40th Annual Salary Survey: Salary and satisfaction up

Our latest Peerless Research Group (PRG) survey reveals current salary trends, career satisfaction rates, and shifting job priorities for individuals working in logistics and supply chain management. Here are all of the findings—and a few surprises.

As global supply chains continue to transform, use more technology and address new challenges, the professionals who run these networks play a critical role in shepherding goods from the point of raw material and right out to the end consumer. As the conductors of this complex orchestra, supply chain and logistics specialists streamline the flow of goods, reduce costs, improve customer satisfaction, manage risk, and help their organizations gain strategic advantage.

The complex supply chain environment demands a skilled and dedicated workforce that, of course, deserves fair compensation for its efforts. To learn more about the key salary trends, job challenges, and career satisfaction shifts in the industry, Peerless Research Group (PRG) and Logistics Management recently conducted their 2024 Salary Survey. More than 240 respondents shared their insights for the survey, which revealed several interesting trends currently taking place in the supply chain and logistics field.

To get their expert input on the survey results and feedback on the career-related industry trends, we spoke with Abe Eshkenazi, CEO at the Association for Supply Chain Management (ASCM), and Tom Derry, CEO at the Institute for Supply Management (ISM). Both contributed their feedback on the report and explained some of the surprises that emerged in this year’s survey.

Survey says…

Most of this year’s survey respondents work in the manufacturing industry (44%), including food, beverage, and tobacco (18%), automotive and transportation equipment manufacturing (11%), and industrial machinery manufacturing (10%). Others work for third-party logistics providers (12%), distributors (10%), retail trade (9%), and wholesale trade (9%).

Twenty percent of this year’s survey respondents work for companies with less than $50 million in revenues, 15% for organizations with $50 million to $99.9 million in revenues, and 14% for companies in the $100-million to $249.9-million range. Seventeen percent of respondents work for organizations with $2.5 billion in revenues and 9% for companies in the $1-billion to $2.49-billion range.

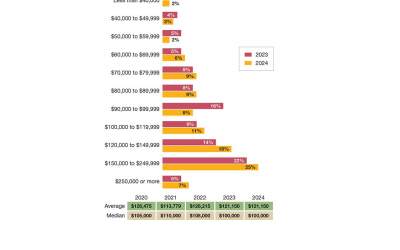

Supply chain and logistics professionals working in the manufacturing sector earn the highest average annual salary of $123,450, while those working for 3PLs earn $107,900, distributors $107,500, and consulting firms $102,200. On average, supply chain and logistics professionals expect to earn $121,150 annually in 2024, with the median salary being $100,000. These salary levels are both consistent with 2023’s survey results.

This year, 25% of supply chain professionals will earn between $150,000 and $249,999 annually, while 18% will earn $120,000 and $149,999, 11% earn between $100,000 and $119,999 and 9% say their annual salaries will land somewhere between $80,000 and $89,999.

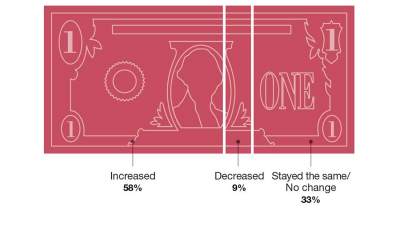

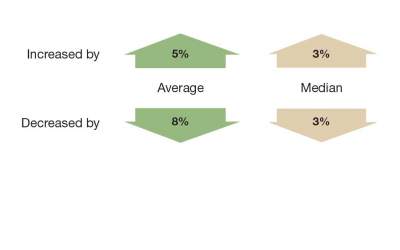

Average salaries remained consistent from 2023 to 2024, but over the past year, 58% of professionals say their salary level has increased (compared to 67% last year). Also, 33% say that their salary level has stayed the same, and only 9% say it has decreased. When asked by what percent their salary has changed, the average increase was 5% and the average decrease was 8%.

Reflecting on the average reported salary of $126,475 (and median salary of $105,000) from 2020’s survey, Derry says the extreme impacts of the pandemic may have boosted salaries during that timeframe.

“It’s interesting that total cash compensation has declined since 2020; but 2020 was one of the most challenging years in logistics in recent history,” says Derry. “We had a shortage of ocean containers, a shortage of drivers in the United States, and massive congestion at U.S. ports. I would assume logistics professionals earned significant bonuses in 2020 as an appropriate reward for successfully negotiating those incredibly difficult conditions.”

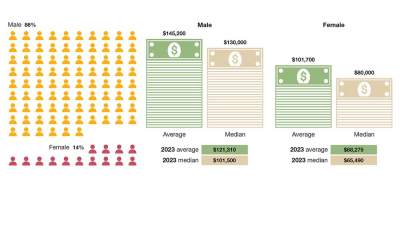

How demographics affect salary

This year’s survey group was 86% male and 14% female, with the former continuing to earn more than their female counterparts. However, women’s salaries are increasing: Men earn an average of $145,200 annually (up from $121,310 in 2023) and women earn $101,700 (compared to $88,275 in 2023).

Professionals located in New England continue to earn the highest wages at $120,100, followed by Canadian professionals at $108,300 and the Midwest at $106,950 annually.

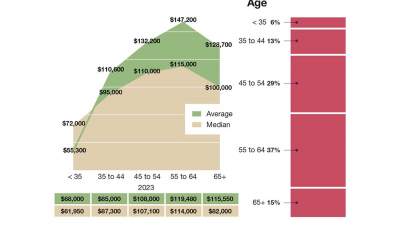

Respondents’ salaries clearly increase with age, according to the survey results. Respondents aged 55 to 64 report the highest annual salaries at $147,200 (compared to $119,470 in 2023), while those aged 45 to 54 report an average salary of $132,200 (compared to $108,000 in 2023) and professionals aged 35 to 44 earn $110,600 (compared to $68,000 in 2023).

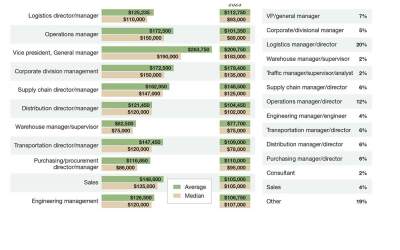

Salary increases by job title

This year, 20% of survey respondents are logistics managers or directors, 12% are operations managers or directors, and 7% are VPs or general managers. Other positions include supply chain managers or directors, transportation managers or directors, distribution managers or directors, and purchasing managers or directors.

On average, VPs and general managers come out on top with an average annual salary of $263,750 in 2024 (compared to $209,750 in 2023), followed by operations managers and corporate/divisional managers at $172,500. Supply chain directors and managers earn $162,950 on average and sales professionals report annual average salaries of $148,600. With the exception of corporate/divisional managers, every job role has seen a salary increase over last year’s numbers.

Individuals involved with supply chain management reported the highest average of $167,700, followed by distribution and logistics ($141,050); warehousing ($134,750); procurement ($131,900); and traffic and transportation ($128,900). Individuals across all job functions are now earning more than they did in 2023.

Earning more and doing more

Over the last two years to three years, most respondents (67%) say the number of functions they perform on the job has been increasing. Meanwhile, 27% say their job responsibilities have stayed the same and just 6% say they’re now handling fewer functions.

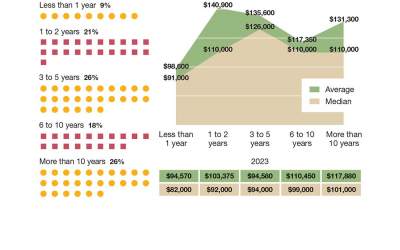

When asked how many years they’ve been in their current position, 26% of respondents say that they have held their position for more than 10 years, while another 26% have been in their position for between three years and five years.

Individuals who have held their positions for 10 years earn $131,300 on average (compared to $117,880 in 2023), while those in the six-to-10 year range earn $117,350.

Eshkenazi says the number of respondents with under three years of experience versus those with 20+ years is a clear indication of a looming talent shortage in logistics. “Companies need to act on this now before it’s too late,” he says. “The salary by different employers is a unique perspective. It’s interesting that salaries increase as one has more employers, but drops off at 10 or more.”

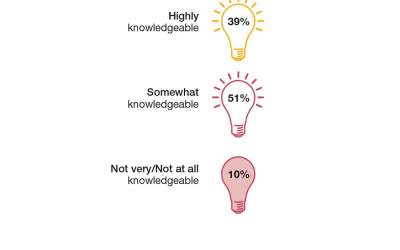

Asked to rate their levels of understanding of e-commerce and e-fulfillment processes within their organizations, 39% of professionals consider themselves “highly knowledgeable,” while 51% are “somewhat knowledgeable,” and 10% say they’re “not very/not at all knowledgeable.”

These results concern Eshkenazi, who sees them as yet one more indicator of a talent gap in the supply chain and logistics sector. “For the past five years, ASCM’s Innovation and Sensing Committee has foreseen a major digital transformation in supply chains that’s now underway,” Eshkenazi says. “This skills gap needs to be addressed for companies to stay competitive.”

Seeking out new opportunities

This year, 41% of respondents say they’re open to better job opportunities, 28% are happy where they are, 19% are passively looking, and 12% are actively looking (compared to only 3% last year).

Salary plays a role in these job pursuits. Respondents who are happy at their current employers earn $129,100 annually, while those passively looking earn $129,900 on average. Those actively looking earn $113,400 on average, while those who are always looking earn the least at $112,700.

More than half (51%) of respondents say that they are very satisfied with their careers in supply chain and logistics, while 43% are somewhat satisfied, 5% are somewhat dissatisfied and only 1% say that they’re “very dissatisfied.”

Education and industry involvement

Thirty-eight percent of this year’s respondents hold a bachelor’s degree, while 20% hold an MBA degree, 15% have completed some college, and 12% earned an associate’s degree.

To advance their careers, 54% of respondents use personal or social networking, 24% earn industry certifications, and 22% take classes or earn a degree in business or another related field.

Specific to logistics and supply chain management education, 68% of respondents have completed job-related training; 42% attend industry conferences, seminars or workshops; and 24% earned professional certifications such as AST+L or APICS.

Only 8% of professionals have completed an undergraduate degree in logistics or supply chain management, and 9% say they hold a graduate degree in logistics or supply chain management. These percentages are consistent with the 2023 survey.

Eighteen percent of respondents say “joining an industry or professional association” has helped them advance their careers. This year, 30% of respondents say they are planning to take continuing education programs or classes during the next 12 months, compared to 44% in 2023.

When negotiating salaries, nearly all respondents (70%) view involvement with professional associations as being critical or somewhat important to the process. “It’s both interesting and gratifying that such a high percentage of respondents say involvement with a professional association is very important to extremely important in negotiating salaries,” says Derry. “For supply chain professionals, career opportunities, and upward mobility are both recognized as critical enablers of business success.”

Finally, the majority of survey respondents (79%) would recommend the logistics or supply chain management field to their son, daughter, or friend, while 21% wouldn’t make this recommendation. Similarly, 80% say they are either seeing or expect to see younger managers enter the logistics and supply chain workforce, while 20% say they’re not seeing this trend taking shape yet.

Article Topics

Peerless Research Group News & Resources

42nd Annual Quest for Quality Awards: Honoring the industry’s top performers in logistics excellence 2025 Less than Truckload Research Study Results 2025 Outook Survey: Warehouse automation comes into full focus 2025 Automation Survey: Diving deep into the warehouse automation trends 2024 Warehouse/DC Operations Survey: Technology adoption on the rise 33rd Annual Study of Logistics and Transportation Trends: Puzzling path forward Annual Study of Logistics and Transportation Trends: Puzzling path forward More Peerless Research GroupLatest in Logistics

Looking at the LTL market with Scooter Sayers U.S. Department of Transportation targets ‘CDL Mills’ as thousands of training providers removed from federal registry National diesel average falls 7.3 cents, down for second consecutive week, reports EIA U.S. Chamber of Commerce-led letter to USTR reiterates support for USMCA Q3 intermodal volumes see annual gains, reports IANA Manufacturing declines for the ninth consecutive month, reports ISM Looking at the impact of tariffs on U.S. manufacturing More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

November 2025 Logistics Management

Latest Resources