Revolutionizing SCM Software: Real-time visibility, AI, and seamless integration

With its real-time visibility, intelligent automation and flexible architecture, modern SCM software is helping shippers plan, adapt and deliver with confidence. We explore how these technologies are empowering companies to stay agile—and respond to disruptions faster than ever before.

If the supply chain is the engine that drives global commerce, then supply chain management (SCM) software is the workhorse that keeps that engine running. From tracking inventory and planning transportation routes to managing fulfillment and optimizing labor, these solutions manage the critical, behind-the-scenes work that keeps goods flowing smoothly from the point of raw material right out to the end user.

Warehouse management systems (WMS) help companies control and optimize inventory, labor, and fulfillment operations inside the four walls, while transportation management systems (TMS) are used to plan, orchestrate and track the physical movement of goods. Yard management systems (YMS) streamline the flow of trailers and containers in and out of warehouses, and enterprise resource planning (ERP) systems manage finance, procurement and other key business functions.

Together, these systems form the digital backbone of modern supply chain operations.

And they’ve become especially vital amid the ongoing supply chain uncertainty and complexity, where smart SCM platforms can help companies stay ahead of the game. From AI-driven exception handling and real-time planning to modular applications that scale right along with a business, today’s SCM tools are being built to deliver both speed and adaptability.

Developing and delivering smart solutions

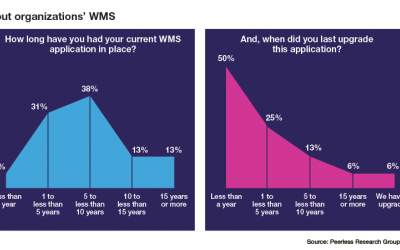

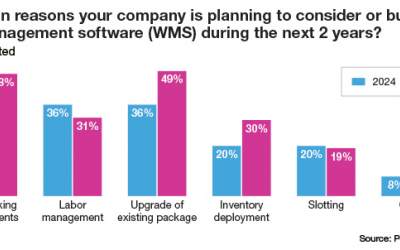

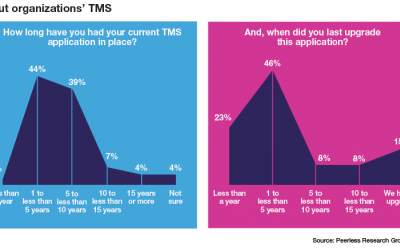

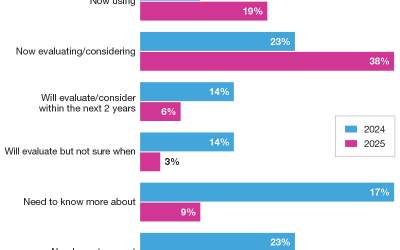

Shippers are well aware of SCM’s value. According to Peerless Research Group’s 2025 Software/Automation Outlook, nearly half (49%) of companies are currently using WMS, 35% rely on TMS and 14% have adopted YMS platforms. Over the next two years, 28% of companies will evaluate or upgrade their WMS, while 27% will be shopping for new TMS platforms.

In making these upgrades, shippers are focused on improving labor management, boosting picking speed and gaining real-time control over inventory, according to the survey. Return on investment is also an important part of the conversation.

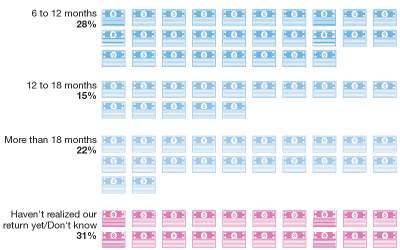

And of the companies that have implemented a WMS, for instance, more than half of them realized a return on investment (ROI) within 12 months. TMS and SCP software also showed strong ROI potential, with many users reporting payback within 6-18 months.

To meet shipper expectations, SCM software vendors are stepping up and delivering smarter tools that drive ROI, boost agility and support quick actions. For example, many supply chains have historically operated in daily “batch mode,” where systems plan once, execute once and wait until the next cycle to adjust.

Shashank Mane, VP of sales & go-to-market for manufacturing at Capgemini, says artificial intelligence (AI) and machine learning (ML) have turned that age-old model on end. “We’re now seeing companies move toward intraday planning,” he explains. “They’re refining decisions throughout the day based on real-time disruptions, like a delayed shipment or a supplier issue.” Now instead of waiting 24 hours to make an important adjustment, shippers can respond within minutes.

For example, if a truck breaks down, a weather event emerges or a supplier misses a deadline, platforms can instantly reoptimize routes or reallocate inventory to protect service levels. “AI is also helping companies run processes more frequently and more intelligently,” Mane adds, “which effectively increases service reliability and improves the overall customer experience.”

Managing growing complexities

As supply chains become more complex and as customer expectations shift, organizations need smart tools to help them keep up with the changes. Traditional software alone can’t always handle the volume, speed and variability that define today’s logistics environment. This is where AI, machine learning and other advanced tools can step in and help out.

Software vendors understand this evolution. In response, they’re integrating more AI, ML and other advanced technologies into their platforms to help their customers boost agility, improve visibility and make faster, more informed decisions. And with AI now “baked” into many SCM platforms, the advanced technology is starting to play a more active and influential role in operations.

Howard Turner, director of supply chain systems at St. Onge Co., says some of the most exciting developments are coming from how systems are starting to assist, and in some cases even lead, the decision-making process.

“We’re seeing generative AI [Gen AI] showing up in WMS, TMS and labor management systems,” says Turner. “The ability to summarize data and present it clearly is valuable, but what’s really intriguing is the use of large language models [LLMs] that let users interact with systems more naturally. You don’t have to remember keywords or commands anymore; you just ask, and the system responds.”

Beyond Gen AI, Turner says the use of machine learning in ERP systems is also gaining momentum. These tools can proactively analyze order patterns, inventory levels and warehouse constraints, for example. Then, they can suggest actions like redistributing inventory across different DCs and warehouses. The user can either approve the recommendations or allow the system to automate the task (i.e., generating a transfer order).

“We’re just starting to scratch the surface with all of this,” Turner says. “But using this level of computing power to improve supply chain decisions and respond more proactively to changes is a significant step forward.”

Opening up Tier 2 & 3 visibility

The verdict may still be out on the long-term role that AI will play in supply chain management, but the volume of that buzz has become too loud to ignore. Organizations are currently testing AI out in areas like forecasting, inventory management and exception handling.

Looking specifically at exception handling, some companies are using AI to automatically flag late shipments, suggest alternative suppliers or reroute orders based on real-time conditions. Tasks that used to take hours of back-and-forth emails, manual tracking and spreadsheet analysis now happen in minutes (or even seconds). This frees up team members to focus on more strategic, value-added work.

Mane says AI is also helping companies address one of the most persistent visibility gaps in supply chain operations: Tier 2 and Tier 3 supplier disruptions. “Historically, most exception handling focused on Tier 1 suppliers because that’s where companies had the most access and control,” he explains. “With AI and machine learning, we’re now seeing more organizations extend that visibility deeper into the supply base, making it much easier to respond quickly and minimize the impact of delays.”

Making the ERP-SCM connection

As supply chain and logistics complexity accelerates, the need for tighter integration between SCM and ERP systems is becoming more and more clear. While the two systems can operate separately, they tend to perform best when tightly integrated.

Knowing this, many ERP makers have integrated supply chain modules (WMS, TMS, YMS, etc.) right into their software suites. This allows companies to manage procurement, order fulfillment and inventory on the same platform they already use for financials, procurement and reporting.

Turner says ERPs are also playing an increasingly important role in enabling sound sales and operations planning (S&OP) practices. With core data like inventory levels, order status and purchase requisitions centralized in one place, for instance, ERP can serve as a solid foundation for coordinated, data-driven planning.

“It’s about synchronizing tasks, consuming data in the right order,” says Turner, “and having a clear understanding of what a good S&OP process actually looks like.”

Turner adds that more advanced systems are taking this a step further by helping cross-functional teams work in sync. Instead of just giving each department the tools to do their individual jobs, for example, those individual departments can use SCM software to work more closely together, optimizing inventory, meeting customer demand and creating more efficient fulfillment operations.

Composable architectures, microservices & integrations

Supply chain management software has come a long way over the last 5 to 10 years, during which time it’s become more flexible and easier to integrate with other systems. Cloud adoption and developers’ use of application programming interfaces (APIs) have made connecting systems with external partners like carriers, third-party logistics providers (3PLs) and suppliers much more straightforward.

Rishabh Narang, director analyst at Gartner, Inc., says that there's still work to do when it comes to connecting SCM and ERP with outside partners. For example, he says most ERPs “still lack true plug and play connectivity with external ecosystems [e.g., carriers, 3PLs, etc.]. “Everything needs an interface, but those connections aren’t always easy to set up or maintain,” says Narang, who adds that simpler integrations would help speed up shipper response times and take some of the burden off their internal IT teams.

Narang also sees growing demand for composable applications, or those “modular software components” that can be mixed and matched based on an organization’s specific requirements.

Instead of deploying a full ERP or SCM software suite, for instance, companies may want to activate only the modules they need (e.g., HR, finance, warehouse management or inventory management).

This pivot to using more microservices architecture—where individual functions are built at separate, individual modules that work together—may give companies more control, shorten their software implementation times and even lower their upfront costs.

“The real advantage for shippers is the ability to choose what they want,” adds Narang, “go live with it quickly and then scale from there as needed.”

Article Topics

Capgemini News & Resources

Revolutionizing SCM Software: Real-time visibility, AI, and seamless integration Evolution of the Connected Supply Chain: ERPs lead the charge with smart tech AI in Supply Chain Software: Opportunities, Challenges, and the Future of Automation Warehouse Management Systems (WMS): The ultimate e-commerce warehouse orchestrator The Rise of the Intelligent Supply Chain: Driving efficiency with data and automation Beyond the horizon: What’s next for supply chain management (SCM) software? Yard Management Systems (YMS) Update: Optimize your yard, optimize your business More CapgeminiLatest in Logistics

Looking at the impact of tariffs on U.S. manufacturing UP CEO Vena cites benefits of proposed $85 billion Norfolk Southern merger Proposed Union Pacific-Norfolk Southern merger draws praise, skepticism ahead of STB Filing National diesel average is up for the fourth consecutive week, reports Energy Information Administration Domestic intermodal holds key to future growth as trade uncertainty and long-term declines persist, says intermodal expert Larry Gross Railroads urged to refocus on growth, reliability, and responsiveness to win back market share Q&A: Ali Faghri, Chief Strategy Officer, XPO More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources