Global Logistics: Forwarders face unstable times

Congestion and capacity shortages have been big subjects among forwarders and have resulted in high air, ground and ocean rates. The shortage of capacity has pushed freight rates to historic highs during the last 18 months. Forwarders are banking on technology to build in more agility.

Some observers expect further lockdowns in China, say nothing of the disruptions and concerns caused by the Russian invasion of Ukraine.

“In January 2021, people said surely things cannot get worse in the new year,” says Lars Jensen, CEO and partner of Vespucci Maritime. “Then 2021 happened, and now we have a déjà vu in 2022 with an even worse scenario because there’s little buffer capacity in the system. It will take very little for us to face something even worse.”

Whereas forwarders once distinguished themselves by the capacity they could acquire, today they find managing that capacity their most difficult issue. In fact, Rolf Habben Jansen, CEO of Hapag Lloyd, recently said during a virtual press conference: “There is no capacity; there are zero ships available. Every ship we can get our hands on is sailing.”

For now, many in the industry are pessimistic and do not see the situation abating soon.

“There’s a lot of uncertainty in the market regarding securing medium- and long-term capacity, particularly with rate agreements,” says Florian Neuhaus, partner, McKinsey & Co.

And industry experts warn shippers to expect a residual impact for 12 additional months even after market conditions “normalize.”

Bumper year

The sky-high rates that have resulted from dysfunction on specific trade lanes and capacity shortages has led to record revenues and profits in 2021, especially among large and agile forwarders.

“You can see it in their profits in their annual reports. It’s staggering,” states Neuhaus.

All that cash has led several of the largest players to pursue merger and acquisition activities in 2021. “Some forwarders are buying ‘size’,” says Neuhaus. “Others are procuring niche areas and market share. Fundamentally all have buying power right now.”

DSV paid $4.2 billion to acquire GIL from Agility, thereby making it the third largest ocean freight forwarder globally with 2.9 million TEUs and the third largest airfreight forwarder with 1.6 million metric tons, reports A&A.

Kuehne + Nagel bought Apex International for approximately $1.5 billion. The combination made K+N the largest global airfreight forwarder, handling over 2.2 million metric air tons in 2021 surpassing DHL Supply Chain and Global Forwarding.

“Apex also helped K+N expand its Asian 3PL operating network, and its air charter operations added significantly to K+N’s net revenue in 2021,” comments Armstrong.

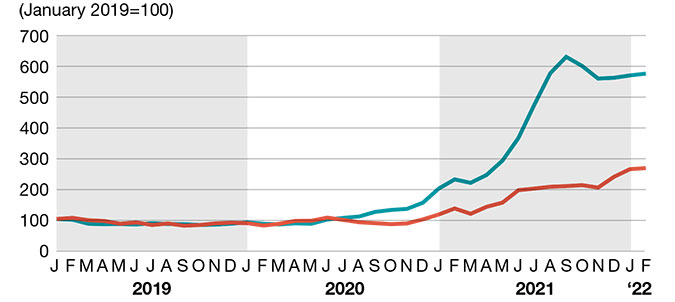

Global ocean freight rates index

Infringing actions?

Steamship lines are moving in on the space traditionally occupied by forwarders and 3PLs.

Maersk, MSC and CMA CGM have not only begun to establish a relationship with shippers directly, but also to extend services beyond the provision of capacity in their core market.

“Carriers have taken steps down this path, adding air capacity and, in some cases, additional warehousing, road and last-mile services,” says Nick Bailey, head of research, Transport Intelligence. “Maersk and CMA CGM, in particular, have made deals to acquire Logistics Service Providers (LSPs) that specialise in e-commerce.”

Florian Neuhaus, partner, McKinsey & Co., however, is quick to point out that new digital sales networks are plain vanilla for moving an ocean container. “You don’t really need a forwarder with the new digital channels,” he says. “However, in today’s current tight market, going direct to a carrier limits shippers from the flexibility of finding space on a different carrier. This is where forwarders still have an advantage.”

The situation is even more exacerbated in air cargo where 95% of cargo, he says, goes to forwarders because of the complexity of air forwarding.

And Deutsche Post DHL Group added JF Hillebrand to its global forwarding operations for $1.65 billion, in a move CEO Frank Appel referred to as a “bolt-on acquisition,” meaning the move is highly complementary to the company’s existing portfolio.

Bailey notes how the three deals illustrate three different approaches to growth. DSV added scale, particularly in emerging markets; K+N acted to establish itself as a major player on a key cross-border e-commerce trade lane; and DHL chose specialisation in a value-added sector with potentially higher margins.

“All approaches have merit, and it’s likely we’ll see more merger and acquisition activity in 2022,” Bailey says.

Armstrong further reports how 3PLs in the international transportation management (ITM) segment of the industry led all 3PL segments with revenue growth.

“Overall, ITM realized an unheard of 81.4% gross revenue gain in 2021, or $127 billion, all while underlying global ocean carrier container rates more than doubled from 2020 and air freight rates trended up, peaking in December of 2021,” Armstrong says. “While having a lower growth rate than overall gross revenue due to a tight carrier capacity market and high spot market rates, net revenue increased a healthy 46.2% to $36 billion.”

Armstrong also notes the ITM environment this year has seen increased willingness by ocean carriers to provide contracted capacity and good rates for targeted port-to-port pairs, but with fewer fee waivers and increased surcharges.

“On the air freight side, air carriers are still constrained without passenger capacity and are not as amenable to contract for space,” Armstrong adds. “Even large airfreight forwarders are still sourcing 30% or more of their air capacity in the spot market. “

Technology advancements

Technology continues to play a big role in helping forwarders to be more agile, although COVID abated forwarder use of technology to sell services and provide direction online quotes.

“Forwarders expect this is change when supply and demand balance out,” Neuhaus says.

Meanwhile, other trends are taking hold. Large and mid-sized forwarders are expanding their digital platforms throughout their operations as part of a strategic plan to create better customer and carrier experience and build customer loyalty.

For example, Kuehne + Nagel extended the visibility of its Seaexplorer platform by launching the “Seaexplorer disruption indicator” to measure the efficiency of container shipping networks and show cumulative TEU waiting time in days.

“The solutions that have helped this come both from forwarders themselves and from market-level providers such as marketplaces and visibility platforms,” remarks Bailey.

Supporting technologies, like real-time visibility platforms, have gained traction and positioned forwarders as key enablers for both shippers and carriers. Such solutions have improved rate transparency and allowed for much easier and quicker booking and management facilities, particularly in accessing the spot market. It also has led to higher services levels.

“Transparency is the biggest push forwarders are looking at,” says Neuhaus. “Knowing where your freight is in the supply chain on any given day is extremely important to customers.”

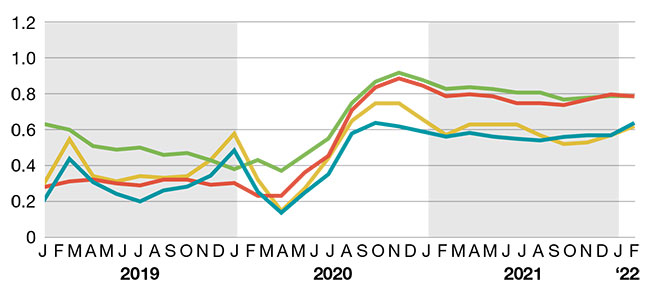

Container availability index

Many forwarders, particularly large firms, are investing in upstream transport management systems (TMS) such as cloud-based networks. This allows 3PLs to manage their forwarding business even down to a local level, which better helps them understand their customer needs, Neuhaus explains.

In February, DB Schenker announced the extension of its existing strategic partnership with Infor, a global producer of business Cloud software in the ocean and airfreight market. DB Schenker’s air and ocean freight customers now benefit from full access to the entire spectrum of Infor’s supply chain technology, including supplier collaboration and shipping automation, as well as easier cost, factory, and transportation management.

“This, in turn, helps reduce inventory, improve supply chain resilience, cut costs, and increase operational reliability by data-driven decision-making and predictions,” a DB Schenker spokesperson explains. “Shippers will profit from this comprehensive supply chain management tool also because it brings together strong performance of both companies: Infor provides the industry-leading software functionality while DB Schenker has the experts to connect digitization with physical elements of the supply chain.”

The Internet of Things (IoT) and Cloud-based solutions have seen wide acceptance across industries, with such notable examples as customer relationship management (CRM) software.

While “on-premise” solutions remain an option, such Cloud-based solutions offer a new frontier into IoT and digitization. One is the use of smart ports, an automated port that uses data analytics to make the right business decisions and run operations effectively.

This technology in particular is changing the future of freight forwarders faced with the COVID economy. “From autonomous forklifts and warehouse automation to inventory management and chatbots for improved customer service, smart ports across the globe embrace digitization to the benefit of freight forwarders,” Armstrong says.

Similarly, artificial intelligence (AI) and advanced machine learning (AML) are being employed in robotic process automation. AML offers freight forwarders a unique asset toward data analysis. “Identifying patterns and forecasting continues to enhance resource utilization while tracking real-time performance. This provides actionable data to drive business decisions,” Armstrong adds.

Investments in fleet management systems (FMS) are also changing the future of freight forwarders. FMS software uses GPS, telematics and other information technologies to drive fleet efficiency optimization.

“FMS’ track valuable, actionable metrics and assist in crucial fleet management practices,” says Armstrong. “FMS is becoming increasingly abundant and will continue to evolve to meet the industry’s demands.”

But automation has created increased cybersecurity risks. Expeditors International, for one, had to shut down its computer systems in February after a targeted cyberattack limited its ability to manage customs and distribution activities.

“The incident affected its global operations, forcing it to initiate crisis management and business continuity plans,” Armstrong says. “Expeditors also said that services would remain limited until the complete restoration of its computer systems from data backups.”

Nonetheless, new technologies will continue to dramatically shape the future of logistics. Digital forwarders are also gaining traction.

“New industry players are often driven by startups,” Armstrong observes. He adds that without the need for a rich asset background, startups tend to focus on the “asset light” part of the value chain and lack its service elements.

Article Topics

Global Trade News & Resources

Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence 2026 Rate Outlook: Early signs of a new freight reality? Federal Reserve moves forward with its third consecutive rate cut National Electric Manufacturers Association calls for stronger enforcement, predictability in upcoming USMCA review U.S.-bound imports slide in November as seasonal slowdowns and tariff uncertainty weigh on volumes Port Tracker report points to ongoing import declines as 2025 ends and into 2026 More Global TradeLatest in Logistics

Cass Freight Index sees annual declines in November Zebra Technologies is looking at strategic options for its robotics automation business ISM forecast sees a manufacturing rebound in 2026 as services maintain steady expansion PwC report indicates transportation and logistics dealmaking activity is focused on strategy, not scale ShipMatrix reports strong Cyber Week delivery performance results National diesel average falls for the fourth straight week, reports EIA FTR’s Shippers Conditions Index shows modest growth More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources