Going Deep with 3PLs

From ever-increasing customer demands to increased operating and finance costs to delivering against the sustainability targets set by the C-suite, the need to go deeper with your third-party logistics provider is not only needed, but necessary to survive in the world of uncertainty in which we all live.

It’s no surprise that supply chains are in a constant state of flux as they face the uncertainty in the world. In fact, today, we face even greater uncertainty as established economic models are seemingly not able to reliably predict how the macroeconomic environment will perform.

A recent economic report lauded higher than anticipated growth at 3.1%—which was surprising to most, as the traditional economic models all predicted that inflationary pressure would usher in recessionary impacts and lower growth. So, as we stand today, the only certainty we can count on is uncertainty, and that extends to the supply chains.

From ever-increasing customer demands to increased operating and finance costs to delivering against the sustainability targets set by the C-suite—all while navigating the geopolitical impacts that seem to be ever-present—the need to go deeper with your third-party logistics (3PL) provider is not only needed, but necessary to survive in the world of uncertainty in which we all live.

Moving from players to partners

Going deeper means moving beyond only the transaction. Transactional relationships work very well to cover the current, known workloads of today. But they may not be the best for dealing with tomorrow and beyond.

Source: EY Methods

Source: EY MethodsIn the growing 3PL services environment that, according to Statista, is expected to see growth leading to a $1.31 trillion 3PL market in 2024, and expected growth through 2028 is pegged to a CAGR of 2.39%, resulting in a $1.41 trillion 3PL market, having a deep partnership with your 3PL is critical to delivering success not only now, but also in the future—all while managing the complexities of the services and value offered in this space.

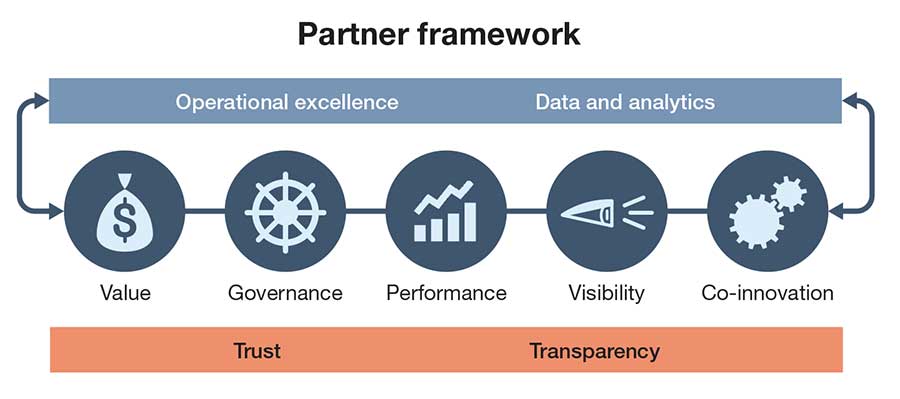

To achieve a true partnership requires both trust and transparency between the shipper and the 3PL that’s derived from collaboratively working together and focuses on five key areas: value, governance, performance, visibility and co-innovation.

Value. Moving from just a cost focus to understanding the full value of the partnership will allow both parties to align on the right strategic elements that will lead to shared success. If the only thing that matters is cost, eventually, the partnership will revert to being just a transactional relationship, with little or no incentive to find ways to improve outcomes for both the shipper and the 3PL.

Governance. Not to be confused with performance, governance is critical to establishing the best ways of working between the partners, including how the relationship will be measured. Traditionally, the parties will establish quarterly business reviews (QBRs) that are focused on the historical performance. This needs to adjust to being a more real -time measure of actual performance by sharing the right data in a near-real-time environment on a common analytics platform to allow for both parties to work from a single source of the truth.

Performance. To most, this is table stakes in the partnership. The 3PL must be able to perform and meet the service and quality needs of the shipper; if those are not both meeting expectations, then the relationship will never be able to become a partnership as trust will be eroded through poor performance.

Visibility. This is one area that is grossly undervalued in most shipper/3PL relationships today. Standard practices today do a great job of sharing location visibility—where it is in the physical supply chain. However, this is not enough when trying to harness the current information to make informed predictions about the future—creating an opportunity for the shipper and the 3PL to step into extended visibility across the value chain through near-real-time transactional data, increased financial visibility and visibility across environmental, social and governance, as well as the extended visibility into the resiliency of the multitiered network.

Co-innovation. With the proliferation of supply chain technologies (software and hardware), the need to co-innovate is growing exponentially. This requires the shipper and the 3PLs’ overall business strategies to be intertwined so that both partners work collaboratively to deliver on the promise of innovation. From the application of artificial intelligence (AI) to automation that brings real returns on investment to flexible network capacities, shippers and 3PLs stand to reap a great deal of value through co-innovation.

Value comes from the focus on the customer

Professionals involved in established partnerships between 3PLs and shippers know that the most important value besides safety is meeting customer expectations.

Whether that’s an internal customer, a business partner or an end consumer, the outcomes need to be aligned to drive value for the customer while also bringing value to the shipper and the 3PL, creating a three-way value proposition.

As such, the need to have a very robust and established data and analytics strategy—supported by the right technology that is shared between the shipper and 3PL—is critical to delivering on that value proposition.

3F principle

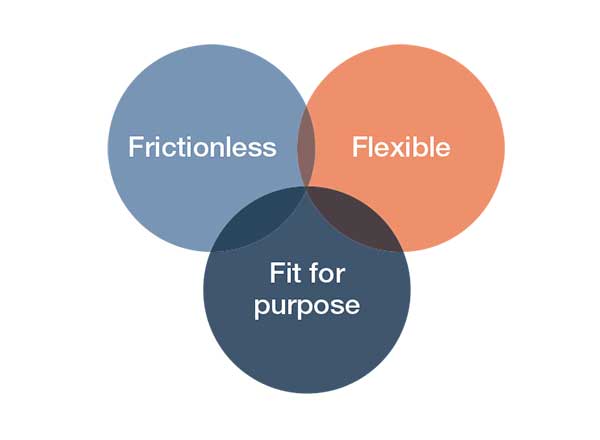

Value to the customer. Meeting the customer’s need is first and foremost. This is what drives the performance of the shipper/3PL relationship. However, just meeting the need is not enough these days; it needs to follow the 3-F principle:

- frictionless—easy to do business with;

- flexible—able to be dynamic, given the changing needs of the customer on a real-time basis); and

- fit-for-purpose—one size does not fit all; each node in the shipper/3PL value chain needs to be aligned to the service need and the desired outcome of achieving and hopefully exceeding customer expectations.

Value to the shipper. The value to the shipper is all about continued loyalty and growth with their customer. The most advanced facility with the most efficient 3PL capabilities does not guarantee a sale to the customer. That value must be derived by meeting the specific needs of the customer—at a consistent service level.

Value to the 3PL. Continued growth with the shipper increases their ability to serve other shippers in similar industries, as well as applying those same learnings to

shippers in different industries—driving the predicted growth in this market segment as noted above.

Data to inspire

Data is the lifeblood of any business today, but it’s just ones and zeros. The need for proper analytics is necessary, as it’s the way to use all those ones and zeros to inspire people and drive better insights.

A quote from author Mike Schmoker in “Results: The Key to Continuous School Improvement,” summarizes it nicely: “Things get done only if the data we gather can inform and inspire those in a position to make a difference.”

However, data does not present itself on its own—it’s brought into existence through the technology that’s used to manage and operate the business.

As such, it’s imperative to align on how the various shipper, 3PL and customer technologies all work together in the best way to manage and serve up that data for ingestion into a robust analytics platform that provides the information and insights to improve the value across all parties while meeting the performance expectations safely and securely.

This is one area of the partnership that will require a bit of that co-innovation to define and deliver on the right data models that will be used to share the data and transform it into an inspiring story that motivates resources to succeed.

While there are many decisions on which a shipper and 3PL need to align with respect to tech platforms that will be used to manage and execute the work in front of them, the decisions need to be shifted from binary choices (you must use my platform vs. your platform) to combinatorial choices (if we use your platform, then we need to integrate with our platform).

This focus on data and technology is supported by the “28th Annual 3PL Study” released in early 2024, which noted that technology is one of the highest focus areas for shipper and 3PLs, with the use of predictive analytics, the application of automation in warehouse operations, and inclusion of wearables and mobile applications being core areas of interest.

Additionally, the application of generative AI is stealing the headlines around the globe with the presumed potential that it has to redefine the way we manage and execute in the value chain. According to EY-Parthenon Leader Jeff Wray, 43% of CEOs are currently investing, with another 45% planning to invest in generative AI. This area has tremendous potential for changing how we conduct business, and it brings new opportunities for shippers and 3PLs to create shared value.

Beyond the new shiny tech in front of us, decisions around core platforms, like TMS, WMS and OMS, need to be framed up more around how we integrate all of these various packages in ways to support the overall data strategy as defined in the shipper/3PL partnership.

Going deeper means moving beyond only the transaction. Transactional relationships work very well to cover the current, known workloads

of today. But they may not be the best for dealing with tomorrow and beyond.

Additionally, 3PLs are in a unique position as a co-innovator as they work with many flavors of shippers, giving them the ability to look beyond the contracted shipper and see where real opportunities to innovate are presenting themselves. This applies to all areas of the shipper/3PL value chain, from physical automation within and around the four walls; increasing test-learn cycles of emerging technologies, such as generative AI; to navigating real-time obstacles in the network.

Moving forward as partners

In the face of the multidimensional uncertainties that are in front of us, there are some pragmatic areas on which partners can work now to advance the value of the partnership and deliver on the customer promise.

- Revisiting contract terms to better align outcomes will allow for a partnership to thrive. For example, it’s all too common that there are penalties for not meeting a specific service-level agreement (SLA), but, often, those are not balanced with rewards for consistently exceeding the same SLAs.

- Talent is one of the areas that is highly underutilized today. Typically, the talent discussions between the 3PL and the shipper are limited to the labor force and some supervisory talent, but they rarely encompass more strategic talent that is desperately needed in the value chain today. There needs to be a focus on expanding the collaboration between the partners by opening up the discussions to be more strategic and inclusive of the talent that each partner has and leverage that talent for the betterment of the partnership.

- Optimizing the network and combining the power of the shipper’s network with the 3PL network can lead to a 1+1=3 equation if done correctly and at the right intersection of operations and technology. This gives root to the ability to flex the network in real time based on changes in demand or supply, opens up new channels that could have been overlooked when a partner is only focused on their physical network, and expands the pool of overall suppliers that can service the combined network.

Getting it right with your 3PL

Going deeper does not mean adding more services to the commercial arrangement between a shipper and their 3PL.

However, it does mean working at new levels of trust and transparency to enable the needed value creation, co-innovation and operational resilience to be successful in the face of the uncertainty in the supply chain and to meet the challenges of building a better working world

Article Topics

EY News & Resources

Looking at how a ‘Moneyball’ approach is able to lift supply chains Assessing the impact of the ILA-USMX deal for the future of U.S. ports Strategically integrating 3PLs into your operations The artificial intelligence (AI) conundrum Managed services in network design Going Deep with 3PLs EVs + AVs = FVs (Future Vehicles): A seismic wave? More EYLatest in Logistics

Union Pacific-Norfolk Southern merger application is filed with the Surface Transportation Board FedEx posts fiscal first quarter earnings growth U.S. rail carload and intermodal volumes are down, for week ending December 15, reports AAR DAT’s November Truckload Volume Index sees more mixed results November intermodal volumes see annual decline, reports IANA Looking at the state of the parcel market with Robert Persuit, Sr. Director of Business Development, ShipMatrix Teamsters Rail Conference makes its case for the Union Pacific-Norfolk Southern proposed merger to not be approved by the STB More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources