforce

- Renegotiate service levels or contract terms

- Delay or cancel capital or technology investments

- Enhance internal capabilities to reduce reliance on external providers

The question is: have these moves actually strengthened people, processes, and technology—or are they just keeping pace?

As in previous years, we asked respondents to compare their company's performance with that of its competitors across five key performance measures: profitability; return on assets (ROA); revenue growth; market share; and customer satisfaction. This scale provides insight into how respondents perceive their performance where it matters: in the market.

The results? Virtually unchanged from last year and still well below 2023—evidence that reactive moves have maintained parity, not create competitive advantages.

While the industry has faced unprecedented challenges over the last couple of years, the disconnect between strategy and outcome serves as a reminder that short-term fixes can stabilize operations. However, without sustained planning and investment in people, processes, and technology, they rarely deliver lasting gains.

Disconnect #5: Technology for the people who use it (Technology)

When we asked participants what they wished their logistics, transportation, and supply chain systems could do that they don’t do now, the answers were telling.

The top wishes include:

- Integration: systems that seamlessly connect with partner and customer platforms.

- “Intragation”: seamless connectivity among internal systems like TMS, WMS, ERP, and finance.

- Automation: tools that automate and simplify repetitive processes.

- Analytics, Prediction & Visibility: better forecasting, market trends, cost predictions, and custom reporting.

- Improved User Experience & Accessibility: Intuitive, easy-to-use systems accessible to all users.

- Security & Fraud Prevention: Stronger protection against cyber threats and freight fraud.

- Compliance & Regulatory Adaptability: Technology that quickly adapts to evolving regulations.

- Future-Ready Systems: Scalable platforms ready to integrate emerging technologies.

- Workforce Enablement & Support: Tools that enhance training, skills, and daily decision-making.

None of the wishes seem unrealistic, and most, if not all, should be table stakes for a modern digital supply chain. Yet here again, the knowing/doing gap stands in the way.

Bridging the Disconnect: From knowing to doing

The 34th Annual Study of Logistics and Transportation Trends reveals an industry that’s not lacking in awareness. Leaders know what matters and recognize the trends, but moving from “we should” to “we did” remains the real hurdle.

To help bridge this knowing/doing gap, here are five practical actions, one for each disconnect, that organizations can take:

- From AI Awareness to AI Readiness: Stop just watching. Start small. Identify low-risk use cases, assign internal champions, and encourage peer learning to reduce fear and build confidence around AI-enabled tools.

- From Talent Talk to Talent Development: Move from acknowledging the talent shortage to actively building capability. Establish or expand learning and development programs—even informal ones such as job rotations, mentorship, or lunch-and-learns—and formalize career paths to attract and retain emerging talent.

- From Valuing Credentials to Supporting Them: If certifications matter, invest in them. Offer tuition assistance, allow study time, and connect credentials to performance reviews, promotions, and raises to reinforce their value.

- From Strategy Implementation to Strategic Outcomes: Shift from reacting to market conditions to building lasting advantage. Evaluate whether recent strategic moves improved service, margins, or resilience; restart delayed initiatives that close capability gaps; and avoid short-term workforce cuts that might weaken future competitiveness.

- From Tech Availability to Tech That Works for People: Focus on tools that truly support users. Prioritize systems that integrate across platforms, automate routine tasks, improve visibility, and adapt to changing needs. Involve end-users early to ensure solutions are intuitive, accessible, and seamlessly integrated into daily operations.

Overcoming The Great Disconnect and bridging the gap between knowing and doing will not happen overnight, but it can start now. Small, intentional steps can turn awareness into action—building the flexibility, responsiveness, and resilience organizations need to succeed today and in whatever future the supply chain delivers next.

Contributors:

By Christopher A. Boone, Ph.D., Associate Professor, Mississippi State University

Karl B. Manrodt, Ph.D., Professor, Georgia College and State University

M. Douglas Voss, Ph.D., Professor and Scott E. Bennett Arkansas Highway Commission Endowed Chair, University of Central Arkansas

Joseph Tillman, Manager Education Programs, SMC3

Article Topics

Warehouse News & Resources

Looking at the impact of tariffs on U.S. manufacturing C.H. Robinson expands El Paso operations with 450,000 square-foot facility to meet rising Mexico trade demand Despite billions invested, supply chain technology is still falling short, says DHL report Logistics growth holds steady in October, states new edition of LMI Logistics real estate demand hits an inflection point, reports Prologis Industrial Business Indicator GXO posts record-setting Q3 earnings results Amid economic uncertainty, NRF forecast calls for a record retail holiday sales season More WarehouseLatest in Logistics

Looking at the impact of tariffs on U.S. manufacturing UP CEO Vena cites benefits of proposed $85 billion Norfolk Southern merger Proposed Union Pacific-Norfolk Southern merger draws praise, skepticism ahead of STB Filing National diesel average is up for the fourth consecutive week, reports Energy Information Administration Domestic intermodal holds key to future growth as trade uncertainty and long-term declines persist, says intermodal expert Larry Gross Railroads urged to refocus on growth, reliability, and responsiveness to win back market share Q&A: Ali Faghri, Chief Strategy Officer, XPO More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources