Cloud Solutions Dominate Supply Chain

As logistics operations seek out new or replacement supply chain management solutions, an increasing number of them are putting Cloud solutions at the top of their shopping lists.

Demand for computing services delivered via the web has taken off across most industry sectors, with logistics and supply chain organizations ranking among the biggest users of on-demand computer system resources. As they continue to shed their on-premises solutions in lieu of Cloud-based options, companies are driving up Cloud adoption rates across the board.

The proof is in the numbers: Gartner, Inc., predicts that worldwide end-user spending on public Cloud services will grow by 20.4% this year to reach nearly $494 billion, up from $411 billion last year. By 2023, that amount spent on public Cloud services is expected to reach nearly $600 billion.

“Cloud is the powerhouse that drives today’s digital organizations,” said Sid Nag, research vice president at Gartner. “CIOs are beyond the era of irrational exuberance of procuring Cloud services and are being thoughtful in their choice of public Cloud providers to drive specific, desired business and technology outcomes in their digital transformation journey.”

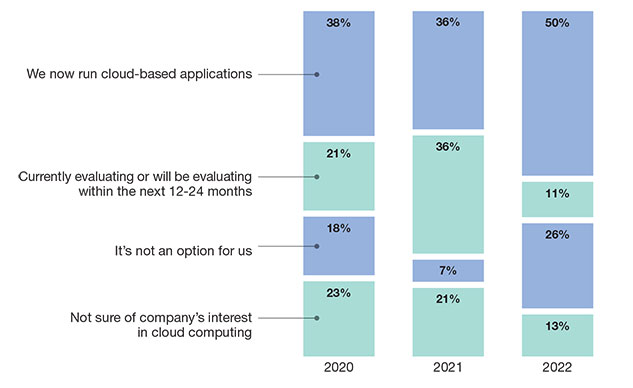

Peerless Media’s own research shows just how eager organizations are to get their supply chain management (SCM) software off of their own servers, reduce the stress and expense on their own IT departments and run their applications in the Cloud. According to Peerless Research Group’s “2022 Software/Automation Outlook,” 50% of companies are currently running Cloud-based applications—up from 36% in 2021.

What is your company's status regarding the adoption of Cloud computing for supply chain management?

Source: Peerless Research Group (PRG)

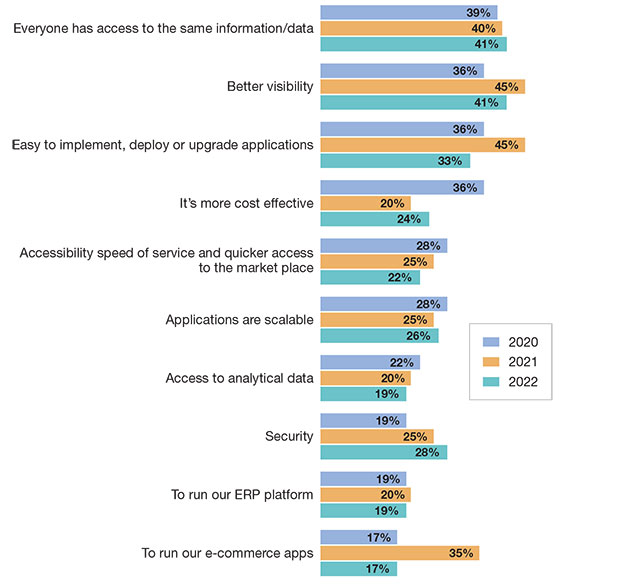

Eleven percent of survey respondents say they’re either currently evaluating Cloud applications or planning to do something in the next 12 months to 24 months, with the key drivers being: everyone has access to the same information and data (for 41% of companies); better visibility (41%); and the easy implementation (33%); security (28%); and scalability of the applications (26%).

Other reasons companies are investing in Cloud-based SCM include the applications’ cost effectiveness, the analytical data that it provides and how quickly it can be put in place and ready to use (i.e., “speed of service”).

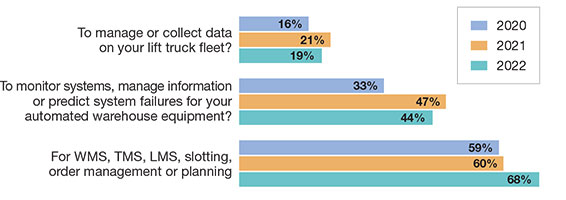

Currently, 68% of responding companies are planning to use Cloud-based applications for warehouse management (WMS), transportation management (TMS), labor management (LMS), slotting, and order management (OMS). This represents an 8% increase over 2021’s Cloud SCM adoption levels.

Balaji Abbabatulla, senior director of product management SCM software at Gartner UK, has been tracking companies’ investment in Cloud SCM for years and says the continued, steady uptick equates to about 2 times to 2.5 times that of the overall supply chain software market. He says some of the prominent software providers in the Cloud SCM market currently include Coupa, Oracle, Kinaxis and JAGGAER, among others.

Abbabatulla says Cloud has almost become a “no brainer” for organizations that want software loaded with the most modern and innovative capabilities. Those that stick with their on-premises approaches may miss out on these new bells and whistles.

“Providers are delivering software faster and better in the Cloud versus on-premises,” Abbabatulla explains. “Those companies that prefer to keep their software in-house may miss out on those innovative capabilities and wind up behind their peers in terms of the capabilities and delivering better business outcomes.”

Cloud in the warehouse

As director of supply chain research at ARC Advisory Group, Clint Reiser conducts extensive WMS research every year. He’s noticed that North American-based WMS providers have been making good progress when it comes to switching their customers over to the Cloud, and that in some cases that progress has outpaced what’s happening in European markets right now.

Reiser says some of the software providers that are leading the pack in North America include Manhattan Associates, which has seen “a good deal of uptake and adoption” of its Cloud WMS. “They’re going gangbusters with that,” says Reiser, who points to Blue Yonder’s Luminate applications—namely, Warehouse Tasking and Robotics Hub—as two SaaS-native solutions that are also experiencing “some good traction right now.”

Other factors that could be pushing more SCM software vendors into the Cloud right now include a private equity sector that’s placing a higher multiple on SaaS-based revenue (versus one-time, perpetual software licenses). In other words, switching customers over to recurring revenue may positively affect a software provider’s value.

“I wouldn’t say that this is driving up adoption of Cloud WMS right now,” Reiser points out, “but I would say that it’s a factor that’s playing a role in its growth.”

Why are you or will you be using Cloud-based applications? What do you see as the benefits?

As Software Equity Group, an investment bank that focuses on software and technology sectors, recently put it: “If there’s one thing private equity firms love, it’s recurring revenue.” It goes on to say that compared to the traditional selling model of one-time purchases, the annual subscription model gives investors more insight into future revenue. “Stable monthly recurring revenue is a great indicator of success, and a key metric investors vet for. Software companies often outshine startups from other industries when it comes to churn and continued revenue growth.”

Reiser says software providers are also using the Cloud to reduce the total cost of ownership (TCO) of their solutions while increasing the value propositions of their offerings. “We’re at a point where Cloud has become a platform for delivering greater value to the end customer,” says Reiser, “versus just being a means of reducing risk or switching responsibility and burden from the customer to the vendor.”

More and more mainstream

As Cloud SCM continues to transform the logistics, supply chain and transportation sectors, it’s giving shippers the connected ecosystems they need for end-to-end visibility, real-time insights, better decision-making and cost savings. Bill Brooks, VP, NA transportation portfolio at Capgemini, says that these and other benefits are pushing more companies away from on-premises SCM and over to using more Cloud-based applications.

“Every year we see Cloud SCM becoming more and more mainstream,” says Brooks, who adds that Cloud adoption is “pretty much across the board” in terms of which applications are moving in this direction. Where some of the earliest applications to move into the Cloud were TMS—namely due to the need for improved carrier connectivity—and global trade management—which has to be continually updated with new rules and requirements—the delivery method now applies to nearly every corner of supply chain management.

Brooks credits Cloud’s subscription arrangement as a key driver of this trend, and says companies like that can be managed via an OpEx (an ongoing cost and is usually incurred monthly versus CapEx) budget. Speedy implementation times and the fact that the software can be used 24/7 from anywhere also make it particularly attractive, and especially for managing a remote workforce. Cloud applications can also be expanded, scaled and upgraded more seamlessly than with on-premises solutions, which often take time, resources and investment to update.

“The Cloud gives end users more capabilities as software makers come out with new versions, functionalities and modernizations,” says Brooks. “Traditional software providers, on the other hand, have some innate hurdles to work through when adding new functionalities and capabilities to their systems.”

Asked what may still be holding shippers back from adopting Cloud-based SCM, Brooks points to some of the age-old obstacles: the desire to maintain control of solutions; uncertainty over how “safe” it is to put systems and data into the Cloud; and potential cybersecurity issues.

Are you using or planning to evaluate Cloud-based applications…

“I think these roadblocks still exist in some people’s minds, but the security and strength of the Cloud have been well proven,” says Brooks, who sees reluctance to switch out veteran, workhorse systems as one potential inhibitor of higher Cloud SCM adoption.

“If you’ve been doing something a certain way for the last 30 years, change can be extremely difficult,” says Brooks. Still, there comes a time when all shippers must assess their current solutions and ensure that they are still delivering the desired business value.

If the answer is “no”—and factoring in Gartner’s expectations that $600 billion will be spent on public Cloud services in 2023 alone—then the Cloud is sure to be at the top of those companies’ SCM shopping lists.

Incremental modernization, courtesy of the Cloud

To companies that are investing in Cloud SCM this year, Abbabatulla says existing solution providers should be adding new capabilities periodically, and in a completely “seamless and non-disruptive” manner. That doesn’t mean adding one new capability every two years either; those upgrades should take place within a “rapid cycle of innovation that sits on top of a robust, strong foundational platform that’s being used today,” he adds.

Abbabatulla also sees more companies taking “chunks” out of their existing legacy platforms and replacing them with modern, scalable, Cloud-based options. He sees this as a viable way to gain access to new capabilities without having to completely rip-and-replace a legacy solution that’s been in place for years or even decades.

And while this may be difficult to do with larger, intertwined solutions like TMS or WMS, a Cloud-based yard management (YMS) solution can often be layered on top of an existing, on-premises enterprise resource planning (ERP) platform.

The same approach can be used with autonomous mobile robots (AMRs) for picking and packing or Cloud-based labeling systems that can be integrated directly with an existing WMS or TMS for added functionality.

Abbabatulla refers to this approach as “incremental modernization” and says it differs from “big picture digital transformation,” which generally drives investments in software over time. “Shifting to this level of modular incremental modernization is a new way of thinking,” he adds.

Article Topics

Cloud News & Resources

Emerging trends in logistics technology adoption 2025 Robotics Application Conference rolls out session, speaker lineup Key characteristics of emerging digital supply networks Leveraging Artificial Intelligence (AI) to Transform Supply Chain Planning and Resilience Steady march into the cloud Technology Issue: Evaluate first, then apply Warehouse/DC Automation & Technology: It’s “go time” for investment More CloudLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources