2019 State of Logistics: Third-party logistics (3PL) providers

State of 3PL: More mergers and aquisitions on the horizon

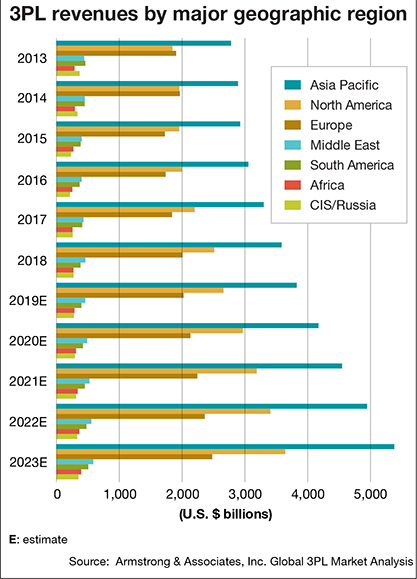

The global third-party logistics (3PL) market is estimated to reach $1.3 trillion by 2024, registering a strong compound annual growth rage over the forecast period, say industry analysts. A steady increase in the need to meet growing e-commerce penetration continues to act as one of the key drivers.

However, this bullish forecast by Research and Markets, a Dublin, Ireland-based consultancy, is tempered somewhat, with the acknowledgement that some 3PLs have experienced “loss of control over the shipping functions,” which could be a major restraint to the market.

According to Catriona Rigley, research manager at Research and Markets, Asia was the top contributor to trade growth in terms of volume so far this year, growing by 8%. Furthermore, Asia saw steady year-on-year growth in imports throughout 2018.

According to Catriona Rigley, research manager at Research and Markets, Asia was the top contributor to trade growth in terms of volume so far this year, growing by 8%. Furthermore, Asia saw steady year-on-year growth in imports throughout 2018.

Asia also recorded the highest growth in merchandise trade volume in 2018 for exports (6.7%) and imports (9.6%), following two years of modest expansion. The region contributed 2.3% to the global growth of 4.5% in 2018, or 51% of the total increase. Asia also contributed 2.9% to the world import growth of 4.8%, or 60% of the overall increase. Last year, Asia-Pacific’s third-party logistics market was estimated to be $329.3 billion.

“The global 3PL market is highly competitive with the presence of major international players, like Agility, CEVA, DB Schenker, and DHL, among others, trying to capture significant market shares,” observes Rigley. “The industry exhibits shifting patterns and this has allowed new competitors to enter the market and challenge the existing players.”

According to Rigley, 3PLs have shown the willingness to partner with other players to reduce cost and leverage on mutual competitive advantage. Hence, the market observes a high volume of ongoing mergers, and acquisitions.

“The global 3PL market players are also observing a shift in technology with the development of artificial intelligence, Internet of Things (IoT), and Blockchain, among others,” says Rigley. “The introduction and implementation of these new technologies have further intensified the market competition. Additionally, the technology adoption also helped reduce operational costs and improved efficiency.”

Greg Aimi, vice president and team manager at Gartner, agrees that the 3PL industry is progressing along “a maturity spectrum,” and is trying hard to accommodate increasing shipper requirements through a combination of acquisitions, organic growth strategies and investments in innovation—such as digital technologies and processes.

“However, our research shows that not all 3PLs are at the same place in their journey,” he says. “Many companies view logistics outsourcing as an effective strategy primarily to reduce costs, but more and more shippers are seeking innovative solutions that can improve process and service as well.”

Courtney Rogerson, senior principal analyst with Gartner, and co-author of this year’s “Magic Quadrant for Third Party Logistics, North America,” adds that mergers and acquisitions are a very common growth strategy, and consolidation is likely to continue as it presents a faster way to obtain more services and provide coverage in additional geographies than organic growth.

“In that regard, as evidenced by recent events, shippers should be aware that a 3PL provider of almost any size could be involved in a change of ownership,” Rogerson concludes.

Read the feature article on the 2019 State of Logistics here.

Article Topics

3PL News & Resources

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 U.S. rail carload and intermodal volumes are mixed in November More 3PLLatest in Logistics

FTR’s Shippers Conditions Index shows modest growth Trucking executives are set to anxiously welcome in New Year amid uncertainty regarding freight demand ASCM’s top 10 supply chain trends highlight a year of intelligent transformation Tariffs continue to cast a long shadow over freight markets heading into 2026 U.S.-bound imports see November declines, reports S&P Global Market Intelligence FTR Trucking Conditions Index shows slight gain while remaining short of growth AAR reports mixed U.S. carload and intermodal volumes, for week ending December 6 More LogisticsAbout the Author

Subscribe to Logistics Management Magazine

Find out what the world's most innovative companies are doing to improve productivity in their plants and distribution centers.

Start your FREE subscription today.

December 2025 Logistics Management

Latest Resources