2025 Automation Survey: Diving deep into the warehouse automation trends

Our annual Peerless Research Group study explores how technology and automation are reshaping the future of warehouse and DC operations.

You’d be hard pressed to find a warehouse or DC right now that hasn’t deployed technology and automation in some form or fashion. Sure, some facilities may be way ahead of the pack when it comes to automation while others are still just beginning to dip a toe in those waters, but the overall trend is clear: Technology and automation are becoming increasingly commonplace in today’s warehouse and distribution center operations.

Credit the persistent warehouse labor constraints, booming e-commerce marketplace and ever-changing customer demands (particularly around faster and faster delivery times) with creating the perfect conditions for more technology, automation, robotics, artificial intelligence (AI) and other innovations.

No longer able to simply “throw more people at the problem” during peak seasons, for example, companies are constantly looking for modern answers to the age-old problem of how to get goods in the door, stored, picked, packed and back out the door as fast as possible.

To learn more about how warehouse and DC operations are investing in and using automation, Peerless Research Group (PRG) recently conducted the “2025 Automation Solutions Study.” The annual survey touched on the key factors and features that companies consider when evaluating automation systems and solutions; the extent to which specific warehouse processes are automated; and areas that companies want to improve over the next two years.

The survey also asked respondents to share details about their current order fulfillment activities and improvement plans. Other points covered included estimated spend on materials handling equipment and solutions in 2025, and respondents’ go-to sources for order fulfillment solutions and replacement parts.

The evolving warehouse landscape

The “2025 Automation Solutions Study” was administered over e-mail, and 139 individuals who are personally involved in materials handling solutions participated in the survey. Respondents represent a variety of manufacturing industries including food, beverage and tobacco (14%); industrial machinery (10%); computers and electronics (9%); and chemicals and pharmaceuticals (8%).

Thirty-five percent of respondents work in warehouses or DCs; 25% in manufacturing; 19% at their companies’ corporate headquarters; and 17% in warehouses that support manufacturing operations. Most (30%) work in facilities that span more than 250,000 square feet of warehouse/DC space and 28% are in facilities that are smaller than 50,000 square feet. The average facility size across all respondents was 137,054 square feet.

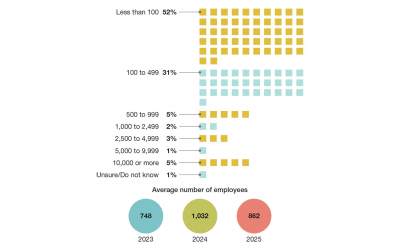

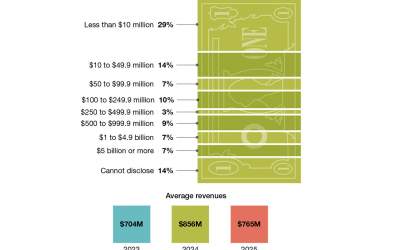

In terms of facility size, 52% of respondents work in operations with fewer than 100 employees, 31% say they have 100 to 499 associates, and 5% work in warehouses that employ between 500 and 999 people. Annual revenues for these operations range from less than $10 million (29%) to $5 billion+ (7%). The average revenue size for this year’s companies was $765 million versus $856 million in 2023.

The automation revolution

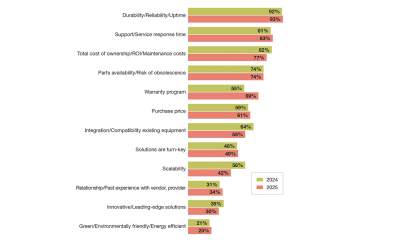

When evaluating automation systems and solutions, 93% of respondents consider durability, reliability and uptime “very important” to the selection process. Support and service response time also matter (83%), as does total cost of ownership, return on investment, maintenance costs, warranty programs and purchase price. This year, 56% of companies factor integration and compatibility with existing equipment into their buying decisions compared to 64% last year.

Companies planning to evaluate and/or purchase materials handling automation over the next two years are making these investments for a few key reasons. Most want to fill orders faster and meet customer service level agreements and expectations, while others have set their sights on increasing e-commerce order-related piece picking and packing. Labor constraints continue to plague the sector, which also wants to test out new go-to-market strategies and stay out in front of its competition.

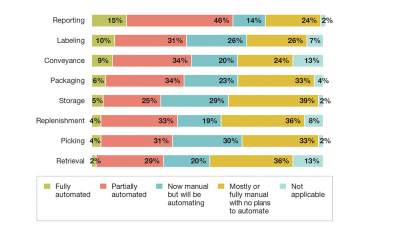

Automation continues to make its way into fulfillment operations. According to the survey, 15% of companies have fully automated the reporting function (compared to 19% last year), 10% say labeling is fully automated (versus 17%), and 9% say conveyance is fully automated (down from 26%). In addition, 6% say packaging is fully automated, 5% have fully automated storage and 4% have done so with their picking operations.

Most companies’ (39%) storage functions remain fully or primarily manual (with no plans to automate these operations in the future) and many respondents also rely on mostly manual replenishment and retrieval processes. An equal number of respondents (33%) say their packaging and picking processes are manual, but others say those operations are either partially automated or ready to be automated in the future.

Asked about their future automation purchasing goals, 10% of respondents plan to tweak their warehouse and distribution center solution plans (compared to 16% last year), while 71% will stick to the script. Of the former group, 35% say they’ll make changes within the next three months while 31% will do so within the next three to six months.

Materials handling investment plans

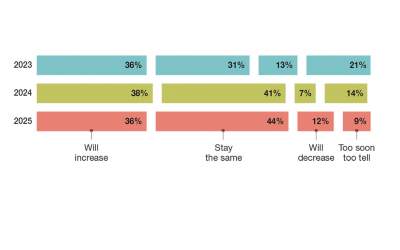

For 2025, 36% of companies will increase their spending on materials handling equipment and solutions, 44% will maintain the same budgets they used in 2024, and 12% plan to spend less on this area of their business.

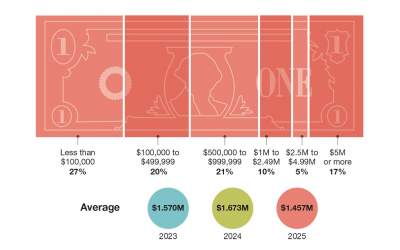

Companies expect to spend an average of $1.5 million on their materials handling equipment and solutions in 2025, down from $1.7 million last year. About 27% of respondents peg their 2025 spend at less than $100,000; 21% say the number will land somewhere between $500,000 and $999,999; and 20% are budgeting anywhere from $100,000 to $499,999.

Improving & modernizing operations

Companies are managing various activities in their fulfillment operations, including warehousing and storage; individual pick, pack and ship wholesale distribution fulfillment; case and mixed case fulfillment; and mixed pallet load fulfillment. Also, 64% manage order customization, repacking and value-added services, and 60% use individual pick, pack and ship e-commerce fulfillment.

The majority of survey respondents (64%) use racks and shelving in their facilities (up from 70% last year) while 83% use lift trucks (compared to 74% last year) and 75% use dock equipment. Looking ahead to the next two years, 42% of companies plan to upgrade or implement hoists, cranes and monorails; 31% plan to use palletizers, pallets/totes, bins and containers; and 26% want to implement new or upgrade existing dock equipment.

Over the next two years, companies want to improve various aspects of their warehouse and DC operations. For example, 67% want better warehouse capacity utilization, 58% are looking to improve order accuracy (up from 52% last year), and 49% hope to improve packaging operations. About 44% are looking to improve labor reduction (down from 57% last year) and the same percentage have set their sights on achieving better order fill rates this year.

Automation can help companies achieve their improvement goals, and there appears to be plenty of room for more of it in the typical warehouse or DC right now. To manage their order fulfillment operations, 52% of companies are still mostly or all manual (up from 43% last year), while 42% use a mix of automated and manual processes. And 4% say these processes are “highly automated,” down from 10% for the 2024 survey.

Automating key processes

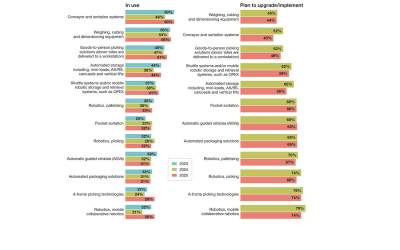

Currently, 60% of companies are using conveyor and sortation systems and 40% plan to upgrade or implement these systems within the next two years. Fifty-six percent use weighing, cubing and dimensioning equipment; and 44% plan to adopt these solutions at some point in the next 24 months. Other types of automated equipment that companies are using and/or planning to use include goods-to-person picking solutions, automated storage and retrieval systems, carousels and vertical lifts.

Forty-one percent of respondents are currently using shuttle systems and/or mobile robotic storage and retrieval systems, and 59% plan to upgrade or implement this equipment in the next two years. The robotics now in use in the fulfillment setting include palletizing robots (33%), pocket sortation robots (32%), automatic guided vehicles (31%), automated packaging solutions (31%), A-frame picking technologies (26%) and mobile collaborative robotics (26%).

The role of data, analytics & software

Data is important in any business setting, and warehousing is no exception. According to the survey, 77% of companies are now using mobile/wireless technologies for data collection—up from 58% last year. Seventy-six percent use bar code scanners (versus 66% last year), and 46% are currently using pick- or put-to-light picking technologies. Meanwhile, 45% of respondents say they’re using RFID (down from 57% last year), 21% rely on voice-directed picking technologies (down from 37% last year), and 18% are using heads-up display/vision technologies.

Software also continues to be an important business tool for fulfillment operations, with 63% of companies using warehouse management systems, 62% relying on transportation management systems, 50% using warehouse control systems and 41% relying on labor management systems. Other popular applications include slotting software, warehouse

execution systems, parcel rating systems and yard management systems.

The survey found that most respondents (59%) want to upgrade or implement network design and optimization software in the next two years (up from 47% last year), while 39% plan to upgrade or implement supply chain planning software, and 36% want to start using distributed order management applications. Other applications that are either already in use or on companies’ shopping lists are order management systems, enterprise resource planning solutions and customer relationship management software.

Article Topics

Peerless Research Group News & Resources

42nd Annual Quest for Quality Awards: Honoring the industry’s top performers in logistics excellence 2025 Less than Truckload Research Study Results 2025 Outook Survey: Warehouse automation comes into full focus 2025 Automation Survey: Diving deep into the warehouse automation trends 2024 Warehouse/DC Operations Survey: Technology adoption on the rise 33rd Annual Study of Logistics and Transportation Trends: Puzzling path forward Annual Study of Logistics and Transportation Trends: Puzzling path forward More Peerless Research GroupLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources