2025 Outook Survey: Warehouse automation comes into full focus

E-commerce demands, labor shortages and the need for space optimization are driving demand for more warehouse automation. Companies are investing in robotics, IT systems and other technologies to boost speed and efficiency. Our 2025 Industry Outlook study reveals how these trends are shaping spending and priorities in the materials handling sector.

Ongoing labor constraints, e-commerce growth and the desire to optimize current space are all pushing warehouse and DC operators to adopt more automation, experiment with robotics and find new ways to increase speed and efficiency.

No longer a futuristic concept, automation has rapidly become a “must have” for fulfillment operations that want to stay competitive in an uncertain, demanding business environment.

To better understand current market conditions, trends and best practices in manufacturing, warehousing and distribution operations, Peerless Research Group (PRG), in conjunction with Modern Materials Handling and sister publication Logistics Management, recently completed its 2025 Industry Outlook study.

The annual survey was further designed to track any changes that may have occurred during the last 12 months as well as over the past few years in materials handling environments.

2025 respondent demographics

Peerless Research Group’s (PRG) e-mail survey questionnaire was sent to readers of Modern Materials Handling and sister publication Logistics Management in December 2024, yielding 110 qualified respondents.

The respondents were from sites whose primary activity is corporate headquarters (34%), manufacturing (34%), warehouse/distribution (21%), and warehousing supporting manufacturing (8%). The average annual revenue size for respondent companies was $345.9 million this year—up from $263.7 million last year.

Qualified respondents—managers and personnel involved in the purchase decision process for materials handling solutions—hold influence over an average of 125,415 square feet of DC or facility space.

After reviewing the survey results, Norm Saenz, partner and managing director at consulting firm St. Onge Co., says capital spend is about the same as it was last year, but with a major increase in the amount of pre-approved capital budgets going into 2025.

“Most companies plan to spend on the mainstays in the industry, including racking and lift trucks,” Saenz points out. “But there are consistent responses showing an increase in the evaluation of automation and robotics.”

Saenz says it’s also clear that labor productivity and management is a continued concern for organizations and driving the interest in automation. “Companies are also concerned about supply chain factors like maintaining suppliers, dealing with data breaches and managing natural disasters,” Saenz adds. “And, there is an encouraging trend with increasing the amount of automated data capturing being used to track and improve performance.”

Spending goes up

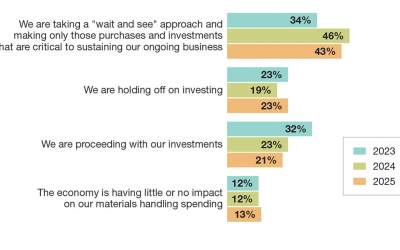

Economic conditions appear to be impacting spending on materials handling equipment, technologies, services and solutions. While 34% of companies say it’s “business as usual” on the investment front, 43% of respondents say they are taking a “wait-and-see” approach, and 23% are holding off on investing altogether.

Companies making investments say they’re spending on automation and technology (64%), forklifts and lift trucks (55%), storage equipment (36%), and technology information systems like warehouse management systems (WMS) and enterprise resource planning (ERP) platforms (32%).

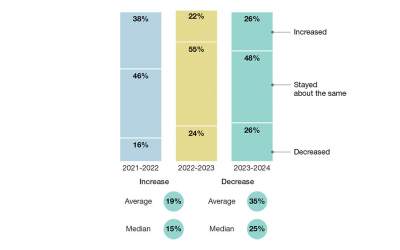

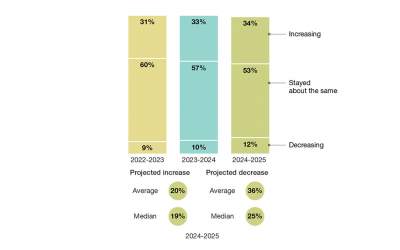

Compared to 2024, 34% of respondents say they expect their company’s spending on materials handling solutions to increase (by an average of 20%), while more than half (53%) expect spending to stay the same, and 12% expect their spend to decrease this year.

“Capital spend remains strong and similar to last year’s levels,” Saenz says, “with the majority of the funding going toward robotics and automation, for those companies that are spending.”

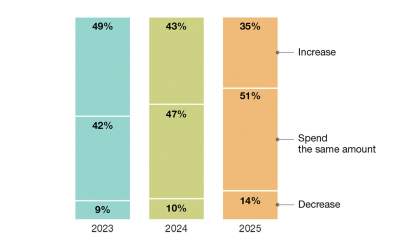

Over the next two to three years, 35% of respondents expect their materials handling equipment and related information systems spending to increase, 51% say budgets will remain steady, and 14% plan to spend less in this area.

More IT systems and equipment, please

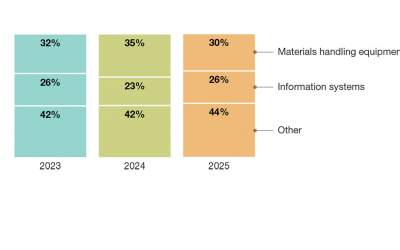

According to the survey, 43% of companies will be investing in more information systems and 30% will be buying more materials handling equipment over the next 12 months.

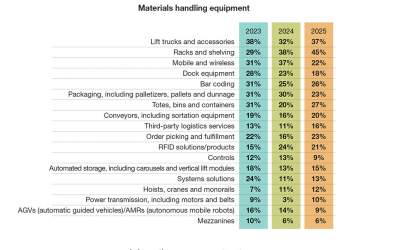

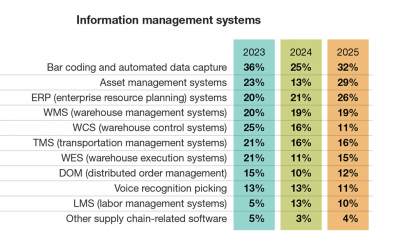

Information systems of interest include bar coding and automated data capture systems (32%), asset management systems (29%), ERP (26%) and WMS (19%).

On the materials handling equipment side, the solutions companies are most interested in are racks and shelving (45%); lift truck and accessories (37%); totes, bins and containers (27%); and bar coding systems (26%).

“There’s an interesting and clear increase in information systems spend—from 26% in 2024 to the

current 43%,” says Saenz, “including basic radio frequency (RF) and bar coding systems used to automatically collect and manage data, and asset

management software.”

In the materials handling and storage equipment category, lift trucks and racking are the two biggest spend areas, similar to 2024.

Warehouse automation is trending

Right now, about 10% of companies are using automatic guided vehicles (AGVs) and autonomous mobile robots (AMRs), and 30% say they’ll be evaluating these options within the next one to two years (compared to 23% last year).

More specifically, 13% of companies are using robotic solutions like articulating arms or industrial robots (up from 10% last year), with 32% of respondents planning to evaluate these solutions (up from 24% last year).

“There’s been a jump in the number of companies planning to evaluate AMRs and AGVs in 2025, growing from 20% in 2023 to now 30% in 2025,” says Saenz. “It’s interesting because those companies actually using AMR/AGVs are declining compared to 2023 (18% to a current 10%). Robotics is seeing a similar trend, with declining usage and more evaluation plans.”

Companies that either already use or that want to start using AGVs and/or AMRs will be deploying them for storage (40%), truck unloading (37%), order fulfillment (30%), pick and place (30%), transportation (30%) and truck loading (30%). In most cases, robotics solutions are being used for storage (36%), palletizing (33%), packing and packaging (33%), pick and place (30%) and truck loading (30%).

“Companies are using AGVs and AMRs across the facility, and not just in one area—from moving pallets across the warehouse, to goods-to-person each-pick automation, and pick-assist AMRs,” Saenz says, noting that palletizing remains a popular deployment function for robotics. “Two years ago, palletizing was the biggest use of robotics, then goods-to-person robotics like shuttle systems was the top category last year. This year it’s storage robotics, which also involves shuttles.”

Average spend increases

Over the next 12 months, companies plan to spend an average of nearly $402,000 on materials handling equipment and information systems solutions—up from about $329,000 last year.

At either end of the scale, 14% of organizations plan to spend $1 million to $2.5 million+ while about 46% are allocating anywhere from less than $25,000 up to $49,999 on this aspect

of their business.

The majority of survey respondents (59%) say they’ll either be buying new or upgrading existing solutions. Other key spending areas include staffing and labor (43%), maintenance services (41%) and information technology (36%).

To maintain their automated materials handling systems, 62% of companies rely on internal/in-house staff, 17% outsource it, and 33% use both internal staff and outsourcing.

“We’re seeing a steady increase in companies leveraging outside groups for maintaining automated equipment,” says Saenz. “This makes sense, based on the growing interest in automation and the need to keep these advanced solutions running and performing well.”

Vendors and maintenance suppliers play different roles in maintaining their automated systems, with 61% of companies asking these providers to participate in maintenance, 53% using them for consulting, and 41% working with their vendors on equipment upkeep and upgrades.

Warehousing and manufacturing priorities

As the logistics and fulfillment environment continue to evolve, survey respondents say their key concerns are safety (84%), cost containment (80%), corporate growth (69%) and employee training (64%).

These challenges aren’t expected to change much over the next 24 months, although by that point about 66% of companies also expect to have added labor availability to this list. Companies may be anticipating a worsening labor situation over the coming 12 to 24 months, even though they may not be feeling the pinch right now.

“The top three issues now and in the future are safety, cost containment and growth,” Saenz says. “Labor availability, achieving productivity goals, capital availability, disaster recovery and the environment are multiple areas of concern that will increase in importance over the next two years.”

Other key trends to watch

The survey also explored key manufacturing trends, with 64% of respondents pinpointing continuous improvement and 60% saying lean practices were very important to their operations. Just more than half (53%) of companies view labor productivity measurement and management as being highly important, and 38% are prioritizing just-in-time production.

Looking out about two years, 67% of respondents see continuous improvement as highly important, followed by lean manufacturing (56%) and labor productivity measurement and management (53%).

“Again, it looks like the issues that companies are focused on now will still be on their radar screens two years from now,” says Saenz.

Companies want to untether their employees and let them operate more freely without wires. According to the survey, 28% of organizations are giving employees more mobile solutions; 21% are expanding the number of locations where they’re providing mobile technology; and 16% say they are giving employees mobile systems that allow them to work outside of the four walls of the warehouse. Drilling down into those numbers, 69% of organizations use smart phones or tablets; 55% use bar code scanners; 52% have deployed bar code labels; and 38% are using radio frequency identification (RFID) readers. Over the next 12 months, 38% plan to deploy bar code scanners, smart phones or tablets; 33% will invest in voice technology; and 31% will start using bar code labels.

Article Topics

Peerless Research Group News & Resources

42nd Annual Quest for Quality Awards: Honoring the industry’s top performers in logistics excellence 2025 Less than Truckload Research Study Results 2025 Outook Survey: Warehouse automation comes into full focus 2025 Automation Survey: Diving deep into the warehouse automation trends 2024 Warehouse/DC Operations Survey: Technology adoption on the rise 33rd Annual Study of Logistics and Transportation Trends: Puzzling path forward Annual Study of Logistics and Transportation Trends: Puzzling path forward More Peerless Research GroupLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources