Freight Payment Update: In with the new

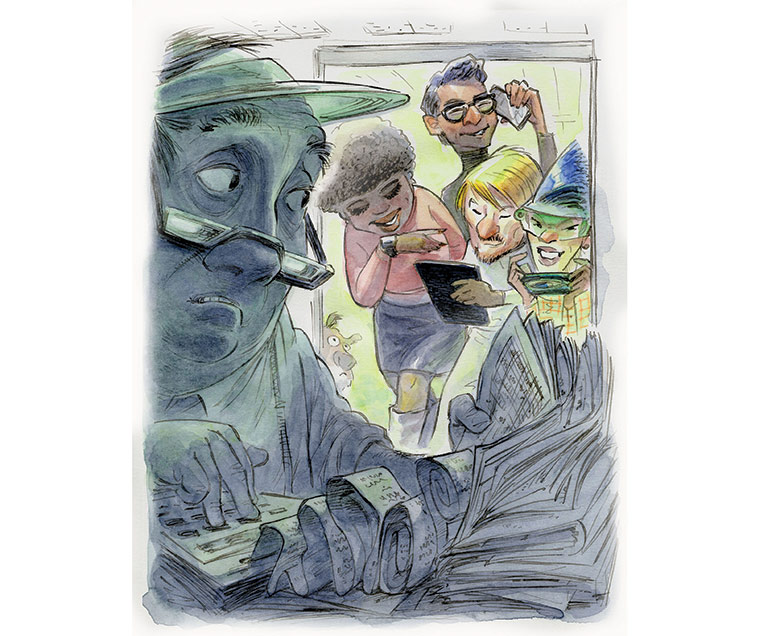

With the “old guard” leaving the sector, new blood is moving into the freight payment industry. They are more data-driven, faster, and more international—and savvy shippers are benefiting by realizing lower, better-managed freight bills.

A long time ago, the freight bill payments sector ditched its green eyeshades and moved to a mainframe computer. Then came the evolution to a desktop and then the laptop—and that’s now led to a new digital methodology of doing business from practically anywhere freight is managed. Could paying freight bills from one’s smartphone be next?

“It’s something we talk about,” says Jeff Carlson, vice president of global sales and marketing for Cass Information Systems, a company which processed more than $40 billion in freight bills last year for a blue-chip list of companies including Siemens, Stryker, Ford, Mars, Emerson and other multinational giants.

“We don’t see much demand for use by cell phone…yet,” Carlson adds. “That’s not to say it won’t be out there someday. However, it’s not that much of a stretch request in today’s world.”

One aspect of the freight bill payments industry is that it largely reflects the freight shipping business overall. There are industry giants such as Cass and U.S. Bank concentrating on large, multi-national corporations. Then there are smaller, feisty competitors such as Cleveland-based CT Logistics, which is celebrating its endurance with a 100th anniversary this year.

“I started in the mail room 40 years ago, but now a lot of the old guard is retiring,” says Allan Miner, president of CT Logistics, referring to the loss of institutional knowledge among shippers and freight bill payment personnel today.

Miner says that many of the new guard coming up through the ranks don’t have the same in-depth management training or “boots on the ground” experience as traffic managers or other freight management jobs at their companies.

“There’s not the same kind of education and pedigree in the industry today,” Miner says. So, it’s only natural, he adds, that some of those shipper clients with less industry experience are relying on CT Logistics and others for transportation expertise for their logistics solutions.

And with that new environment in mind, experts in the industry told Logistics Management that they see the following three trends emerging in the freight audit and payment (FAP) space:

- Using data and visibility to manage freight volatility.

- Conducting scenario planning exercises to model how various modal choices will impact their businesses.

- Getting better at communicating logistics issues “upstream.”

So, let’s take our annual New Year’s dive into the state of freight payment. Let’s find out what data these companies are collecting, how they’re using it, how shippers can benefit from it, and what the cost savings can be to shippers of all size.

Managing volatility in a “data-rich” industry

Perhaps the most valuable contribution freight bill payment companies can provide to their customers has little to do with paying bills. It’s the rich trove of data that’s behind those bills.

Mike Regan, chief relationship director and founder of TranzAct Technologies, says the availability of data today is “much greater than it’s ever been.”

But shippers can still have issues accessing that data in usable formats.

“In particular, companies want to be able to answer the ‘what if?’ question based on their established freight patterns,” says Regan. “Specifically, they can look at ‘this is how we have always done this’ versus ‘this is what would happen if we did this differently.’”

In the long run, trucking companies have the ability to collect much more data than shippers, Regan says. They know when their truck enters your facility, and they ask drivers to rate experience with that data. And with few exceptions, he says that none of that data is being accessed by shippers—yet this data is used by carriers to affect shippers’ rates.

“Those invoices are data rich,” says Carlson of Cass. “We’re seeing a huge investment in technology to analyze that data in real time, and we’re seeing requests for consulting, especially since supply chain costs have increased.”

How to save a fast $1 million in parcel costs

Nearly every shipper knows parcel costs have skyrocketed. So, it’s news when a third-party logistics provider with solid freight audit and payment credentials can save a customer $1.17 million a year in parcel costs.

But that’s what AFS Logistics has done for Rexel USA, one of the world’s largest electrical distributors and serves millions of customers from more than 500 branches and distribution centers in this country.

AFS processes $11 billion in freight bills annually. Its freight audit and payment (FAP) services remain the cornerstone of its business and are utilized by nearly 95% of its customer base.

AFS processes $11 billion in freight bills annually. Its freight audit and payment (FAP) services remain the cornerstone of its business and are utilized by nearly 95% of its customer base.

In Rexel’s case, the company’s DCs process massive parcel volumes. But delayed deliveries, claims filing, lack of detailed reporting and a large roster of carriers made managing costs difficult. There were hard-to-fathom accessorials as well—balances due and short pays.

AFS set out to first provide Rexel with better visibility into its shipments. It reduced the number of LTL carriers from eight to two, and it implemented a new claims process that returned more than $238,000 in the first 15 months.

However, the big savings came in parcel costs—$1.17 million in the first year. AFS did this by managing general rate increases and the creation of a parcel claims audit process. Rexel now gets clear, actionable reports and works with carriers to understand the cause of delivery issues.

“We work directly with the AFS team when necessary, and response time is always quick,” says Travis Gordon, Rexel’s national transportation and logistics manager. “This is truly the support we needed.”

Cass, which began in 1956 and now processes 37 million freight invoices a year, has found its niche with large, multinational, decentralized companies. It claims that using its bill-paying and freight auditing and payment services can save 90% of a company’s time by doing it externally.

“It’s not just taking it off someone’s desk, but it’s data-rich information we can provide,” says Carlson. “We can uncover internal issues with claims that we can look at and decide whether to improve packaging to reduce those claims.”

Offering benchmarking tools and the ability to track a company’s internal processes with the best in the industry are other attractive aspects of a freight bill company. “We keep improving our analytics,” Carlson adds.

Modal choices and other options

The best freight bill payment companies can spot trends of wasteful spending by analyzing millions of freight bills a year. If, for instance, spending on expensive parcel and airfreight services seem excessive, they can suggest that perhaps those loads can be combined into more efficient, cheaper over-the-road trucking services.

“It’s not just transportation, but it’s accounting as well,” says Carlson.

Each company looks at its transportation differently, which experts say makes it difficult to design a one-size-fits-all solution. What freight analysts look for are lanes that perhaps are charging high accessorials. There are other keys as well.

“Am I shipping the proper mode?” Carlson asks. “If a company with lots of small parcels are shipping by air for 100 miles, maybe that could go via ground delivery.”

Converting many less-than-truckload (LTL) shipments into full truckload is another common theme. That’s the most common use of the data, experts say. “In the sales process, when we’re showing them the data, we want to show off the value,” adds Carlson. “It’s hard for someone to manage something when they don’t know what it is.”

This has led to value-added propositions that are more long-term and strategic and less transactional, according to Miner of CT Logistics. “That whole just-in-time environment has pushed it down to more frequent shipments and smaller shipments,” he says. “People want smaller packages delivered more often. But that definitely increases cost of doing business.”

That’s why CT and others perform constant auditing services and will re-bid modal contracts every six months or so. “We’re crunching numbers every day so we know where the best of the breed is,” says Miner, whose company pays $8 billion of bills with 50 million transactions every year.

“We can do a lot of cost comparisons, and we can tell a shipper with 100,000 LTL shipments that it’s getting a good rate because we also have a guy with 1 million shipments and he’s paying 10% more,” Miner adds.

Communicating upstream in the future

What customers will look for in the future is a far cry from simply auditing and paying freight bills, industry experts say.

“What a lot of shipper customers are looking for is continued advancement in real-time data sharing to drive efficiencies throughout their organizations,” says Jeff Pape, general manager of global transportation for U.S. Bank corporate payment and treasury solutions.

Pape says that there’s “increasing demand” for real-time analysis and transaction information from specific points of time in freight transactions. U.S. Bank has developed application program interfaces (APIs) to facilitate real-time transfers of information on demand.

The other thing shippers talk about is the need for “actionable data,” Pape says. Getting accurate information “downstream” to help better predict freight activity whether it’s distribution center allocation, modal choices or other internal decisions is increasingly crucial, he adds. “There’s a plethora of data on a freight invoice. The issue is how do we present it in a way that the customer can take action?”

One way is managing freight costs through better forecasts. While these formerly occurred monthly or quarterly, Pape says that with evolving technology, these can be done more frequently to make more accurate forecasts. “It helps reconcile invoices, which drives efficiency and lowers costs.”

No matter what’s coming down the road, experts say, organizational efficiency is the name of the game. And now that the issue of supply chains has become an agenda item at boards of directors’ meetings, shippers “will benefit from working with FAPs that can help effectively communicate the financial and human resources that companies will need to invest in to have strong supply chains,” adds Regan.

Consolidation within the industry in North America is only helping the survivors, adds Miner of CT Logistics. “That creates opportunity for us,” he says. “Either because their service or technology is lacking, we’re seeing more and more prospects knocking at our door. As long as we keep investing in research and development and if we stay one step ahead of the competition, we’ll be fine.”

Article Topics

Motor Freight News & Resources

Cass Freight Index sees annual declines in November PwC report indicates transportation and logistics dealmaking activity is focused on strategy, not scale National diesel average falls for the fourth straight week, reports EIA FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth More Motor FreightLatest in Logistics

Cass Freight Index sees annual declines in November Zebra Technologies is looking at strategic options for its robotics automation business ISM forecast sees a manufacturing rebound in 2026 as services maintain steady expansion PwC report indicates transportation and logistics dealmaking activity is focused on strategy, not scale ShipMatrix reports strong Cyber Week delivery performance results National diesel average falls for the fourth straight week, reports EIA FTR’s Shippers Conditions Index shows modest growth More LogisticsSubscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources